This week from 16- 21 Sept will see important events unfold with interest rate decisions of the Federal Reserve, the Bank of England and the Bank of Japan coming up. The Federal Reserve interest rate decision and economic forecast summary will most likely be announced on 18th September.

Thus, Thursday will see several high-profile meetings and decisions with respect to the U.S. EIA natural gas inventories, initial jobless claims. Bank of Canada monetary policy meeting minutes is also expected to come to fore on 19 September. Powell might hold a monetary policy press conference by Thursday along with Bank of England interest rate decision and meeting minutes announcements on that very day.

On Friday, Japan’s interest rates might be decided followed by governor Kazuo Ueda’s press conference around that day. However, Moody’s expects that the Bank of Japan will remain on hold at its monetary policy meetings on September 19 and 20. Even though the Bank of Japan tightened its policy faster than expected and hinted that further rate hikes may be possible, Moody’s expects the next rate hike to be in October.

Lastly, Philadelphia Fed President Patrick Harker is expected to deliver a speech this Saturday. The most important event- US Federal Reserve certainly will set a precedent to the global interest rate realm.

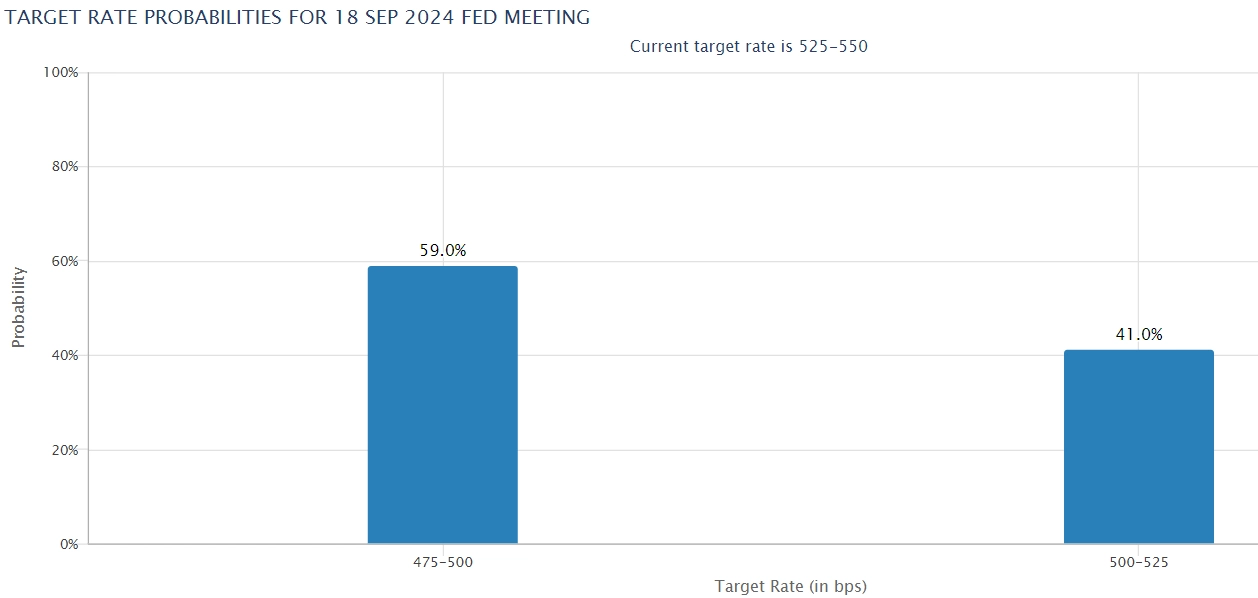

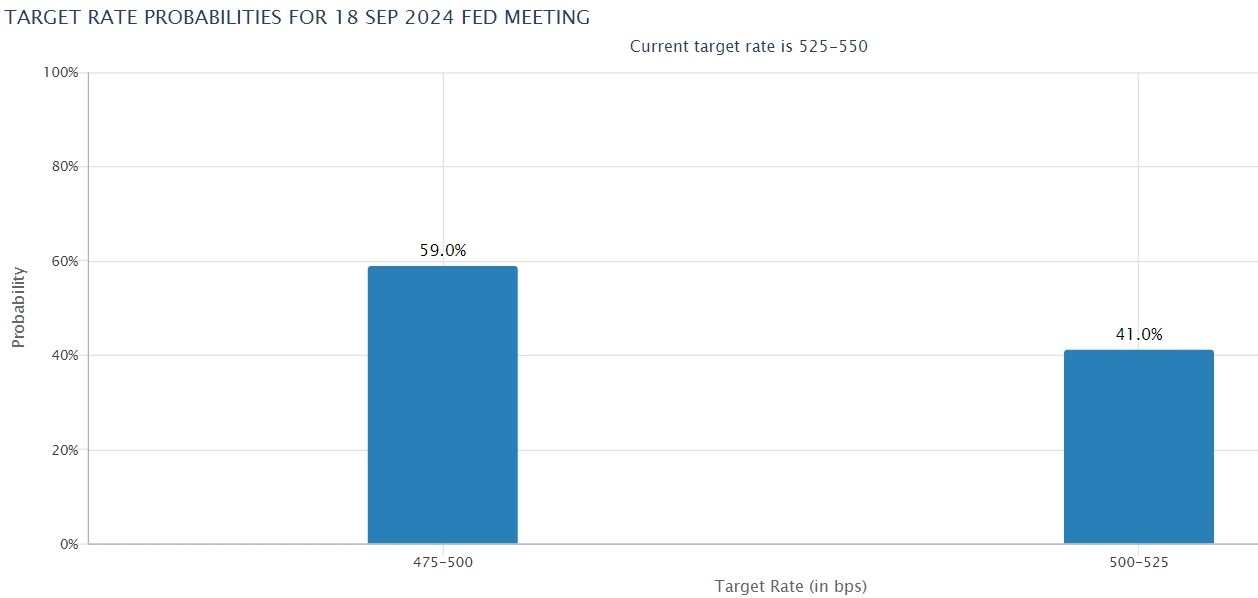

As per FedWatch, the probability of Fed cutting interest rates by 50 basis points in Sept has risen to 59% after the probability of the Fed cutting interest rates by 25 basis points was 41%.

Also Read: Analyst: US Fed to Partner With Ripple for Payments to India

Source: https://www.cryptonewsz.com/sept-fed-bank-of-england-japan-interest-rate/