- Tether freeze 22 blockchain addresses, impacting 13 million USDT.

- No major market impacts reported.

- Addresses frozen show broad regulatory and monitoring trends.

Tether has frozen 22 blockchain addresses holding 13.41 million USDT on the Ethereum and Tron networks, according to data from MistTrack monitoring on October 16, 2025.

This freeze action, involving a substantial USDT amount, highlights Tether’s role in controlling liquidity, raising concerns about transparency and potential effects on stakeholders within the crypto ecosystem.

Tether Freezes 13.4 Million USDT in Regulatory Action

Tether’s recent action affects 22 addresses across the Ethereum and Tron ecosystems, locking up a total of 13.4 million USDT. This effort reflects coordinated attempts to hinder potentially unlawful transactions. MistTrack monitored these activities and reported the largest impacted addresses on their official feed.

While no major alterations in market behaviors are expected, the freeze reinforces concerns about the risks linked with decentralized assets and unverified transactions. As no ties to major exchanges or institutional bodies were identified, broader financial implications appear minor.

“On Oct 16, Tether froze 22 addresses (~13.4M USDT) across Ethereum and Tron; largest are 0xecbd8… (10.3M USDT) & TYzDeb… (1.4M USDT).” – MistTrack Official Account, On-Chain Analytics Platform

Responses from regulatory bodies have yet to surface following this announcement, with no public statements by key figures like Tether’s executives. Social media interactions remain minimal, with reposts primarily highlighting MistTrack’s data.

Expert Insights and Market Impact Analysis

Did you know? During past incidents, Tether has similarly immobilized addresses at regulatory requests, reflecting ongoing scrutiny over crypto transactions. This aligns with historical precedents where market impacts remained marginal.

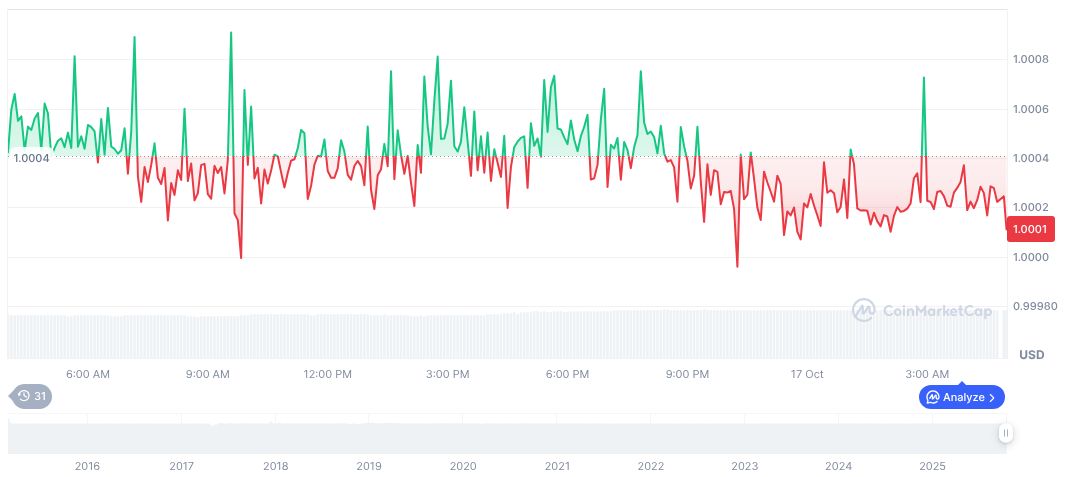

CoinMarketCap data indicates Tether USDt (USDT) remains stable at $1.00, with a market capitalization of 181.52 billion USD. The token maintains a market dominance of 5.15%, while its 24-hour trading volume has seen a 29.27% surge. Notable price changes over set intervals include a 0.05% drop within the last 24 hours.

Experts note that address freezes may influence short-term liquidity but historically pose little threat to Tether’s market stability. The absence of major fluctuations suggests the market’s resilience and steady regulatory environment.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/tether-freezes-13-million-usdt/