Tom Lee’s BitMine has expanded its Ethereum treasury with a fresh $358 million purchase. As a result, the ETH price recorded some gains, outperforming the broader market.

BitMine Expands Ethereum Holdings In New Purchase

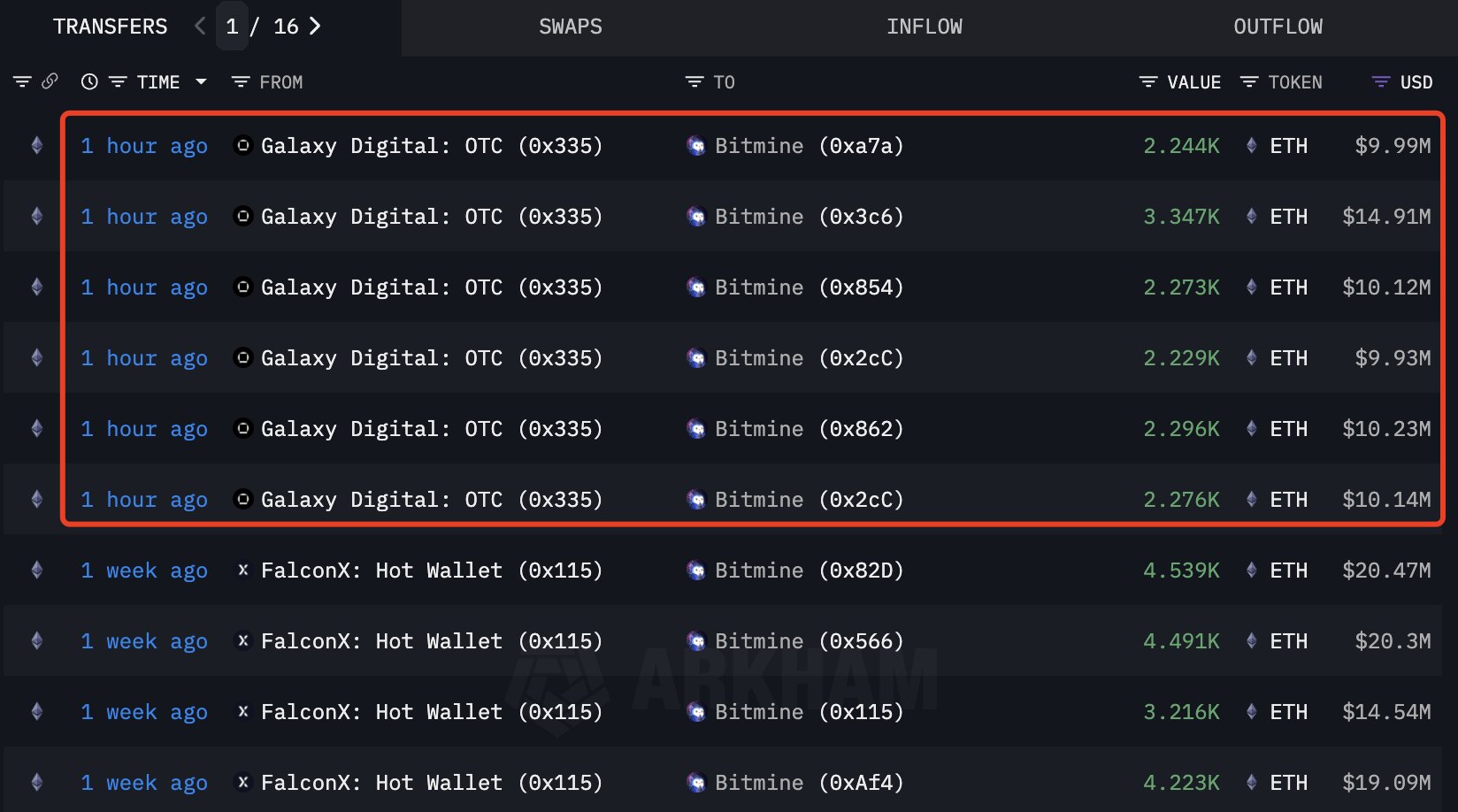

Lookonchain shared that Bitmine has increased its Ethereum treasury after new purchases. The firm received 14,665 ETH, valued at approximately $65 million, from Galaxy Digital within the last 24 hours.

At the same time, FalconX transferred over 65,000 ETH, valued at $293 million, to newly created wallets. This brought the total to an astounding $358 million purchase. Bitmine currently holds 1,947,299 ETH, approximately $8.69 billion.

These transfers come on the back of a week in which BitMine added 153,075 ETH, valued at $668 million. They bought the ETH price dip, pushing its total stash to nearly 1.87 million ETH worth.

