- Tether issues $1 billion USDT on Ethereum.

- Increased liquidity could boost Bitcoin prices.

- Trader optimism surrounds potential market activity.

Tether Limited has issued $1 billion USDT, reinforcing its critical role in providing liquidity to the cryptocurrency market.

This issuance indicates a significant expansion of Tether’s market presence, underlining its importance in crypto trading.

Tether’s $1 Billion USDT Mint: Market Implications and Reactions

Tether Limited has issued $1 billion USDT, a stablecoin tied to the US dollar, on the Ethereum network. This action demonstrates Tether’s continued role in providing liquidity to the cryptocurrency market. The minting occurred as verified by Whale Alert, marking yet another significant issuance for the stablecoin giant.

The large issuance could increase liquidity, impacting transaction volumes on Ethereum. Additionally, past correlations suggest potential Bitcoin price boosts due to enhanced liquidity from such events. This minting represents a significant expansion of Tether’s market presence, underlining its importance in crypto trading.

Notably, crypto community discussions emphasize the potential for increased market activity. While Tether’s leadership, including figures like CTO Paolo Ardoino, has previously highlighted maintaining liquidity importance, no immediate official statements were issued. The reaction among traders generally exhibits optimism for increased trading potential. As Paolo Ardoino, Chief Technology Officer, Bitfinex and Tether states, “We continue to work on providing stable and secure financial services to our users.”

Historical Data Signals Potential Bitcoin Price Rally

Did you know? Historical data often reveals that large USDT issuances like this have been followed by increased market activity, sometimes leading to Bitcoin price rallies as traders capitalize on newfound liquidity.

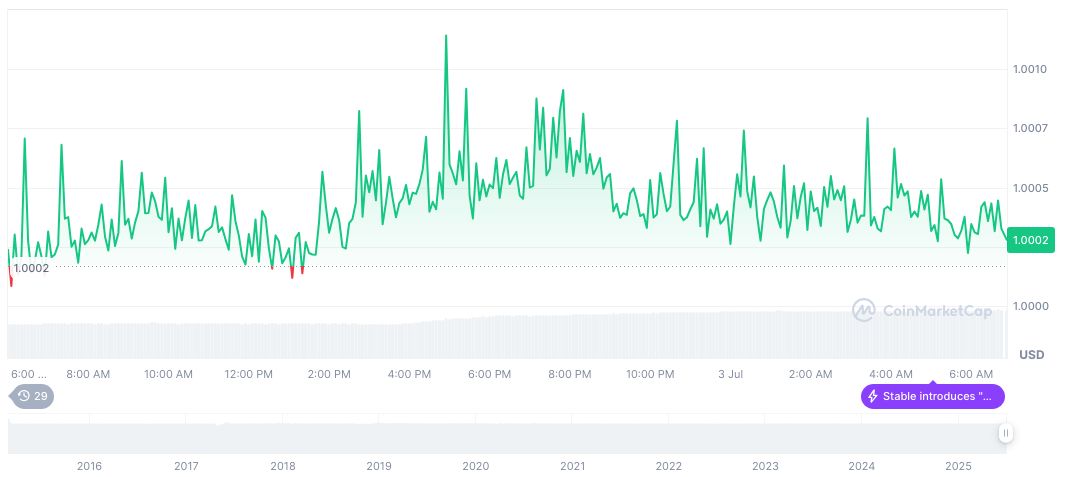

CoinMarketCap reports Tether USDt (USDT) maintains a stable price of $1.00 with a significant market cap of $158.33 billion. The circulating supply stands at approximately 158.27 billion USDT as of July 3, 2025. Noteworthy is the slight 0.05% price decline over the past 24 hours, while trading volume reached $80.08 billion, fluctuating marginally by 1.75%.

Experts from Coincu research suggest that this event will bolster investor confidence in stablecoins, signaling robust market health. The issuance is also likely to spark regulatory interest, given the scale and impact on major tokens like Bitcoin and Ethereum. Market analysts predict greater liquidity-driven activities may follow, as pointed out by Arthur Hayes, Co-founder, BitMEX, “Large USDT mintings often create a liquidity cascade, enabling bullish momentum in the market.”

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/346684-tether-mints-1-billion-usdt-ethereum/