- The Chainlink price breakdown from the support trendline of triangle pattern sets a prolonged correction below $10.

- On-chain metrics revealed continued reserve accumulation, with approximately 99,100 LINK added in a single day.

- The 100-day exponential moving average indicators act as dynamic resistance against the short-term recovery in LINK price.

The Chainlink price dropped 6.17% during Thursday’s U.S. market hours to reach a trading value of $11.1. The downtick aligns with market wide sell-off, cascading liquidation and macro economic hurdles. The falling coin price also breaks below a multiple-month support trendline of the daily chart, signalling a risk of prolonged correction ahead. Despite an intact downtrend, the Chainlink Reserve continued to accumulate more LINK tokens,bolstering the network’s long-term growth and sustainability.

Traders Exit LINK Derivatives While Network Reserves Continue to Grow

On Thursday, January 29th, the crypto market witnessed a notable sell-off which pushed the Bitcoin price below $84.000. Following the momentum, the Chainlink price recorded a nearly lost 6% in value, projecting a bearish breakdown below $11.

Risk appetite weakened after the United States Federal Reserve decided to keep its benchmark interest rate in the 3.50%-3.75% range. While the move was in line with market expectations, policymakers kept reiterating a cautious approach to future adjustments. That tone saw market participants reduce their exposure to assets perceived to be sensitive to liquidity conditions, including cryptocurrencies.

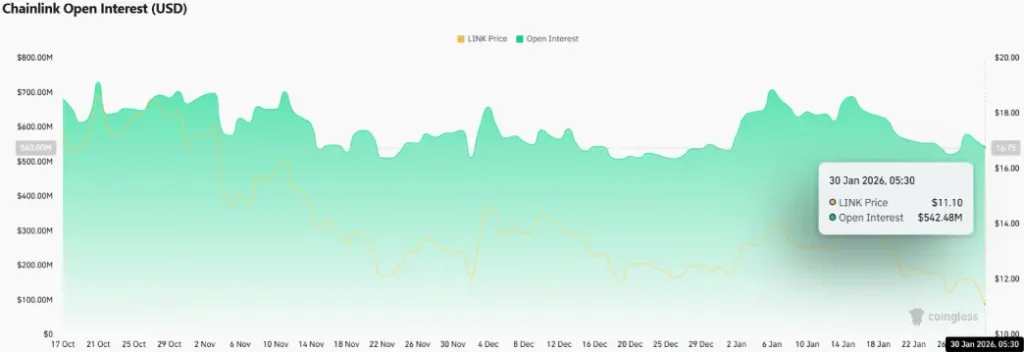

As a result, the open interest associated with Chinlink’s futures contracts witnessed a notable downtick. According to coin glass data, the OI value has plunged from $597 to $542 in the last 24 hours. The reduction indicates traders are closing leveraged positions as opposed to putting on fresh directional bets as volatility rises.

On-chain data, however, indicated that there was continuing activity on the reserve side of the network. The addition of The Chainlink Reserve was about 99,100 LINK during the day. Following this accumulation, the total balance of the reserve is approximately 1.77m tokens with an estimated average acquisition price of around $11.30 per LINK.

The reserve mechanism is financed by a mix of off-chain revenue generated by enterprise users integrating the service from Chainlink and on-chain income generated by protocol usage. Its stated function is to create a long-term buffer that is supposed to support the network operations and development as the adoption grows.

These parallel developments (depleting market prices, diminished derivatives exposure, and continued reserve accumulation) point to the contrasting dynamics that are currently at work in Chainlink’s market behavior in a period of heightened sensitivity to macroeconomic conditions.

Chainlink Price Faces $10 Retest With This Triangle Breakdown

Over the past two months, the Chainlink price witnessed a consolidation trend resonating within two converging trendlines of the daily chart. These trendlines acting as dynamic resistance and support reveals the formation of a traditional continuation pattern called symmetrical triangle pattern.

Theoretically, this sideways action recuperates the exhausted bearish momentum and drives an extended correction after key support breakdown. On 25th January, the LINK price breached the bottom trendline of this triangle, accelerating the selling pressure on this asset.

The post-breakdown fall has pushed the coin price over 10% and challenged the next significant support at $11. With sustained selling, the Chainlink price could reach $10.12 to $9.3.

The momentum indicator ADX at 33% accentuated high-momentum rally and sufficient room for sellers to prolong this downtrend.

On the contrary, if the coin price reverts higher, the recent breached triangle support would act as a strong resistance against LINK.

Source: https://www.cryptonewsz.com/chainlink-price-11-traders-unwind-leverage/