Key Takeaway

World Liberty Financial (WLFI), the token backed by Donald Trump, is facing serious security threats due to phishing exploits linked to Ethereum’s EIP-7702 upgrade. However, despite risks, trading volumes remain high, boosted by a new partnership with Alt5 Sigma.

Donald Trump’s World Liberty Financial’s [WLFI] has entered the market amid a blend of excitement and controversy.

The token jumped 135% after its ICO, fueled by high-profile staking activity from Justin Sun and a surge in spot and futures trading.

Yu Xian on WFLI’s exploitation

However, growing security concerns have dampened the excitement, as SlowMist founder Yu Xian warned that WLFI token holders are being targeted by a phishing exploit tied to Ethereum’s [ETH]EIP-7702 upgrade.

Hackers are reportedly embedding malicious smart contracts into compromised wallets. This allows them to drain WLFI deposits as soon as funds are transferred.

Xian said,

“Encountered another player whose multiple addresses’ WLFI were all stolen. Looking at the theft method, it’s again the exploitation of the 7702 delegate malicious contract, with the prerequisite being private key leakage.”

Well, the security challenges surrounding World Liberty Financial appear to run deeper than a single exploit.

This is because much of the trouble traces back to Ethereum’s Pectra upgrade in May, which introduced EIP-7702.

For those unaware, the upgrade allows regular wallets to temporarily act as smart contract wallets, enabling batch transactions and delegated execution rights aimed at improving usability.

But according to security experts, attackers have been quick to weaponize the change.

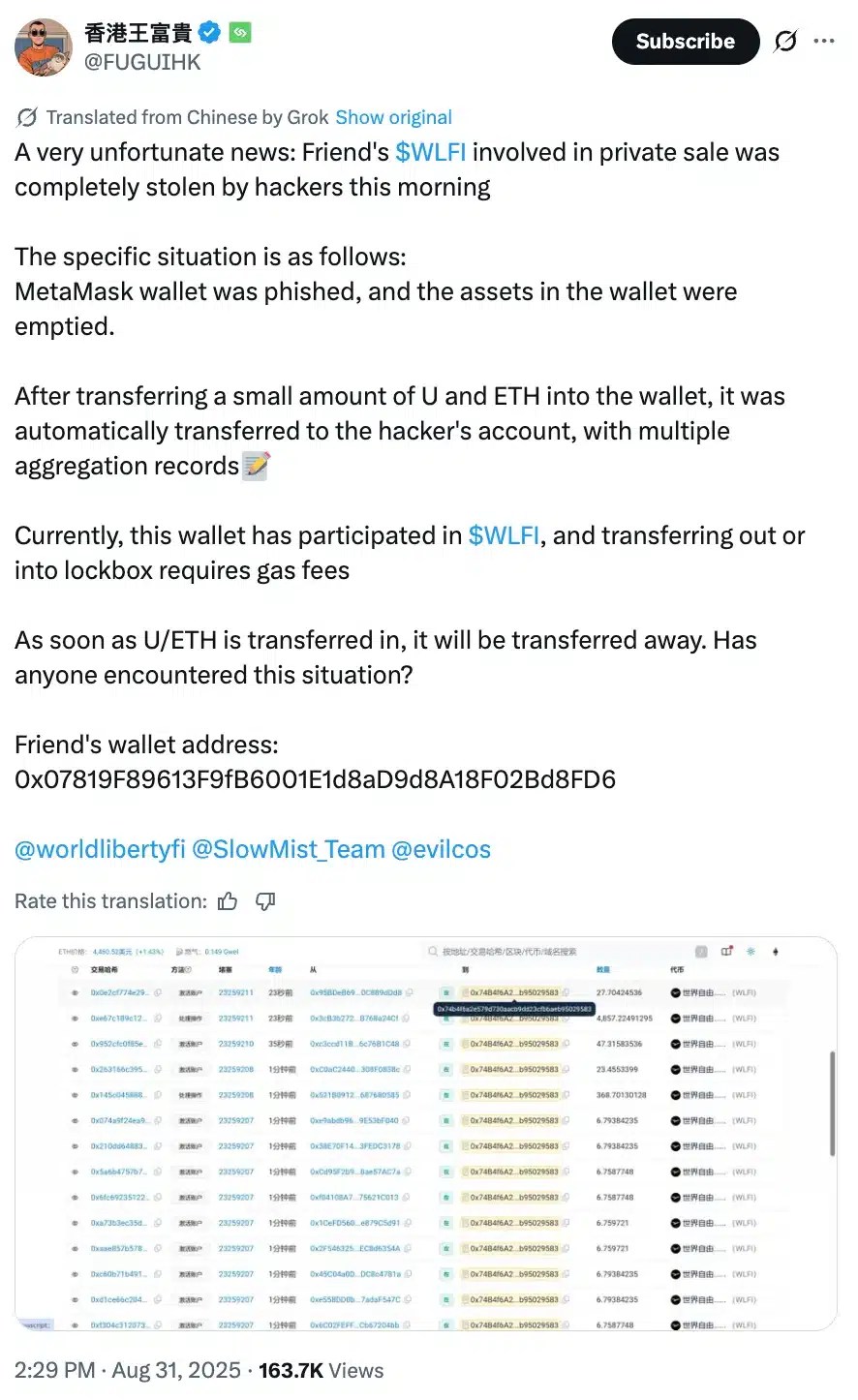

On the 31st of August, a user on X (formerly Twitter) shared that their friend’s WLFI tokens were stolen shortly after sending ETH to their wallet.

Source: X

In response, Xian identified the theft as a “classic EIP-7702 phishing exploit.”

He explained that hackers often steal private keys through phishing, then use them to pre-install a malicious delegate contract on the victim’s wallet.

Source: Yu Xian/X

Community expresses their battles with WFLI

Other community members have also reported being targeted by scams, including one early WLFI supporter whose MetaMask wallet was compromised on the 10th October 2024.

Despite never approving suspicious transactions, the user lost all assets except locked WLFI tokens.

In fact, attempts to recover funds through Uniswap, MetaMask, and a fraudulent recovery service only worsened losses.

The victim managed to secure just 20% of their WLFI once vesting began, while the remaining 80% remains at risk in the compromised wallet.

Adding to investor headaches, analytics firm Bubblemaps flagged a surge in “bundled clones”, look-alike smart contracts designed to mimic legitimate projects.

Users who mistakenly interact with these contracts risk permanently losing their funds, further complicating WLFI’s debut.

In response, the WLFI team stressed it never offers support via DMs and directed users to official email channels to avoid impostors.

WFLI trading activity still hit the spot

However, despite these pullbacks, WFLI’s trading activity remained heated. At press time, the token’s Derivatives Volume soared past $12 billion.

Also, the Open Interest was seen rising across exchanges as per CoinGlass data.

Source: CoinGlass

This heightened speculation comes just as the Trump family’s token venture enters a high-stakes partnership with Alt5 Sigma. This links it to the firm’s $1.5 billion crypto treasury strategy.

In conclusion, while the deal amplifies WLFI’s visibility, it also draws increased scrutiny around the project.

Questions are mounting over whether this political-crypto crossover is driving genuine adoption or simply fueling speculative frenzy.

Source: https://ambcrypto.com/wlfi-how-ethereums-eip-7702-exploit-sparked-investor-panic/