- FG Nexus rebrands and enlarges its outstanding shares to enhance its Ethereum strategy.

- The company aims to raise $200 million capital via pre-funded warrants.

- FG Nexus’s approach is compared to MicroStrategy’s Bitcoin reserve strategy.

Nasdaq-listed FG Nexus Inc. officially rebranded from Fundamental Global Inc., increasing its outstanding shares to 35.4 million to bolster its Ethereum treasury strategy, confirmed by Nevada Secretary of State.

This strategic move signals a robust commitment to expanding Ethereum holdings, potentially influencing institutional interest and ETH market dynamics significantly.

FG Nexus Expands Shares to Enhance Ethereum Strategy

FG Nexus Inc., formerly Fundamental Global Inc., has officially rebranded and significantly increased its outstanding shares. The company amended its articles of incorporation to change its name and boost its stock volume, supporting a massive Ethereum treasury strategy.

The amendment has resulted in a substantial increase in authorized shares from 4 million to 1 billion and outstanding shares from 1.3 million to 35.4 million. This is facilitated by the automatic exercise of pre-funded warrants. The move aims to significantly raise capital for expanding Ethereum holdings, with a private placement of 40 million pre-funded warrants at $5.00 each, targeting a $200 million capital raise.

The broader market noted FG Nexus’s focus on Ethereum, with some drawing parallels to strategies like MicroStrategy’s Bitcoin reserves. No direct industry or governmental reactions have emerged, but it has generated interest in how it might affect Ethereum’s market dynamics.

“We are excited to lead our company into the digital asset space with a strategic focus on Ethereum, positioning ourselves at the forefront of blockchain innovation.” — Maja Vujinovic, CEO, FG Nexus Inc.

Ethereum’s 11.81% Growth amid Institutional Attention

Did you know? FG Nexus Inc.’s focus on Ethereum marks a unique approach, paralleling MicroStrategy’s Bitcoin strategy but exclusive to Ethereum.

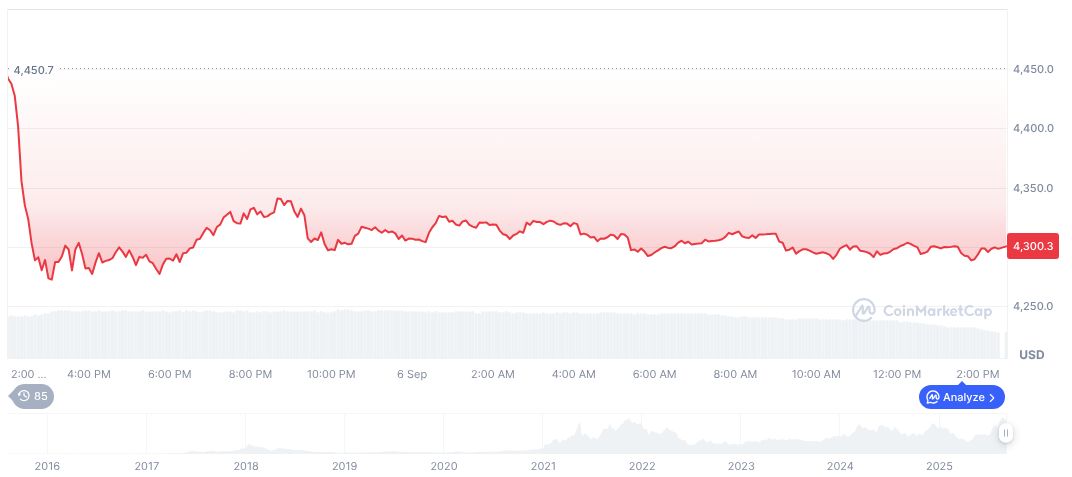

CoinMarketCap reports that Ethereum (ETH) currently trades at $4,272.21 with a market cap of $515.68 billion, showing a 24-hour volume of $20.34 billion. In the past 30 days, ETH gained 11.81%, maintaining a market dominance of 13.60%.

According to the Coincu research team, this focus on Ethereum resembles trends in institutional interest seen previously in Bitcoin strategies. Such a large-scale dedication to a single digital asset might influence broader institutional investment patterns within the cryptocurrency market.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/ethereum/fg-nexus-ethereum-strategy-2/