- Ethereum reserves on derivative exchanges have surged to the highest level in more than a year as speculative activity rises.

- Rising open interest also suggests traders are increasingly betting on Ethereum’s future price moves.

Ethereum [ETH] has struggled to keep up with the performance of Bitcoin [BTC] and other top altcoins because, in the last seven days, it has dropped by 6% to trade at $3,123 at press time.

Ethereum’s failure to break from bearish trends stems from the lack of adequate demand to counter selling pressure. As AMBCrypto reported, sellers currently have the upper hand, which has prevented a breakout above resistance.

However, a look at the derivatives market shows a divergence. Speculative activity around ETH is at its highest level in months, indicating that derivative traders are positioning themselves for future price movements.

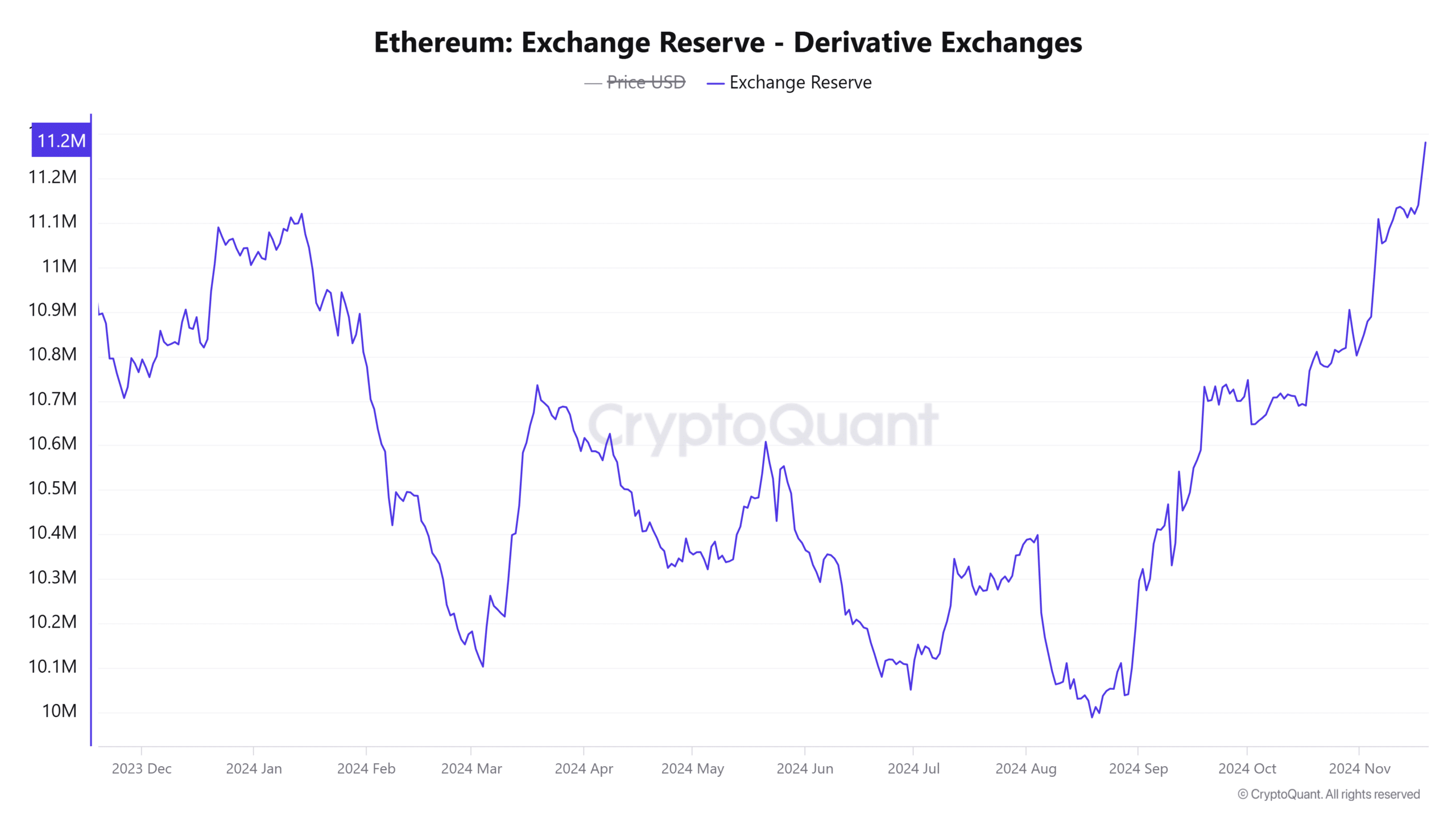

ETH reserves on derivative exchanges hit multi-month highs

Data from CryptoQuant highlights the rising speculative interest around Ethereum. ETH reserves on derivative exchanges stood at 11.28M at press time, marking the highest level in over a year.

