- Grayscale’s Ethereum Trust and Mini Trust gained NYSE Arca approval under Rule 8.201-E.

- New rule streamlines ETF listing, eliminating separate SEC approvals.

- Market expects an easier path for future ETFs like XRP and Solana.

Grayscale’s Ethereum Trust and Mini Trust received approval for listing on NYSE Arca under Rule 8.201-E, simplifying the ETF process as of September 24, 2025.

This regulatory change reduces barriers for crypto ETFs, potentially boosting market competitiveness and accelerating similar listings for assets like XRP and Solana.

Grayscale’s Ethereum Trust Gains NYSE Arca Listing Approval

Grayscale’s Ethereum Trust and Mini Trust gained NYSE Arca approval under Rule 8.201-E as of September 24, 2025. This change permits hedge funds and other institutional investors to access these ETFs more readily. Grayscale intends to use this framework as a basis for listing other potential ETFs, possibly including XRP and Solana.

Rule 8.201-E now facilitates streamlined ETF listings by eliminating the need for a separate SEC approval process for each crypto asset. This is expected to reduce administrative hurdles and costs significantly, enhancing market access and encouraging institutional participation. The move supports broader crypto adoption by providing established channels for trading and investments.

Market responses are optimistic. Experts highlight the reduced friction for fund managers and exchanges, while institutional investors anticipate higher liquidity. Although there have been no formal statements from key figures, the industry’s positive reaction suggests a favorable sentiment toward potential asset expansions under this framework.

Ethereum’s Market Impact and Future ETF Pathways

Did you know? Grayscale’s listing of Ethereum Trusts under Rule 8.201-E reflects a similar shift seen with BTC spot ETFs in 2024, which significantly boosted Bitcoin’s institutional adoption.

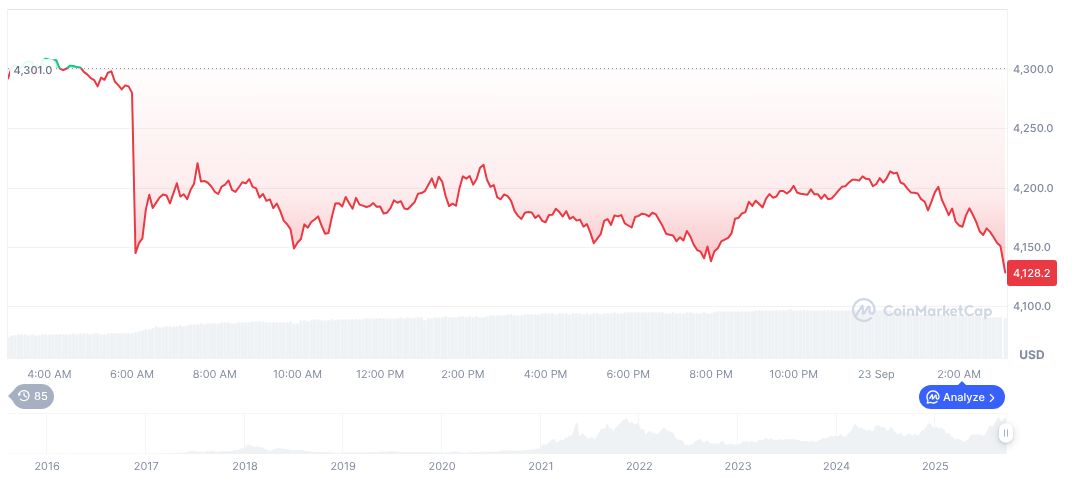

According to CoinMarketCap, Ethereum (ETH) trades at $4,179.14 with a market cap of $504.44 billion as of September 24, 2025. Its 24-hour volume hit $33.07 billion, although transaction activity faced a decline of 38.13%. ETH demonstrated a price increase of 12.32% over 60 days and a robust 72.26% over 90 days.

Crypto analysts from Coincu suggest Ethereum’s trust’s inclusion on NYSE Arca may encourage similar actions for other digital assets. Rule 8.201-E could prove instrumental in expanding the ETF marketplace, driving further innovation in cryptocurrency investment vehicles. This change mirrors broader trends toward regulatory acceptance and institutional confidence in the crypto space.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/grayscale-ethereum-trust-nyse-listing/