- Ethereum, as the largest altcoin, has a history of defying mainstream expectations with sudden surges

- However, its deviation from historical quarterly trends now signals a bearish outlook

Ethereum [ETH] has had a turbulent Q1, facing strong resistance and market uncertainty. However, with improving fundamentals and growing institutional interest, could a 60% rally in Q2 push ETH towards $3,200?

Let’s dive into the key factors that could fuel this move.

Ethereum’s Q1 underperformance in focus

Ethereum opened Q1 at $3,334, but it has since retraced to $2,053 – Posting a 38% drawdown with only a week remaining in the quarter.

In comparison, ETH’s 2024 Q1 rally saw it closing at an all-time high of $4,081 – An 84% quarterly gain. This stark divergence raises concerns about Ethereum’s structural weakness, as both liquidity inflows and network activity have remained subdued.

Consequently, the implications extend beyond short-term price action. In fact, analysts have revised year-end targets by nearly 60%, citing weak institutional participation.

Compounding this, the ETH/BTC pair recently fell to a five-year low, diverging from its 2024 yearly high. Unlike previous cycles, Ethereum has failed to attract capital rotation during Bitcoin’s bullish consolidation.

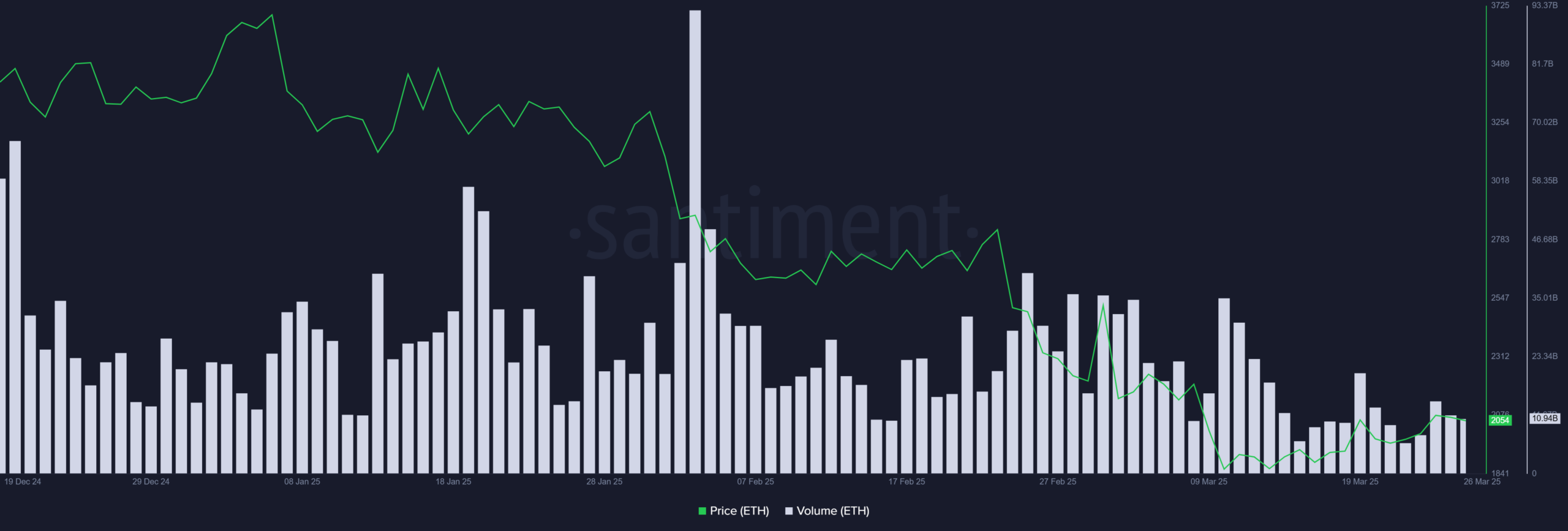

For instance, while BTC reclaimed $88k following a two-week correction, ETH’s rebound to $2k saw no significant uptick in trading volume – A sign of weakening demand.

Source: Santiment

Given this backdrop, a 60% Q2 rally might be unlikely. And yet, Ethereum has a track record of defying expectations.

Could this be another instance of an unexpected breakout?

Can ETH shock the market with a surprise rally?

In Q2 2024, Bitcoin closed the quarter 14% below its opening price, while Ethereum demonstrated relative strength with only a 5% decline. This outperformance highlighted ETH’s resilience, despite broader market corrections.

A potential market shock, therefore, would arise if Ethereum replicates this trend in Q2 2025.

While the ETH/BTC pair remains suppressed, Open Interest (OI) and Funding Rates (FR) in Ethereum Futures suggest traders may be positioning for an alternative outcome.

