- ETH is repeating a familiar price action pattern, with a potential distribution phase ahead.

- Rising ETF holdings and realized cap hint at a shift in market dynamics.

Ethereum [ETH] appears to be repeating a familiar pattern. Usually, from previous observations, altcoins’ price action follow an accumulation-manipulation- distribution phases.

During the previous bullish run in November, ETH witnessed a 42% surge, followed a short term of price consolidation.

Post this, there was a final distribution phase that saw a consecutive 21% price rally, making an all-time high of $4.1K. The price level holds as the all-time up to day.

Zooming down to the daily chart, history appears to be repeating itself.

Since the recent breakout from the bullish flag back on the 8th of May, prices surged by a similar percentage (42%) and appeared to be at a consolidation phase during press time.

Could a similar distribution phase follow for a potential 21% rally-most likely past the $3K milestone price?

Source: TradingView

Notably, the stochastic RSI, a momentum indicator that follows price movement based on recent highs and lows, was approaching the oversold zone at press time — a region that could flash breakout signals.

No guarantee, but this setup extends a hand to credibility of a potential rally in ETH’s price.

ETH capital influx suggests mounting confidence

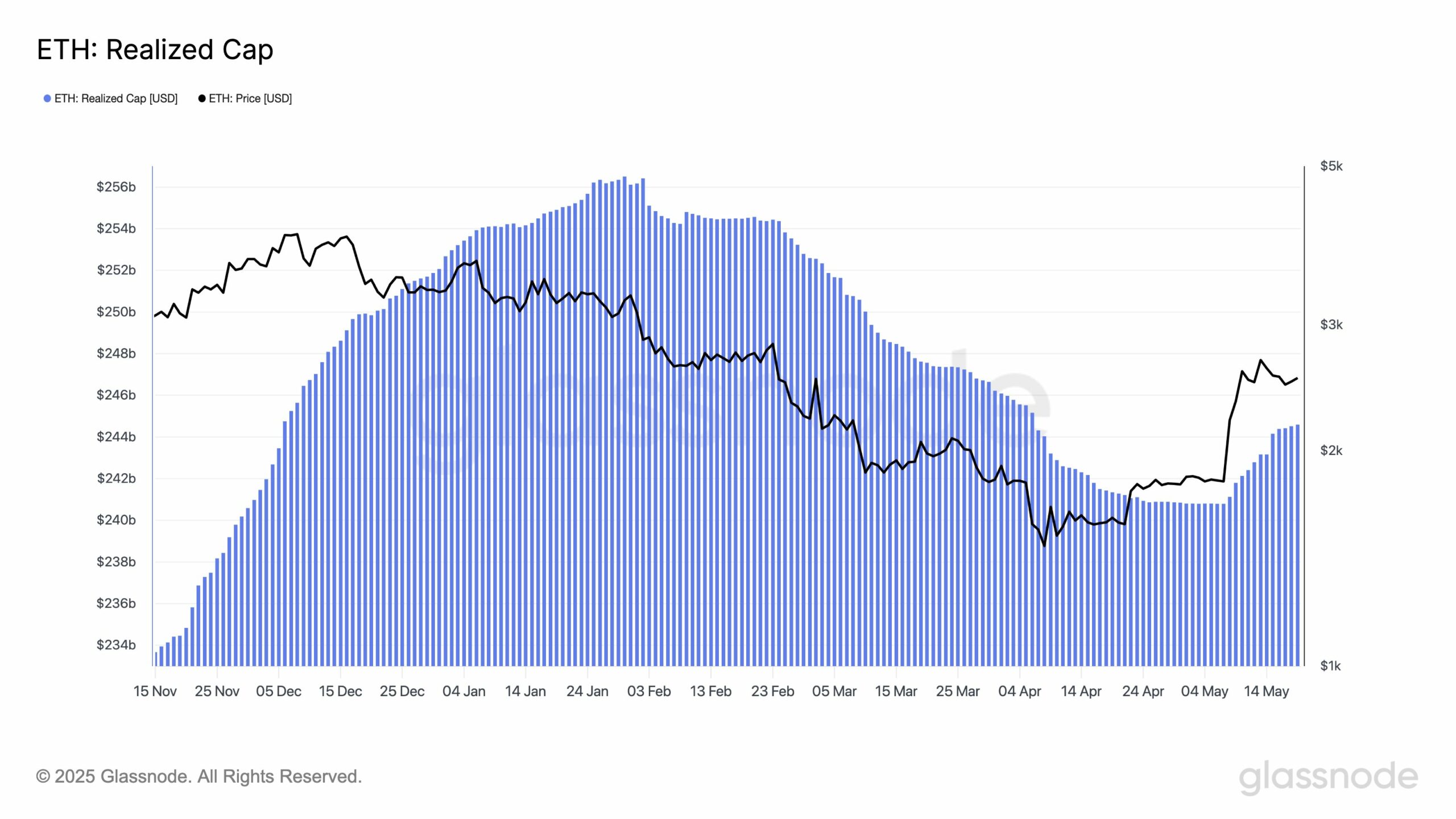

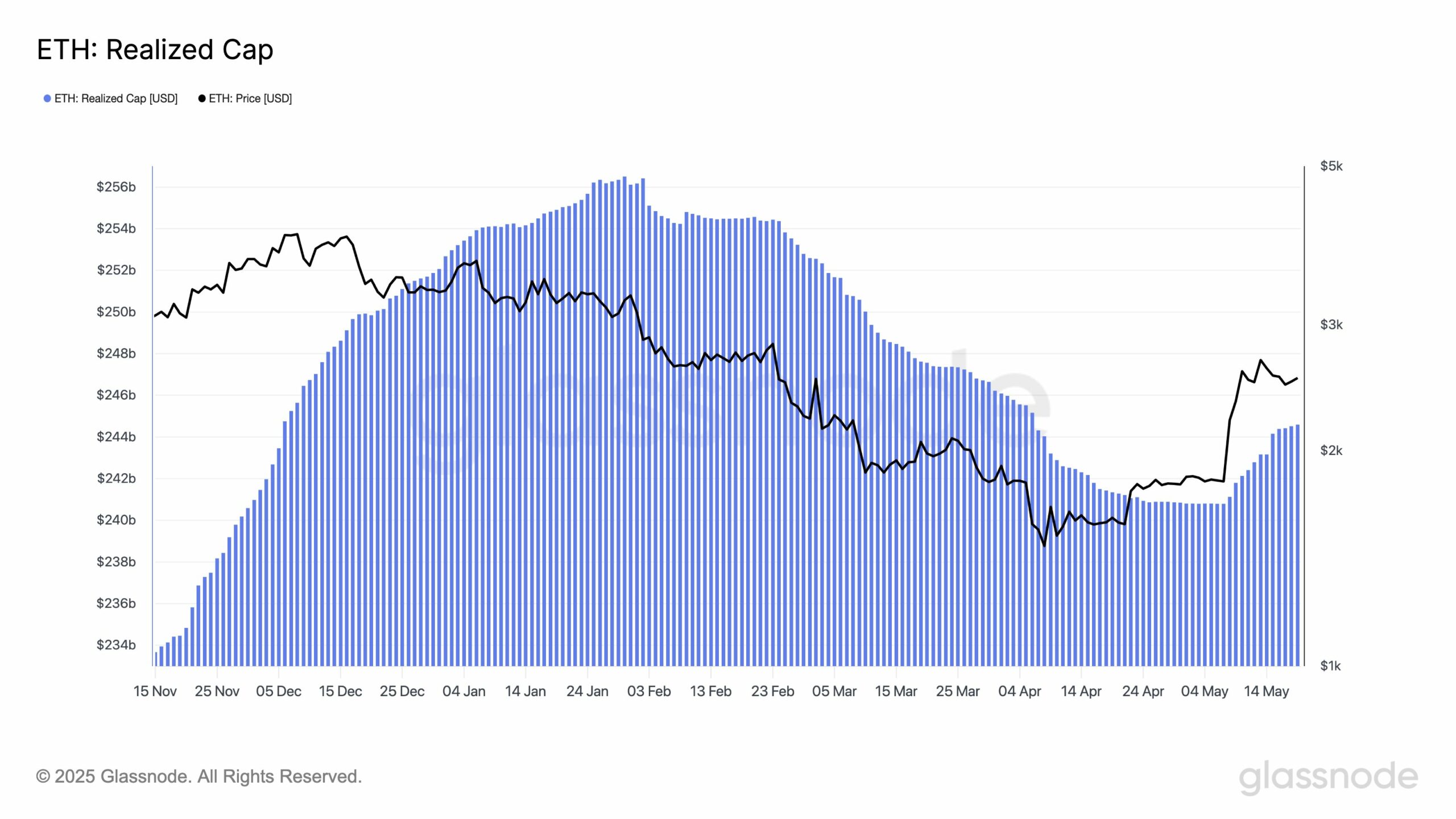

