Ethereum price remains above $3,000, signaling potential for further gains as market sentiment improves. On-chain data reveals large investors accumulating ETH, indicating confidence in a possible rally. Technical indicators suggest Ethereum could climb higher if buying pressure continues, reinforcing bullish expectations in the market.

Ethereum Price Rally Likely After FOMC Volatility

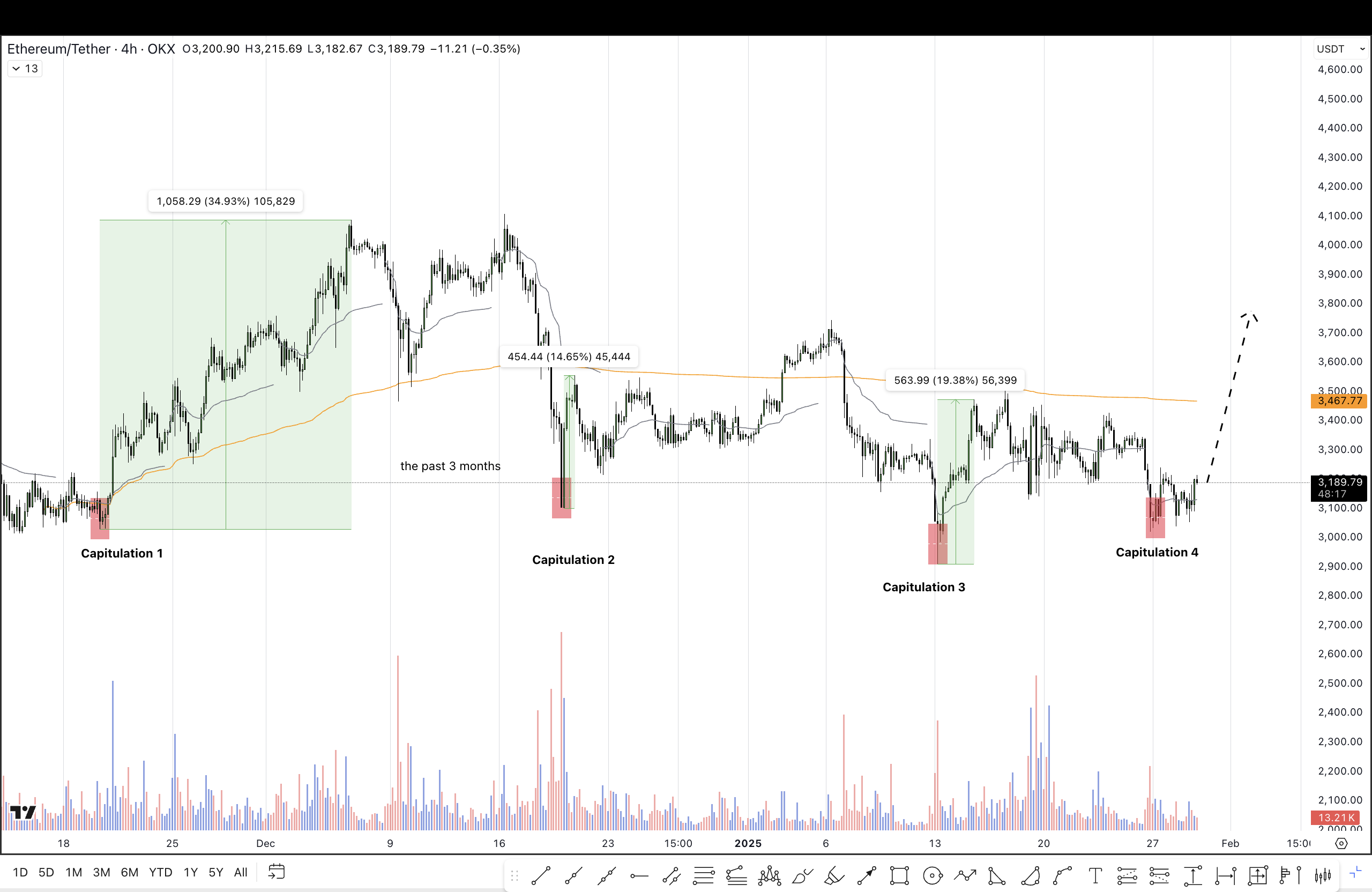

In recent months, following episodes of market volatility due to the FOMC announcements, Ethereum has demonstrated a notable recovery pattern. Observations from Sentiment Feed’s Net Realized Profit/Loss (NPL) indicator revealed that Ethereum often initiated a significant price rebound during these periods of heightened volatility.

Specifically, Ethereum’s response to sudden downturns has been characterized by rapid recoveries, with the magnitude of these recoveries varying. On some occasions, price recoveries have surged by as much as 34%, while in other instances, the rebounds were more modest, around 14%.

Overlaying Ethereum’s price movements on the ETH/USDT chart with the identified capitulation dates provides further clarity on this pattern.

Ethereum has already shown a promising 5.35% increase since the last FOMC announcement, suggesting potential for continued growth in the coming weeks. This ongoing trend signals a robust market sentiment that could propel Ethereum to $3,800 amidst global economic fluctuations.

Whale Activity Suggests Rising Interest in Ethereum

Ethereum price analysis reveals a distinct pattern in recent trading behaviors. According to the NPL indicator, significant capitulation events occurred on January 13 and January 27, rather than January 29.

Despite a milder response from whales on January 13, transactions over $100,000 have seen a noticeable uptick since January 27. This suggests that more prominent investors are growing interest in Ethereum, which may indicate their optimism about its future value.

Since January 21, Ethereum wallets with capacities ranging from 1,000 to 10,000 have amassed a staggering 100,000 ETH. Meanwhile, larger wallets, holding between 10,000 and 100,000 ETH, added 300,000 ETH to their coffers.

The largest of these, containing 100k to 1 million ETH, has seen an increase of 900k ETH. Notably, the transactions by these colossal holders represent a significant concentration of wealth, approximately $310 million in Ethereum accumulated in just nine days, underscoring a sharp spike in whale transaction activities.

Ethereum Price Analysis

Ethereum recent price movements suggest a potential bullish trend. Technical analysis indicates it is currently in a falling wedge formation, a pattern typically followed by a breakout to the upside. If the pattern holds, the significant target of $4,000 is within reach. The ETH price is trading at $3,265, with a 7% surge in the past 24-hours.

The key resistance levels traders should monitor for potential profit-taking are $3,322, $3,592, and the pivotal $4,000 mark. The immediate levels to watch are $3,182 and $3,057 on the support side. If Ethereum price prediction breaks below these supports, there could be a steep decline, with prices dropping around 13% to hit the $2,657 level.

In summary, Ethereum’s current market indicators and whale activity suggest a robust potential for an upward trend. Continued accumulation by large investors could drive ETH prices towards significant resistance levels.

Frequently Asked Questions (FAQs)

Key resistance levels for Ethereum are currently set at $3,322, $3,592, and $4,000.

A break below support levels at $3,182 and $3,057 could trigger a steep decline, potentially down to $2,657.

Ethereum often experiences a price rebound after FOMC-related market volatility, showing strong recovery trends.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/markets/is-ethereum-price-rally-next-as-holders-capitulate-amid-whale-buying-spree/

✓ Share: