- Grayscale’s Ethereum Trusts approved for NYSE Arca listing by SEC.

- New rule streamlines ETF market access.

- This approval may bolster trading volumes and liquidity for Ethereum.

The U.S. Securities and Exchange Commission (SEC) has approved listing Grayscale’s Ethereum Trust on NYSE Arca under Rule 8.201-E as of September 24.

This decision streamlines regulatory processes for Ethereum ETFs, potentially increasing market participation and liquidity.

SEC’s Approval Boosts Ethereum ETF Market Access

Grayscale’s Ethereum Trust and Mini Trust have received approval from the U.S. SEC to list on NYSE Arca, following the new Generic Listing Rule 8.201-E. NYSE Arca becomes a significant platform, accommodating Ethereum ETFs without needing individual SEC approval. This is expected to boost market competitiveness and facilitate quicker listings.

Immediate implications of this regulatory change include potential increases in market participation and liquidity for Ethereum ETFs. By lowering entry barriers for these products, it fosters a favorable environment for institutional investors and potentially enhances trading activity on NYSE Arca.

“The approval of the Generic Listing Rule 8.201-E marks a significant milestone for Ethereum-based ETFs, simplifying the regulatory landscape and fostering greater market access.” — Michael Sonnenshein, CEO, Grayscale Investments

No major public statements were issued by key players or influencers on social media immediately following the SEC’s decision. Market reactions registered primarily as procedural, with no notable controversies or objections from stakeholders, indicating a cautious but positive acceptance of the new rule.

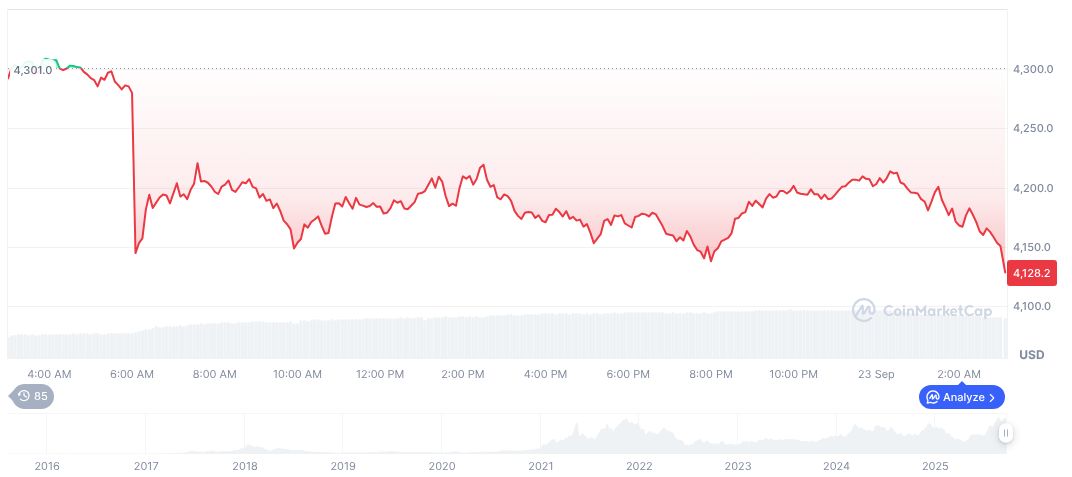

Ethereum Price Trends as Market Awaits Impact

Did you know? The SEC’s previous approvals for Bitcoin-based ETFs, under similar procedures, significantly expanded product offerings and market share for cryptocurrency ETFs, suggesting potential parallels for Ethereum market growth.

CoinMarketCap data shows Ethereum (ETH) priced at $4,189.84, with a market cap of approximately 505,729,544,368. The token’s 24-hour trading volume was 32,175,126,674, a notable 39.71% decrease from prior figures. Ethereum’s 90-day price change reflects a 69.81% increase.

Insights from the Coincu research team highlight that regulatory streamlining could lead to increased investor confidence and continuous inflow into Ethereum-based products. The approval may usher in a new phase of financial activity, particularly from institutional entities, aligning with trends observed in Bitcoin ETF expansions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/grayscale-ethereum-trusts-sec-approval/