- Ethereum ETFs saw a rebound, bringing relief to the 17 million holders in the red.

- ETH will need to step up to stay ahead in the competitive altcoin race.

The New Year buzz is still pretty active now, especially with Bitcoin [BTC] consolidating on the charts. Historically, Q1 has been bullish for the crypto market, typically creating an environment well-suited for altcoins to attract capital.

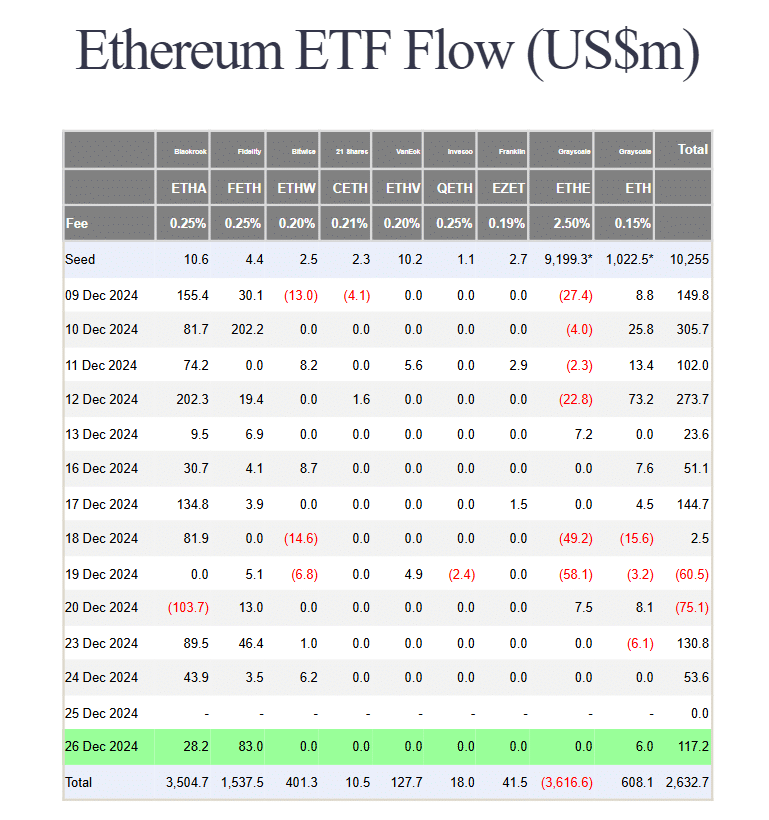

Meanwhile, Ethereum [ETH] ETFs are gaining traction too, with impressive inflows. In fact, Fidelity’s Ethereum ETF (FETH) saw $83 million in net inflows – A sign that investors may be starting 2025 with a focus on diversification.

While it may be too early to draw firm conclusions, Ethereum’s 1.04% price hike seemed to allude to an emerging trend worth keeping an eye on.

For Ethereum, it’s a long road ahead

Since the “Trump pump,” the market has seen several shifts in momentum. What initially seemed like a strong bull rally, with Bitcoin hitting the $100k milestone at the close of the year, has since tapered off. As a result, the “high risk” sentiment is clearly keeping investors cautious.

Ethereum hasn’t been immune to this shift either. After the initial surge, its price fell back to where it was a month ago, erasing much of its election-induced gains. With around 17 million Ethereum addresses now in the red, the pressure for a rebound is building up.

And yet, amidst the uncertainty, $117 million in net inflows through ETH ETFs brings some much-needed relief.

Source: Farside Investors

This marks a positive sign, particularly after two consecutive days of moderate institutional interest – A sign that Ethereum could still be poised for a recovery.

That being said, a full rebound to $4,000 still seems a long way off. Technically, it would require an 18% jump. And, given its recent performances over the last 30 days, this might seem a bit too optimistic in the short term.

There are other players in the race for dominance

Like Ethereum, other altcoins are enhancing their underlying tech to offer investors compelling long-term prospects. One that stands out in particular is XRP.

Interestingly, XRP’s daily price action revealed signs of consolidation at press time, with intense buying and selling pressure creating a stand-off. This tug-of-war has attracted attention from big players, who are betting on XRP for potential big returns.

With its impressive triple-digit gains, real-world use case integrations, and strong whale backing, XRP is positioning itself to potentially take the spotlight from Ethereum as the market rebounds—A trend that must be closely followed in the days ahead.

Read Ethereum [ETH] Price Prediction 2025-2026

On the flip side, Ethereum’s chart has been more volatile. After hitting its yearly high of $4,106 just 10 days ago, ETH dropped a staggering 21% in a week. So, while a recovery is possible, it has been slow, indicating a lack of immediate buying interest from the market.

Looking ahead, the next few days could be make-or-break for Ethereum. Although fresh capital could push BTC into consolidation, potentially benefiting altcoins like Ethereum, the current lack of consistent support in ETH’s price means a swift recovery is unlikely.

On top of that, the competition among altcoins is heating up, and Ethereum will have to show more consistency if it wants to stay at the forefront of the pack.

Source: https://ambcrypto.com/significant-83-million-daily-inflows-recorded-for-ethereum-etf-by-fidelity-whats-next/