- Trump family’s WLFI wallet purchases WBTC and ETH totaling $18.6 million.

- Large acquisitions may influence market dynamics.

- Highlighted crypto assets include WBTC and ETH.

The Trump family’s WLFI wallet spent $18.6 million in USDC for 1,911 ETH and 84.5 WBTC, report suggests via Lookonchain monitoring on ChainCatcher.

This transaction highlights significant crypto market activity, potentially impacting Ethereum and Bitcoin ecosystems. It signals ongoing interest from high-profile individuals, affecting market liquidity and volatility.

Trump-Linked Wallet Invests $18.6 Million in Crypto Assets

The WLFI wallet, associated with the Trump family, spent $10 million USDC to acquire 84.5 WBTC, priced at approximately $118,343 each. Additionally, $8.6 million USDC was utilized to secure 1,911 ETH, each valued around $4,500. The acquisitions mark a considerable movement in digital asset accumulation associated with a high-profile entity.

Market observers note that such activities might cause fluctuations in demand and pricing, considering the substantial financial input involved. However, no official commentary from the Trump family has been disclosed regarding these transactions.

Market and community responses remain observant, with no immediate major statements from key figures such as Vitalik Buterin of Ethereum. Gary Gensler’s statement emphasizes the regulatory interest in making the U.S. a global cryptocurrency hub, although it was not directly in response to this specific event.

Crypto Market Volatility Linked to High-Profile Acquisitions

Did you know? Comparable large-scale cryptocurrency acquisitions have frequently resulted in short-term market volatility, typically increasing public scrutiny on well-known public figures involved in the transactions.

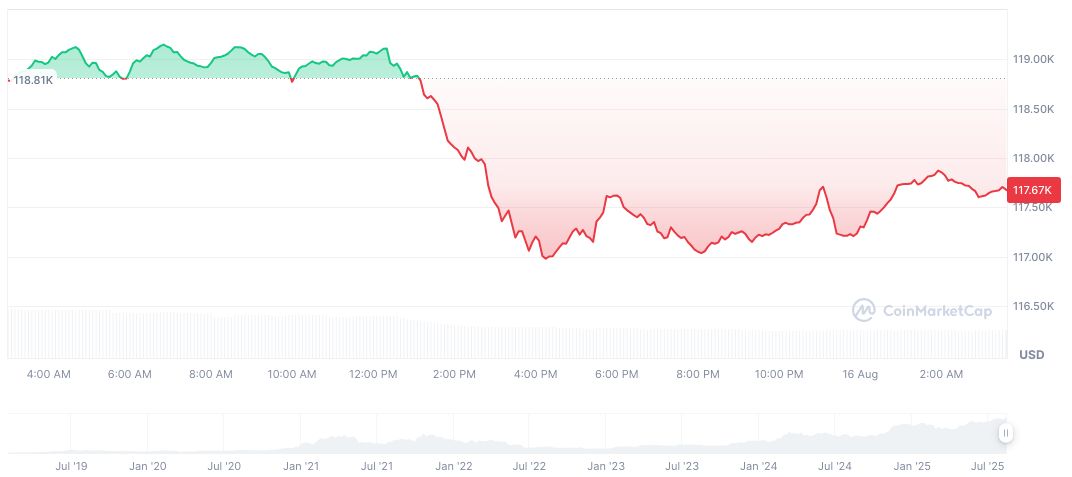

Wrapped Bitcoin (WBTC) recently priced at $117,689.46 exhibits a market cap of $14.97 billion, maintaining its position in the crypto ecosystem with a 24-hour trading volume of $351.82 million. While its price dropped 1.04% over 24 hours, it saw a 14.10% increase over 90 days, highlighting fluctuating investment interests, according to CoinMarketCap.

Insights from the Coincu research team predict that these significant acquisitions by the Trump-linked wallet might spark potential shifts in regulatory interest and financial activity, with a focus on asset liquidity and security implications. Market watchfulness could rise due to the wallet’s association and its impact on crypto economics.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/trump-family-crypto-holdings/