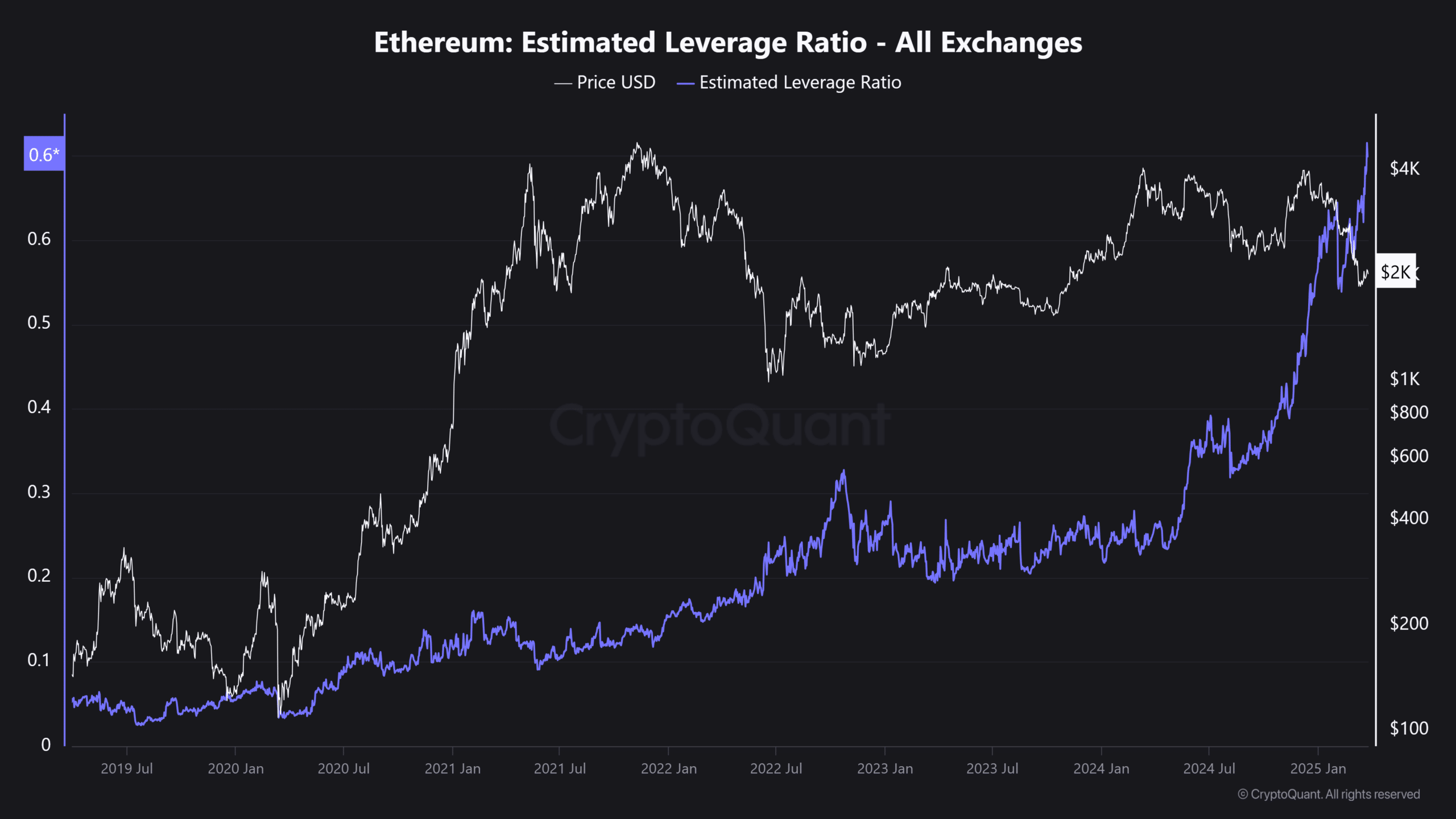

Notably, Ethereum’s Estimated Leverage Ratio (ELR) surged to an all-time high – Indicating an influx of high-risk capital.

Source: CryptoQuant

Historically, such elevated leverage has acted as a double-edged sword — Either fueling a breakout or triggering cascading liquidations.

For Ethereum to capitalize on this leverage buildup, a confluence of factors is required – Sustained Bitcoin strength, increasing spot demand, and a resurgence in institutional inflows.

Should these conditions materialize, the likelihood of an unexpected 60% rally towards $3,200 transitions from speculative optimism to a structurally supported market scenario.

Source: https://ambcrypto.com/ethereums-rocky-q1-can-a-60-q2-rally-propel-eth-to-3200/