- Ethereum experiences a significant weekly price surge despite overbought signals.

- PEOPLE shows a massive weekly gain of 156%, maintaining above MA10.

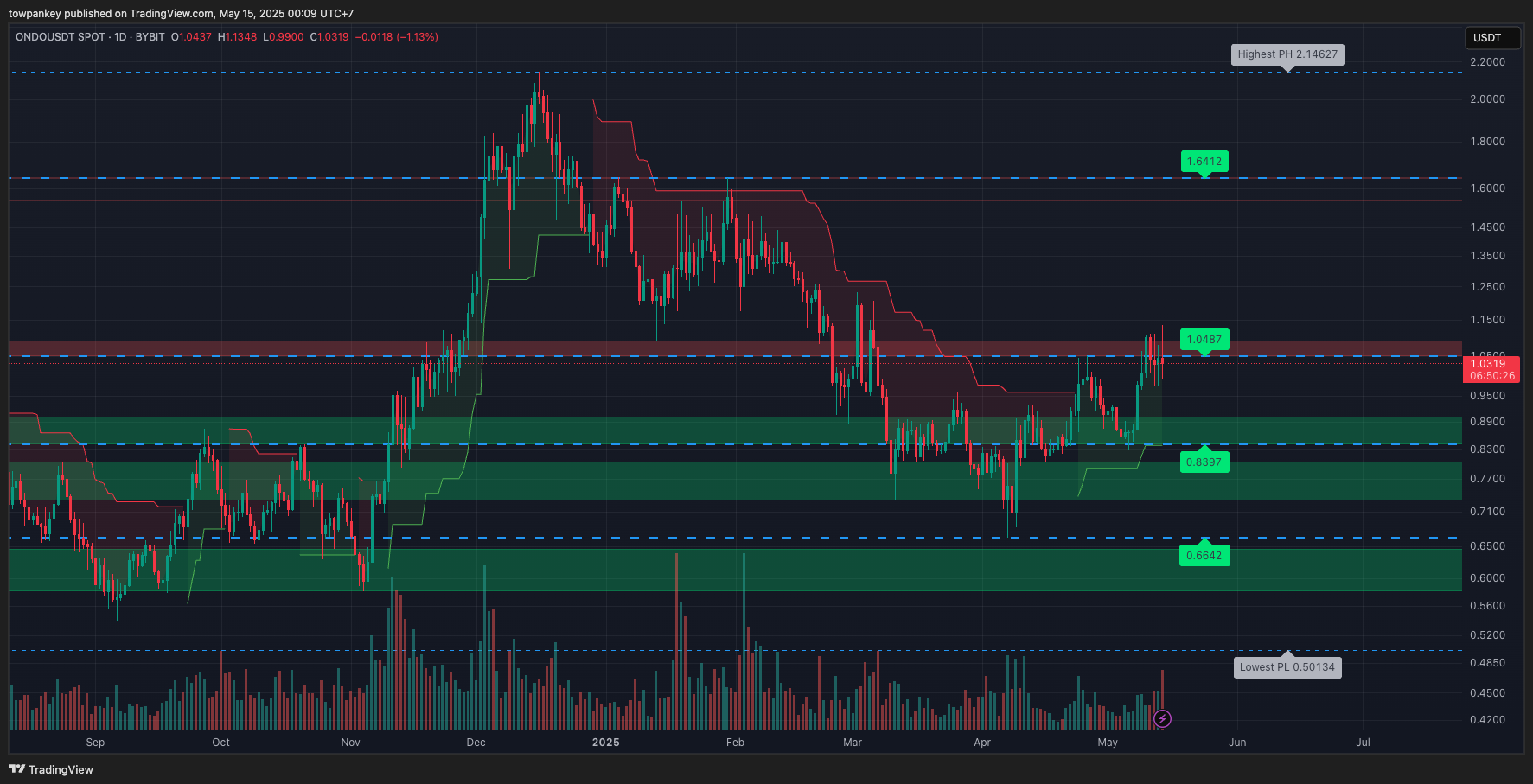

- ONDO sees rising trading volume implying bullish momentum, but caution on trend exhaustion.

Ethereum and PEOPLE break out of prolonged downtrends but face strong resistance levels, signalling a cautious market as bullish momentum meets selling pressure.

Ethereum’s rally faces resistance at $2,857 with high volume suggesting a possible retracement, while PEOPLE sees seller rejection at $0.035 amidst rising volume, indicating supply pressure despite bullish moves.

Methodology

This technical commentary is based on TradingView indicators and public price data from major exchanges as of May 14, 2025. Key indicators include RSI, MACD, EMA cloud overlays, StochRSI, and volume analysis. The insights are educational in nature and should not be interpreted as financial advice.

Ethereum Sees 42% Weekly Surge, Watch Out for Reversals

Ethereum’s recent price of $2,574.05 reflects a 24-hour decline of 1.24%, yet a seven-day surge of 42.27%, attributed to a trading volume increase of 22.37% to $34,993,287,907.32. This boosted its market cap to $310,761,117,641.84, achieving a 9.33% dominance.

Bullish momentum persists despite ETH’s RSI at 77.58, indicating overbought conditions; StochRSI at 83.02 suggests strong buying pressure, while the MACD at 220.10 confirms bearish overtones as traders eye possible trend reversals.

Ethereum (ETH) Technical Analysis

Ethereum has recently broken out of a multi-month downtrend that lasted from early January to late April 2025. After forming a strong base around the $1,700–$1,900 zone, the price surged past the psychological and technical resistance levels near $2,100 and $2,300.

The move was impulsive and supported by rising volume, indicating a fresh, bullish leg. Price has now entered the previous supply zone between $2,600 and $2,850, suggesting a test of an old distribution range.

