Key Highlights

- Coinbase CEO, Brian Armstrong, said that his cryptocurrency exchange is long Bitcoin as its Bitcoin holdings soared by 2,772 Bitcoin in Q3

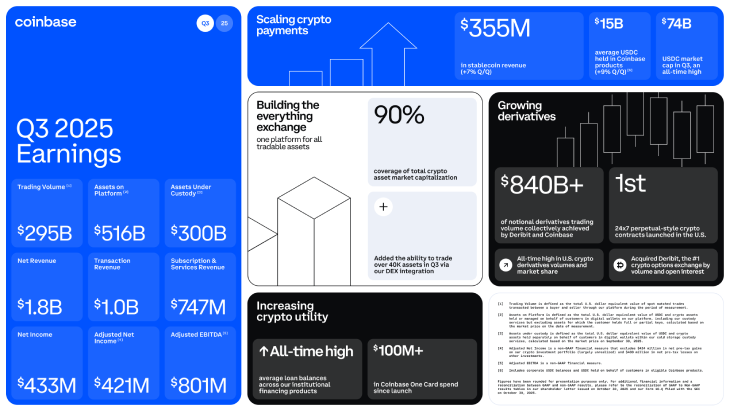

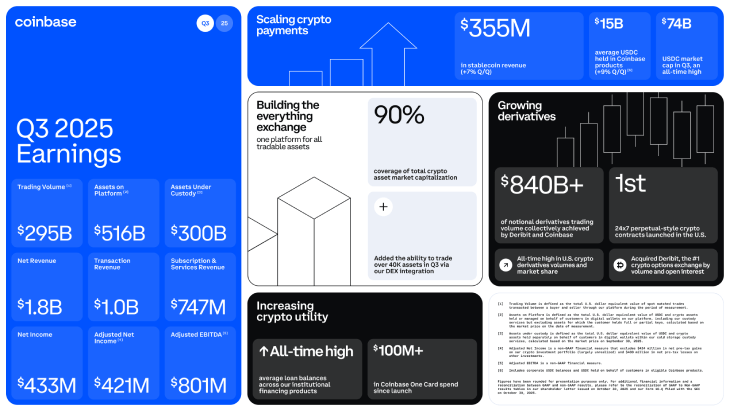

- The company posted a stronger-than-expected $1.9 billion in total revenue, a 25% Q/Q, which was driven by a surge in trading volume that reached $295 billion for the third quarter

- The company demonstrated significant profitability with $801 million in adjusted EBITDA, as both its consumer and institutional divisions saw substantial growth

During the Q3 2025 Earnings Call, Coinbase CEO Brian Armstrong made a huge statement, saying “We had a strong Q3 at Coinbase” and “Coinbase is long bitcoin.”

Coinbase is long bitcoin.

Our holding increased by 2,772 BTC in Q3. And we keep buying more.

— Brian Armstrong (@brian_armstrong) October 30, 2025

In the preview of the Q3 earnings report, Coinbase shared crucial insights, including its Bitcoin holdings. Brian Armstrong revealed that the company’s Bitcoin holdings increased by 2,772 Bitcoin in Q3. “We keep buying more,” he said.

Brian Armstrong, the Chief Executive Officer of Coinbase, has publicly shared his strong optimism in the company’s future. He reported a robust performance for the company in the third quarter, highlighting major revenue generation and a positive adjusted EBITDA. It is a key measure of profitability.

Armstrong also highlighted the company’s continued strategic advances in its “Everything Exchange” vision, an initiative designed to expand its platform beyond basic trading. He specifically noted that the company’s suite of derivatives products demonstrated notable strength during the period. It contributes to the overall positive financial results.

Coinbase Reports Strong Quarterly Earnings

Coinbase has announced a stronger-than-expected financial performance for the third quarter, which shows major growth across its business. The leading U.S.-based cryptocurrency exchange reported total revenue of $1.9 billion, which is a substantial 58% increase compared to the $1.2 billion it reported during the same period last year.

(Source: Coinbase’s Letter to Shareholders)

The surge in revenue largely came after a major rebound in trading activity. Transaction revenue, which remains the core of Coinbase’s business, rose to $1 billion. This is an impressive jump of $573 million from a year ago.

The company reported that total trading volumes reached $295 billion for the quarter. This growth was driven by renewed interest in cryptocurrency markets, with retail user trading volume seeing a notable 37% increase from the previous quarter.

The company’s profitability was also robust, with adjusted EBITDA coming in at $801 million, up from $449 million in the third quarter of the previous year.

Coinbase also revealed its growth across both its consumer and institutional trading divisions. Revenue from institutional transactions more than doubled, reaching $135 million. This jump was partly fueled by the recent acquisition of the crypto options platform Deribit, which contributed $52 million in revenue after the deal closed in August.

On the consumer side, transaction revenue hit $844 million, a 30% increase from the second quarter. It was driven by higher trading volumes for a wider array of digital assets and a growing base of advanced traders.

“Q3 was a strong quarter for Coinbase. We drove solid financial results, maintained focus on shipping innovative products, and continued building the foundation of the Everything Exchange,” stated in a letter.

Stable Subscriptions and a Profitable New Network

The company’s subscription and services revenue continued to be a reliable source of income, rising 14% from the previous quarter to $747 million. A major component of this was stablecoin-related revenue, which contributed $535 million as average USDC balances held on the platform reached a record high of over $15 billion.

The report also revealed the contribution of stablecoins to enhancing payments. The letter stated that, “We are accelerating payments through stablecoin adoption, which we anticipate will continue given policy tailwinds, and ongoing adoption from financial institutions and corporates for payment and treasury needs. In Q3, USDC reached an all-time high of $74 billion in market capitalization, and average USDC held in Coinbase products reached an all-time high of over $15 billion. Additionally, we continue to scale payments with USDC, new partnerships, and crypto rewards for purchases through the CB1 Card.”

Another standout success was the confirmation that Base, the company’s own Layer 2 network, with the company stating it has become the “trusted network of choice” for developers. The exchange ended the quarter with a strong financial position, holding $11.9 billion in USD resources.

Source: https://www.cryptonewsz.com/coinbase-q3-earnings-with-25-revenue-surge/