- Ethereum’s long-term holder NUPL showed anxiety among investors but breaking above $3K could restore confidence.

- The approval of a filing at the CBOE to allow 21Shares to stake the ETH could be the new catalyst for an uptrend.

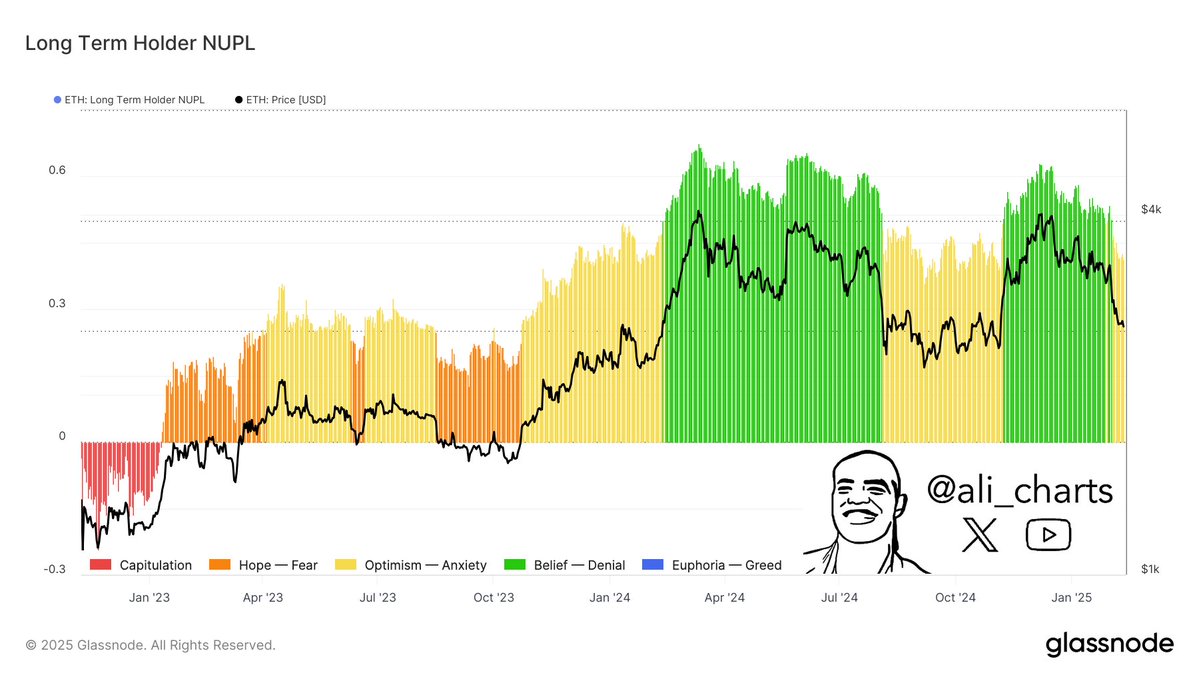

Investor sentiment as per Ethereum’s [ETH] Long-Term Holder Net Unrealized Profit/Loss (NUPL) revealed rising anxiety as the price hovers below the $3,000 mark.

At the time of writing, the NUPL showed a trend towards anxiety. This suggests many long-term investors are seeing their unrealized gains diminish, pressuring their confidence.

A decisive push above $3,000 could shift sentiment from anxiety to belief or optimism. This pattern was seen in mid-2023 when Ethereum approached these levels and saw substantial rallies.

Source: Ali/X

A potential move could trigger renewed investor confidence, encouraging holding and attracting new buyers, driving ETH up. If ETH fails to surpass the $3K threshold, long-term holders might continue or increase sell-offs, fearing further losses.

This could drive the price down further, deepening market anxiety and pushing the NUPL into lower zones, similar to capitulation in early 2023.

This scenario would likely exacerbate the downward pressure on Ethereum’s market value.

Cboe files for Ethereum ETF to enable staking

Despite the anxiety, ETH investors could be hopeful as the CBOE filed a proposal to allow 21Shares to introduce staking within its Ethereum Spot ETF

This decision, approved by the Exchange’s President on the 12th of February 2025, is a pivotal moment for ETH. It could serve as a new catalyst for the cryptocurrency’s growth.

Staking ETH involves holding the cryptocurrency to support blockchain operations, in return for rewards.

This approval enables the ETF to engage in staking, potentially increasing the value of holding ETH through the ETF by offering additional yield from staking rewards.

This development is expected to rejuvenate investor confidence in Ethereum, especially after a period of market volatility.

By integrating staking, the ETF provides a dual benefit of exposure to ETH’s price movements and the additional income from staking.

