Following last week’s rally, Ethereum’s native token, ETH, has encountered a market correction, dipping toward the $3,000 support level. This downturn emerged after the cryptocurrency failed to breach the critical $3,400 resistance zone, resulting in a 12% decline from its recent highs. At press time, ETH was trading at $3,112, reflecting a 4.40% decline over the past week and a 1.45% drop in the last 24 hours.

In addition, the altcoin’s 24-hour trading volume stands at $28.45 billion, marking a 21.31% decrease, implying profit-taking activity as traders await more evident signs of a recovery. Despite the near-term bearish sentiment, Ethereum retains a robust market cap of $374.78 billion, with a healthy volume-to-market cap ratio of 7.69%.

These metrics suggest strong investor confidence and sustained interest in the Ethereum ecosystem, even amid short-term volatility. Interestingly, the token’s recent performance diverges from the broader cryptocurrency market, which recorded a slight 0.52% increase in market capitalization.

Similarly, Bitcoin continues to dominate market momentum, reaching a new peak of $94,002 during late New York trading, setting the tone for a bullish outlook across the sector. The key question is whether the ETH cryptocurrency can gather enough momentum to overcome the $3,400 resistance level or if this cap will continue hindering its rally.

ETH Demand Zone Signals Resilience in the Crypto Market

Recent data underscores a surge in momentum within Ethereum’s ecosystem, with U.S. spot ETH ETFs attracting $147 million in cumulative net inflows over the past two weeks. This robust influx reflects rising institutional interest in the altcoin as a pivotal investment asset bolstered by growing expectations for broader adoption across global markets.

Spot #Ethereum $ETH ETFs have experienced a substantial shift over the past two weeks, with the cumulative total net inflow now standing at over $147 million! pic.twitter.com/mAYU1Bid2V

— Ali (@ali_charts) November 19, 2024

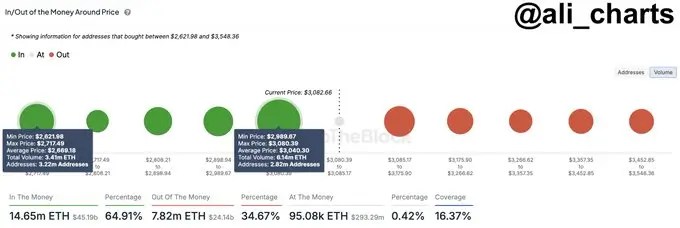

Adding to the bullish sentiment, the ETH token has established a strong demand zone around the $3,000 level. Approximately 2.82 million addresses have accumulated over 6.14 million ETH in this price range, representing 34.67% of Ethereum holdings near $3,082. This accumulation signals inclined buy-side activity, reinforcing $3,000 as a critical support level and reducing the likelihood of steep downside risk.

While ETH ETFs faced intermittent periods of selling pressure (indicated by red bars in net flow charts), the overall trend remains positive, with green bars dominating recent activity. This highlights sustained confidence in Ethereum’s long-term value proposition despite short-term market fluctuations.

Key Levels to Watch for ETH

Ethereum’s strong demand zones and continued accumulation by long-term holders have reinforced the $3,000 level as a key support. This threshold remains critical to monitor, as its stability will likely dictate ETH’s near-term trajectory. On the upside, a successful breakout above the $3,200 resistance level could propel the cryptocurrency toward a retest of the crucial $3,400 barrier. Unlike the previous rally, sustained positive trading volume might give Ethereum the momentum needed to surpass this resistance.

Moreover, a decisive breach above $3,400 could pave the way for a rally toward higher highs, with targets set at $3,570 and $3,900. On the other hand, if the $3,000 support gives way, Ethereum could see a retracement toward the $2,800 level, where another consolidation phase may occur. This safety net could provide a foundation for renewed accumulation before the token attempts another upward move.

Also Read: Is Bitcoin Set to Break $100K? Key Levels to Watch Now

Source: https://www.cryptonewsz.com/eth-rally-stalls-at-3-4k-barrier-whats-next/