Source: CryptoQuant

Higher reserves on derivative exchanges show that speculative traders are participating in leveraged trading around ETH. This shows that traders are placing bets on Ethereum’s future price movements.

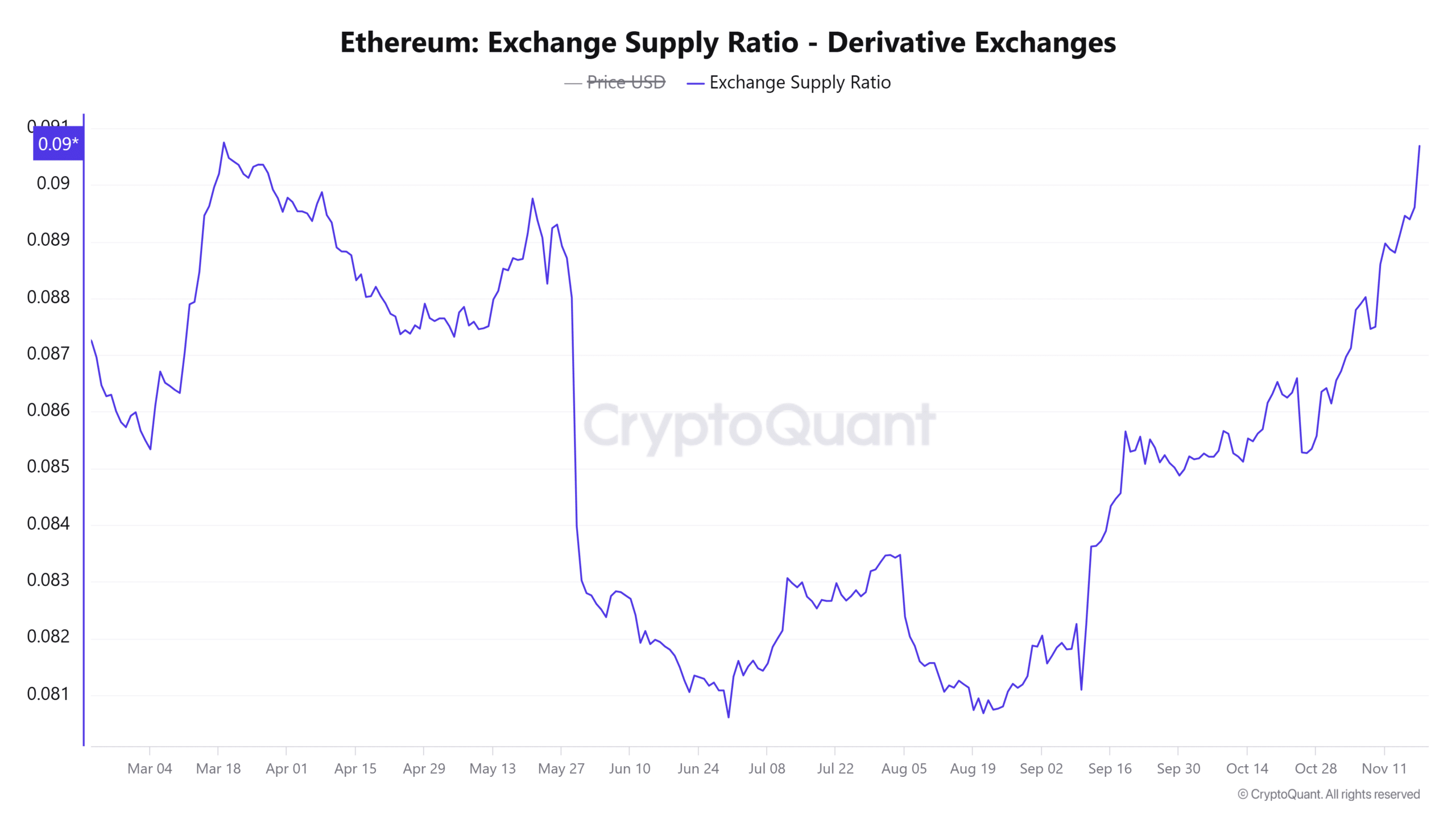

The rising speculative activity is also seen in the derivative exchange supply ratio, which stood at 0.09 at press time, indicating that 9% of Ethereum’s total circulating supply is held in derivative exchanges.