Focusing our analytical lens on on-chain metrics, Ethereum’s realized capital, which mirrors the total value of all ETH at the price they were last transferred — has increased significantly in May.

It moved from $240.8 billion on the 7th of May to $244.6 billion on the 19th of May.

The $3.8 billion boost is a sign of increased conviction among holders and suggests an influx of new capital.

Source: Glassnode

This kind of rapid surge typically indicates less selling pressure, as more investors are holding ETH at higher values. It means that Ethereum is not only being traded, but held for the long term.

The surge tends to solidify the ground for a potential bullish rally as implied by the technical indicators bullish bias.

ETF holdings are gaining momentum

Institutional players are making moves as well. According to AMBCrypto’s analysis of CryptoQuant data, ETH ETF holdings are increasing rapidly, pointing to a renewed investor interest.

With spot ETH ETFs gaining momentum after Bitcoin ETF approvals, larger capital influx may soon follow.

These holdings typically reflect institutional sentiment and the rising trend suggests that institutions are gradually warming up to ETH’s long-term prospects.

Source: CryptoQuant

With restored technical momentum, more realized capital influx and a growing ETF exposure, Ethereum’s foundations look better. If current trends persist, the path to $3,000 is not far away.

The projected target at $3.3K is within ETH radars.

Source: https://ambcrypto.com/examining-if-ethereum-can-rally-past-3k-as-investor-confidence-rises/