Key Highlights:

- Bitwise CEO highlights that even though the price of the Solana token is low, the interest in BSOL ETF is high.

- VanEck launched VSOL yesterday, November 17, 2025, and Fidelity will launch FSOL today, November 18, 2025.

- Solana ETF products are gaining investor interest as it helps investors capitalize on Solana’s low price and staking yields.

Bitwise launched its Solana Staking ETF (BSOL) on October 28, 2025 and since then the price of the SOL token has dropped almost everyday. Even though it seems like a bad sign, Bitwise CEO Hunter Horsley thinks otherwise. According to Horsley, lower price attracts more investors as it lets them enter at better levels. Just because of this exact reason, the BSOL has seen steady inflow every single day since its launch.

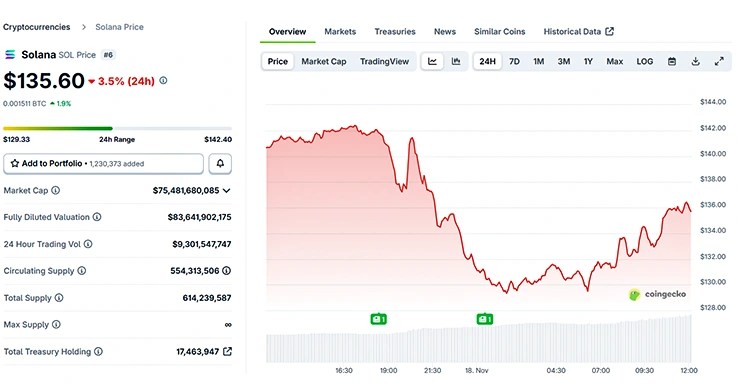

At press time, the price of SOL token stands at $135.60 with a dip of 3.5% as per CoinGecko.

Continuous Inflows Signal Growing Investor Confidence

BSOL has recorded steady daily inflows totalling hundreds of millions within its first few weeks. BSOL when compared with Grayscale’s SOL ETF GSOL, BSOL has more inflow than GSOL as per the data available from Farside. BSOL has attracted $365.1 million in total inflow so far and GSOL has brought in only $25.3 million, which is way less when compared with BSOL.

Moreover, Bitcoin and Ethereum ETFs have also experienced outflows. As mentioned above, since the launch, BSOL has only seen inflows but Bitcoin and ETH ETFs have been experiencing significant outflow for a week. According to SoSoValue, as of November 17, BSOL has had $8.26M in inflow, whereas, BTC experienced an outflow of $254.51M and Ethereum experienced an outflow of $182.80M.

What Hunter Horsley is Implying?

Bitwise CEO Hunter Horsley in his post on social media platform X, indicates that even though the price of the token may not be on the rise, the ETF product is a big hit as it has not seen a single day of outflow since its launch. With his post, he is implying that in this situation where there is daily inflow into BSOL but the Solana price is experiencing a drop, it indicates that there is a shift in the investor activity rather than panic selling. New investors are confident and they are attracted to the ETF’s structure and the lower token price.

Since the launch of BSOL, Solana prices have been down almost every day.

Is that bad or good?

Well, if you want to see new investors in the space, it’s good — better prices, lower cost basis, chance to get in at prices they felt they missed.

Indeed, BSOL has had inflows…

— Hunter Horsley (@HHorsley) November 18, 2025

Considering the current outflows in BTC and ETH ETFs, it is a clear sign that the investors are shifting sides and focusing more on Solana as they are confident about its future. The main reason why the investors are attracted to BSOL right now is because with this product they can capitalize on Solana’s lower price and attractive staking yields of around 7% annually.

Moreover, from Horsley’s tweet, it seems like more and more investors may come in and the current demand is only the beginning of a bigger trend.

Major Issuers Pile In

Fidelity has also launched its own Solana ETF, FSOL today, November 18, 2025, with a 0.25% fee, which is a little higher than BSOL (0.2%). With this launch, it will mark the entry of one of the world’s biggest asset managers into the Solana ETF arena. With BlackRock still absent from this category, Fidelity instantly becomes the largest traditional player to join the line up.

Fidelity Solana ETF $FSOL is slated to launch TOMORROW. Fee is 25bps. Easily the biggest asset manager in this category with BlackRock sitting out. $BSOL got out first, has $450m, $VSOL launched today, Grayscale is in mix. Game on. pic.twitter.com/iCXMkAH9qe

— Eric Balchunas (@EricBalchunas) November 17, 2025

Moreover, VanEck has VSOL launched yesterday, November 17, 2025, and it will provide investors yet another staking-enabled Solana ETF option. VanEck’s is waiving all sponsor fees on the first $1 billion in assets until February 2026, and even its staking partner is waiving fees during this period. The fund already stakes nearly all of its SOL, offering approximately ~6.6% gross staking yield and positioning itself as a cost-efficient, yield-rich product from day one.

Grayscale’s GSOL is also a part of the mix, even though it trails significantly with $25.3 million in inflows.

Why Investors Are Shifting Toward Solana ETFs

Even with Solana’s price sliding, investors are steadily moving into Solana ETFs because they offer a safer, more structured way to gain exposure. Product like BSOL and VSOL provide staking yield, professionally managed custody, easier compliance, and a way for institutions to scale positions without touching exchanges directly. The launch of Fidelity’s FSOL only accelerates this shift.

In short, retail sentiment may be shaky, but institutional money positioning for the long term, and ETFs are becoming the preferred entry point.

Also Read: NYSE Arca Approves Listing for Canary Marinade Solana ETF

Source: https://www.cryptonewsz.com/bitwise-ceo-bullish-on-solana-etf-sol-drop/