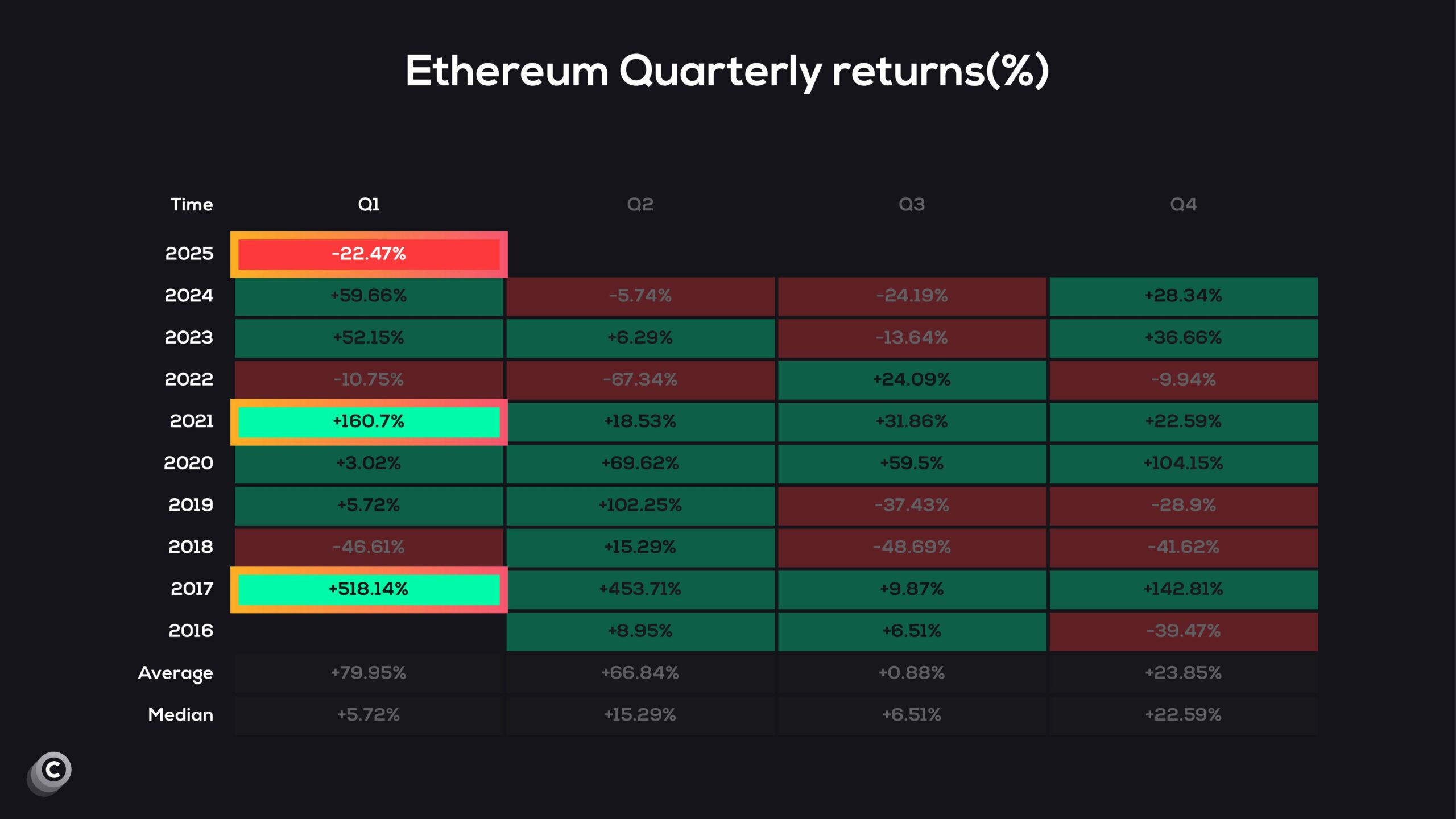

Historical percentage quarterly returns

Winding up, it is key to note that Ethereum has performed well in Q1 historically, but it’s currently facing a downturn, trading at a 22% discount.

This drop could reflect typical early-year volatility or broader market trends impacting crypto assets.

Historically, Q1 has seen average gains of about 80% for Ethereum, except for 2018 and 2022. This suggests a possible rebound or upward correction as the quarter progresses.

Source: X

If market sentiment improves or influential crypto events occur, ETH could recover from its current lows. It might aim for gains similar to past first quarters.

Conversely, if the market remains bearish or external economic factors weigh down, the discount could persist or deepen. This would lead to a subdued Q1 performance for Ethereum.

Source: https://ambcrypto.com/ethereums-nupl-signals-rising-fear-how-3k-can-flip-sentiment/