- SharpLink Gaming plans to stake $3.6 billion Ethereum on the Linea network.

- This strategic move aims for better risk-adjusted returns.

- Treasury funds symbolizing substantial financial parts are considered for staking.

SharpLink Gaming Inc. plans to stake a portion of its $3.6 billion Ethereum treasury on Consensys’s Linea Layer-2 network post-mainnet launch on September 10.

The move aims to achieve higher returns and diversification in its asset holdings, despite causing a 4-5% drop in SBET stock amid initial market reactions.

SharpLink’s Strategic Shift to Linea Network Staking

Market reactions indicate a mixed reception, with SharpLink’s stock experiencing a temporary 4–5% drop post-announcement, aligning with broader market uncertainties. Statements from the Co-CEO emphasize the strategic shift’s intention to diversify risk amid growing interest in Layer-2 solutions like Linea, reflective in Ethereum’s strategic community engagements.

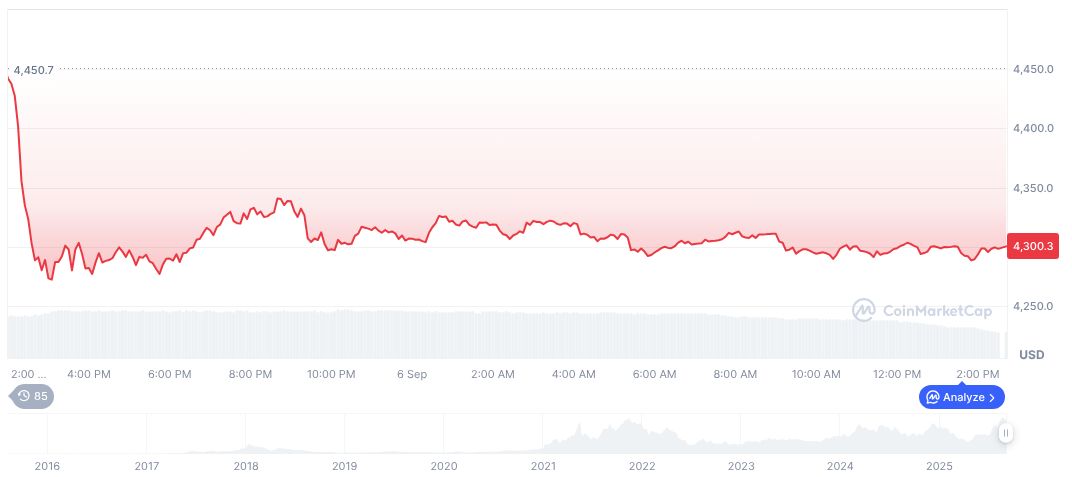

At the current price of $4,272.26 per Ethereum, with a market cap of $515.68 billion, Ethereum dominates 13.60% of the market, per CoinMarketCap. The asset has seen slight decline recently, with -0.96% over 24 hours and -2.18% over a week. Yet, Ethereum enjoyed substantial growth over longer periods, rising 70.48% across 90 days. Co-CEO Joseph Chalom notes the implications for liquidity and staking drive a broader trend supporting the token’s valuation trajectory.

Analyzing Ethereum Prices and Staking Projections

Did you know? SharpLink’s move to stake Ethereum on a Layer-2 network resonates with a trend where large entities increasingly engage in strategic staking. This strategy reflects participation patterns seen with massive ETH movements for enhanced yield pursuits.

Insights from the Coincu research team suggest strategic diversification through Linea furthers Ethereum’s staking narrative, while regulatory frameworks specific to Layer-2 innovations keep evolving. Enhanced returns, when paired with regulated environments, could stabilize SharpLink’s financial profile, aligning it with thriving digital asset strategies. Advanced networks like Linea continue to catalyze technological disruption across sectors.

Insights from the Coincu research team suggest strategic diversification through Linea furthers Ethereum’s staking narrative, while regulatory frameworks specific to Layer-2 innovations keep evolving. Enhanced returns, when paired with regulated environments, could stabilize SharpLink’s financial profile, aligning it with thriving digital asset strategies. Advanced networks like Linea continue to catalyze technological disruption across sectors.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/ethereum/sharplink-stake-ethereum-linea/