Grayscale announced the launch of its staking facility for its two Ethereum ETFs, ETHE and ETH, on Monday, October 6. On the debut day, both these ETFs have staked a total of 32,000 ETH, worth $150 million. However, both these ETFs failed to gather enough steam in terms of institutional inflows yesterday. Following yesterday’s development, ETH price made a strong move and is trading past $4,707, with analysts predicting fresh all-time highs soon.

Grayscale Staking Ethereum ETFs Inflows See Milestone Response

On October 6, Grayscale became the first asset manager to introduce an ETH staking facility to its spot Ethereum ETFs, ETH and ETHE. This is a milestone achievement as introducing a staking facility would further enhance the funds’ returns, thereby attracting greater institutional capital. ETH Price bounced back soon after and is currently trading 4% up at $4,707.

On Monday, Grayscale staked 32,000 Ether (ETH), valued at approximately $150.56 million, across its Ethereum Trust (ETHE) and Ethereum Mini Trust (ETH) exchange-traded funds, as per data from Arkham Intelligence. The move follows the firm’s recent introduction of staking capabilities for its U.S.-listed spot Ethereum ETFs.

Grayscale(ETHE and ETH ETF) staked 32,000 $ETH($150.56M) today.https://t.co/OcQGQe8US6 pic.twitter.com/lQLIWl8yQX

— Lookonchain (@lookonchain) October 7, 2025

In their official declaration, Grayscale noted that the Grayscale Ethereum Trust (ETHE) will distribute staking rewards as cash payouts to investors seeking regular income. On the other hand, the Grayscale Ethereum Mini Trust (ETH) will reinvest staking returns into its net asset value (NAV), enabling compounding over time.

Thus, investors get a tailored exposure to Ethereum staking via a single platform. Rex-Osprey is already competing with Grayscale in this space by introducing its staked Ether ETFs last week.

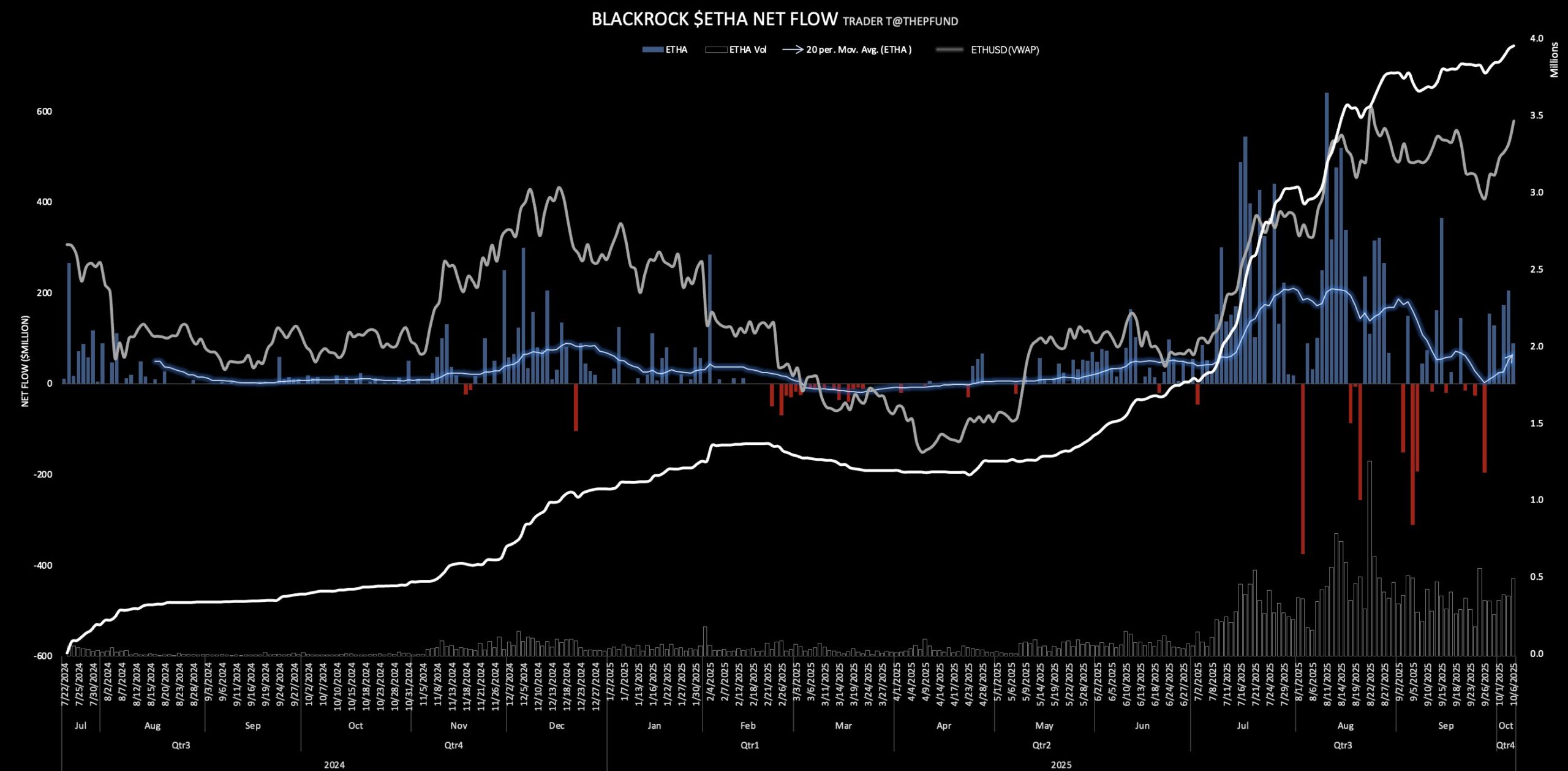

BlackRock Leads Ether ETF Inflows

Despite the launch of staking facility, Grayscale ETHE and ETH didn’t see much inflows. In fact, these two ETFs saw the least inflows in comparison to other US ETF issuers. On the other hand, BlackRock iShares Ethereum Trust (EHTA) clocked the most inflows on Monday $92 million, followed by Bitwise ETHW, at $27 million. On the other hand, Grayscale’s ETHE and ETH saw inflows of $14.8million and $18.7 million, respectively.

BlackRock’s spot Ethereum ETF (ETHA) recorded net inflows of 18,959 ETH, yesterday. The fund’s total volume traded reached $2 billion, showing sustained institutional interest.

At the same time, the ETHA share price surged 4.47% to $35.79, hitting fresh all-time highs. ETHA has gained nearly 200% since April lows, with its assets under management now crossing $18.5 billion.

On the other hand, the ETH price also staged a strong upside, gaining another 4% and is trading past $4,707. Market observers believe that this is the beginning of a bigger rally in ETH to fresh all-time highs.