This positions BitMine’s holdings at 2.23 times that of SharpLink Gaming, the second-largest Ethereum holder. SharpLink itself has been steadily increasing its exposure. They bought over 39,000 ETH between late August and early September.

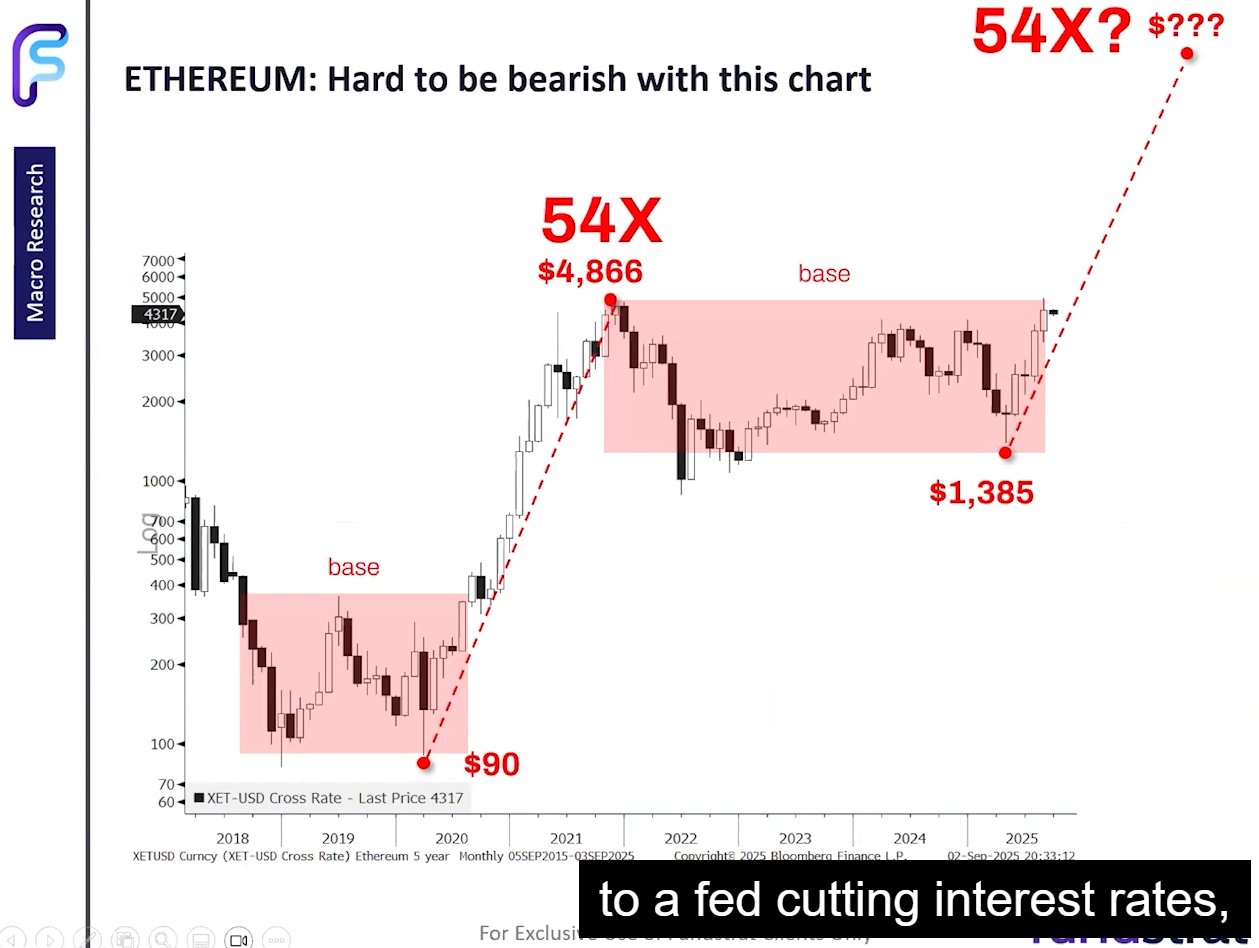

Behind BitMine’s strategy is Wall Street veteran Tom Lee. He has been more vocal about the underappreciation of the altcoin at the institutional level. In a recent interview, Lee compared Ethereum today to Bitcoin in 2017. He argued that while Bitcoin grows in institutional expansion, the altcoin is still in its early adoption phase.

According to Tom Lee, blockchain technology represents a “1971 moment for Ethereum.” This is in reference to the U.S. abandoning the gold standard and its subsequent impact on global finance. He shared that ETH’s growing adoption in payments and tokenization could set it up for explosive growth.