Source: CryptoQuant

This metric is at its highest level since April, representing a shift in market activity where derivative trading activity is playing a pivotal role in influencing Ethereum’s short-term price trends.

A rise in leveraged trading can cause price fluctuations due to forced liquidations if ETH makes unexpected price movements. Moreover, it could reinforce the bullish or bearish trend depending on how market participants are positioning themselves.

Ethereum’s open interest makes another high

Ethereum’s open interest has posted another all-time high of $18.31 billion per Coinglass, showing a rise in the newly opened positions around ETH. Since the start of the month, ETH’s open interest has ballooned by more than $4 billion.

Read Ethereum’s [ETH] Price Prediction 2024–2025

When the open interest rises and the funding rates remain positive, it shows that more traders are opening long positions than short positions. This is an indication of a bullish bias on future price movements.

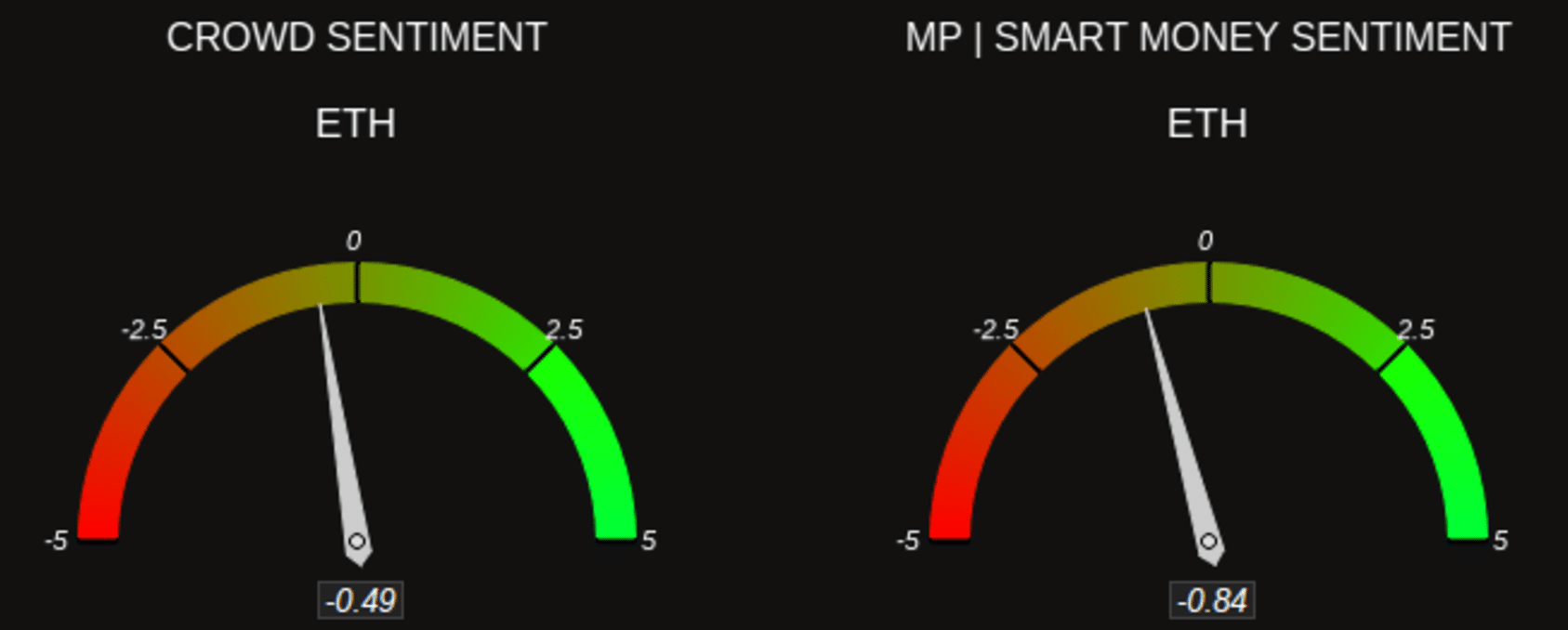

However, data from Market Prophit shows that the general market sentiment around Ethereum remains bearish, which could further weaken demand and prevent a bullish recovery.

Source: Market Prophit

Source: https://ambcrypto.com/speculative-traders-dominate-ethereum-market-bullish-or-bearish-for-eth/