The most recent daily candle shows a long upper wick and a red close, forming a possible shooting star or rejection candle at the $2,857 level, an identified resistance zone. This implies early signs of exhaustion from buyers at the top of the move.

The volume during this rejection is notably high, adding credibility to a possible short-term retracement or consolidation phase. Previous bullish candles were full-bodied with low wicks, confirming strength during the rally phase.

Ethereum Price Prediction Scenarios

- Bullish: If the price breaks above the $2,857 resistance, it may rally toward the next key resistance at $3,437 or potentially extend toward $4,100 (Previous High).

- Bearish: If support at $2,300 fails, watch for a drop to retest the $2,104 level or even deeper toward $1,900–$1,700.

- Neutral: Sideways consolidation is likely if volume dries up in the $2,500–$2,850 range, especially with indecision candles appearing.

Example Trade Setup (Educational Only)

- Consider monitoring $2,300 for support bounce setups — hypothetical long if bullish wick confirms.

- Watch for a breakout at $2,857 with strong volume before entering long setups.

- If the price loses $2,300 with high sell volume, the downside may continue to $2,104 or $1,900.

Read more: Ethereum (ETH) Price Prediction Tomorrow and Next Week

ConstitutionDAO’s PEOPLE Gains 156% Amid Overbought Signals

ConstitutionDAO (PEOPLE) is a trending altcoin, experiencing a 24-hour rise of 11.31% and a current price of $0.03. With a trading volume of $772,337,030 and dominance of 0.01%, it shows positive weekly momentum at a 156.15% gain.

Technical indicators for PEOPLE include an RSI at 92.12 and a StochRSI at 100.00, signalling varied trends. Price holds above MA10 ($0.02103) but below MA200 ($0.03467). ADX suggests a neutral trend strength at 34.20.

ConstitutionDAO (PEOPLE) Technical Analysis

PEOPLE has broken out of a prolonged downtrend that began in late December 2024. After several months of consolidation between 0.011 and 0.017, the price made a decisive bullish breakout above 0.01741 and 0.023, pushing into previous supply zones. The move signifies a potential shift from accumulation to the markup phase.

However, the price has now met resistance near the 0.035 zone, which was previously strong support from October to December 2024.

The recent daily candle shows a long upper shadow and a red body, suggesting seller rejection at 0.035. This indicates that despite bullish momentum, supply pressure exists at this level. Volume during the breakout was significantly higher than in previous sessions—classic confirmation of breakout validity.

Now, however, we see declining volume during the pullback, which hints at temporary exhaustion rather than a full reversal.

ConstitutionDAO Price Prediction Scenarios

- Bullish: If the price breaks above 0.035 cleanly

- Bearish: If the price loses support at 0.023

- Neutral: Consolidation likely between 0.023 and 0.035 if volume fades

Example Trade Setup (Educational Only)

- Watch for a retest of $0.023 with the bullish structure to consider long setups.

- Confirm breakout above $0.035 on strong volume for continuation.

- Avoid if the price closes below $0.023 on high volume.

Read more: ConstitutionDAO (PEOPLE) Price Prediction Tomorrow and Next Week

ONDO’s Trading Volume Jumps 83%, Bullish But Cautious

Ondo (ONDO) is a trending altcoin, showing a slight 24-hour price dip of 0.58% with a current price of $1.03. Its trading volume has surged to $518,287,429, up 83.78%, suggesting bullish momentum despite the recent 19.97% weekly rise.

Technical indicators show bullish signals, with RSI and MFI near but not in overbought zones. SMA alignment (10-200) supports continued momentum, although ADX suggests possible trend exhaustion soon. Monitor StochRSI and MACD for trend confirmation.

Read more: Ondo (ONDO) Price Prediction Tomorrow and Next Week

Ondo (ONDO) Technical Analysis

ONDO recently reversed its bearish trend, forming a rounded bottom structure between March and April 2025. Price broke above key resistance at $0.8397 and surged past $1.00, reaching the $1.0487 level—a zone that previously acted as a strong support-turned-resistance from December 2024.

The overall structure shows a potential trend reversal and the start of a new uptrend, but the current price is stalling at resistance.

The latest candle is a small-bodied red candle with an upper shadow, suggesting hesitation from bulls at the $1.0487 supply zone.

The move up was accompanied by increasing volume, validating the rally, but now volume appears to taper off—a sign of temporary buyer fatigue. This setup could imply a short pullback or sideways consolidation before another move.

Ondo Price Prediction Scenarios

- Bullish: A confirmed breakout above $1.0487 may open the path toward $1.6412 as the next resistance.

- Bearish: A breakdown below $0.8397 support could lead to a drop to $0.6642.

- Neutral: Consolidation likely between $0.95 – $1.05 if volume stays muted and price chops under resistance.

Example Trade Setup (Educational Only)

- Monitor $0.8397 for retest + bullish signal.

- Confirm breakout above $1.0487 on strong volume before entering.

- Consider short if the price breaks $0.8397 on a large sell volume.

FAQs

Is Ethereum’s rally sustainable despite overbought signals?

Ethereum’s rally is strong but overbought. Resistance at $2,857 may trigger a short-term pullback unless volume supports a breakout.

Why is PEOPLE struggling to break $0.035?

Despite a 156% weekly gain, PEOPLE is facing heavy sell pressure at $0.035, a former support zone that has become a resistance zone.

Why is ONDO not pushing higher above $1.05?

ONDO is stalling at a major resistance level ($1.0487) despite high volume, a sign bulls may be losing momentum.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/337654-short-term-price-prediction-5-15-eth-people-ondo/