ETH Price Surges Amid Institutional Activity

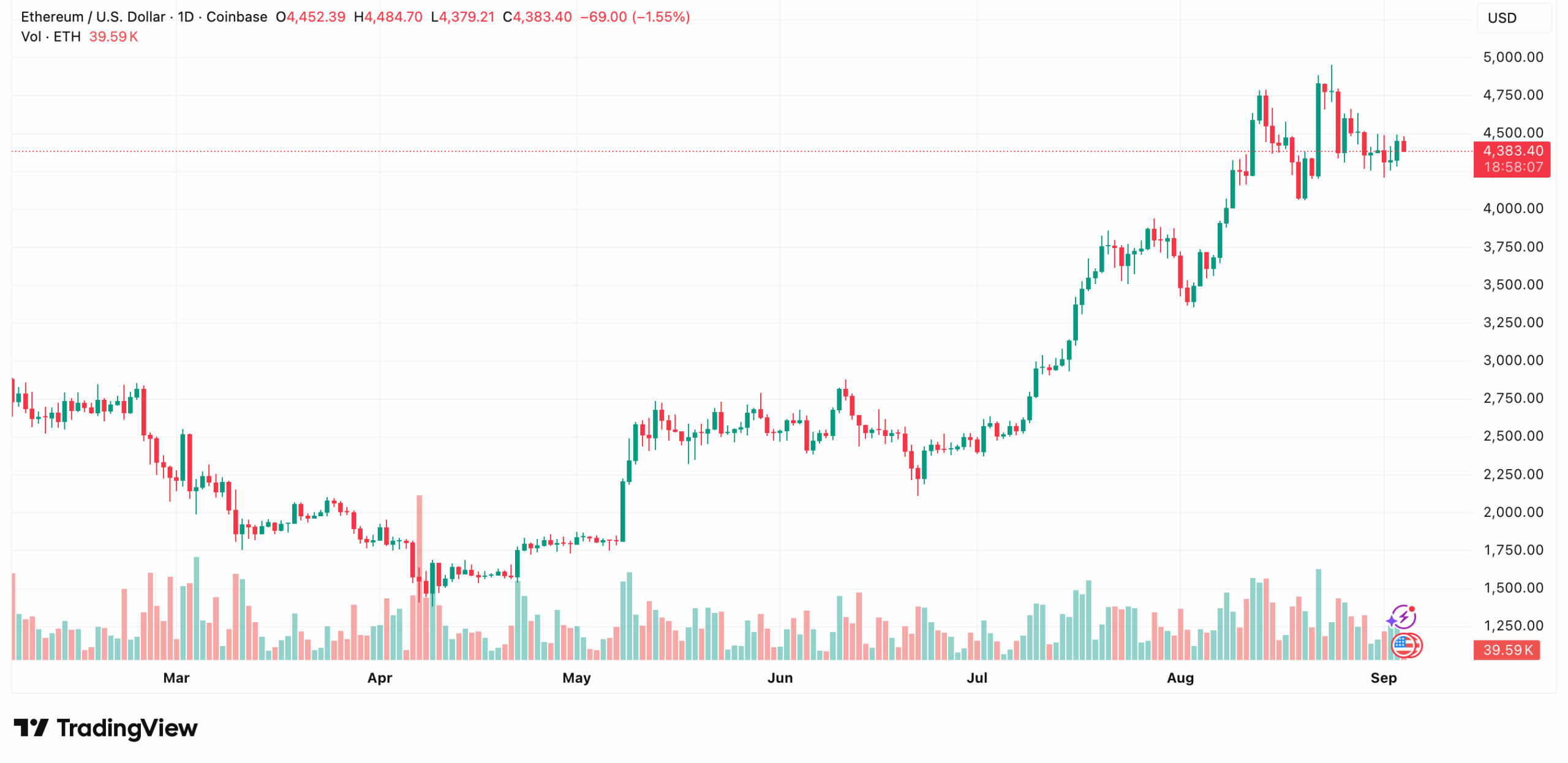

The ETH Price has responded, surging by more than 2% in the past 24 hours, leaving its previous red zone. This extended a nearly 21% monthly rally that has outpaced the broader crypto market.

This is mainly attributed to institutional activities. Public companies and ETFs collectively added over 5 million ETH in 2025. This represents more than $23 billion in inflows.

Furthermore, Ethereum has seen more staking activity since the SEC clarified that liquid staking isn’t a security. More than 35.6 million ETH is now staked, locking up nearly 30% of the total supply.

Notably, Tom Lee pointed to the upcoming Federal Reserve policy decisions as another driver for markets. Historical data indicate that Federal Reserve cuts typically occur in September. Moreso, the president of the New York Federal Reserve, John Williams, echoed the possibility of a Fed rate cut ahead of the September FOMC meeting.

He also highlighted that the ETH price has eased over the past 10 days, but its consolidation trend remains healthy.

Some analysts have, however, warned that short-term resistance levels could trigger temporary pullbacks, as the token looks to regain momentum.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.