Ethereum price moves around $3,000 amid broader crypto market weakness heading into year-end. Crypto research firm Matrixport and analysts predict a massive ETH structural breakout in 2026, which could bring back long-term holders and institutions.

Ethereum Price Set for Major Breakout in 2026

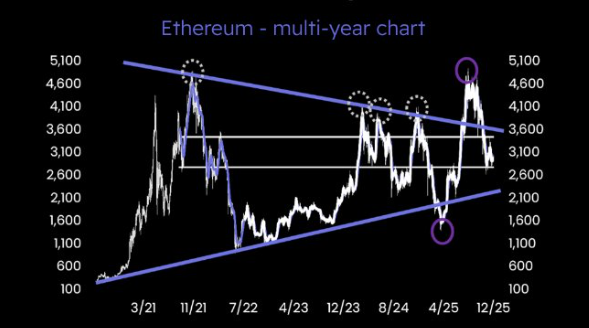

In a recent analysis shared on December 30, Matrixport pointed out that Ethereum price has continued to consolidate within a massive symmetrical triangle formation since 2021. Corporations announcing Ethereum treasury and institutional trading have resulted in two notable false breakouts.

ETH saw a breakdown below the triangle pattern in April and a false breakout above in August that quickly reversed. Ethereum price is again consolidating within a tight range amid lower implied volatility and thin liquidity in the crypto market.

Matrixport claims that a tightening structure leaves little room for further sideways movement, signaling that a decisive breakout or breakdown could occur as early as 2026. A breakout above the symmetrical triangle would trigger a massive upward momentum.

“The coming year is likely to be one of the most pivotal in Ethereum’s history as this long-running formation finally resolves,” the firm added.

ETH Needs Institutional Support for Rally

Institutional interest in spot Ethereum ETFs and the planned Ethereum network upgrades could help price rally in the coming year.

Spot Ethereum ETFs saw $9.6 million in total outflows on Monday, marking the 4th consecutive outflow. BlackRock’s Ethereum ETF (ETHA) recorded $13.3 million in outflow, continuing its outflow streak.

However, Fidelity’s FETH saw $3.7 million in inflow, sparking hopes of a potential rebound in Ethereum price. Many expect an upside breakout could target levels near $10,000, considering earlier bullish projections.

Crypto analyst Ted Pillows said ETH needs to reclaim and hold the $3,000 first for upside momentum. It has a liquidity cluster in the $3,000-$3,100 range.

Some institutions such as Trend Research continue to accumulate ETH, with $63,280,000 in ETH purchased on Monday. Since November, Trend Research has accumulated $1.8 billion in ETH. Also, Fundstat’s Tom Lee-backed Ethereum treasury Bitmine Immersion expanded its ETH holdings to over $12 billion.

Ethereum price is trading sideways near $3000 over the past 24 hours. The 24-hour low and high are $2,908 and $2,997, respectively. Furthermore, trading volume has jumped further by 10% over the last 24 hours, indicating increased interest among traders.

The derivatives market shows buying in the last few hours, as per CoinGlass data. At the time of writing, the total BTC futures open interest is up 1% to in last 4 hours. The 24-hour BTC futures OI dropped more than 2%, with 13% fall in futures OI on CME.