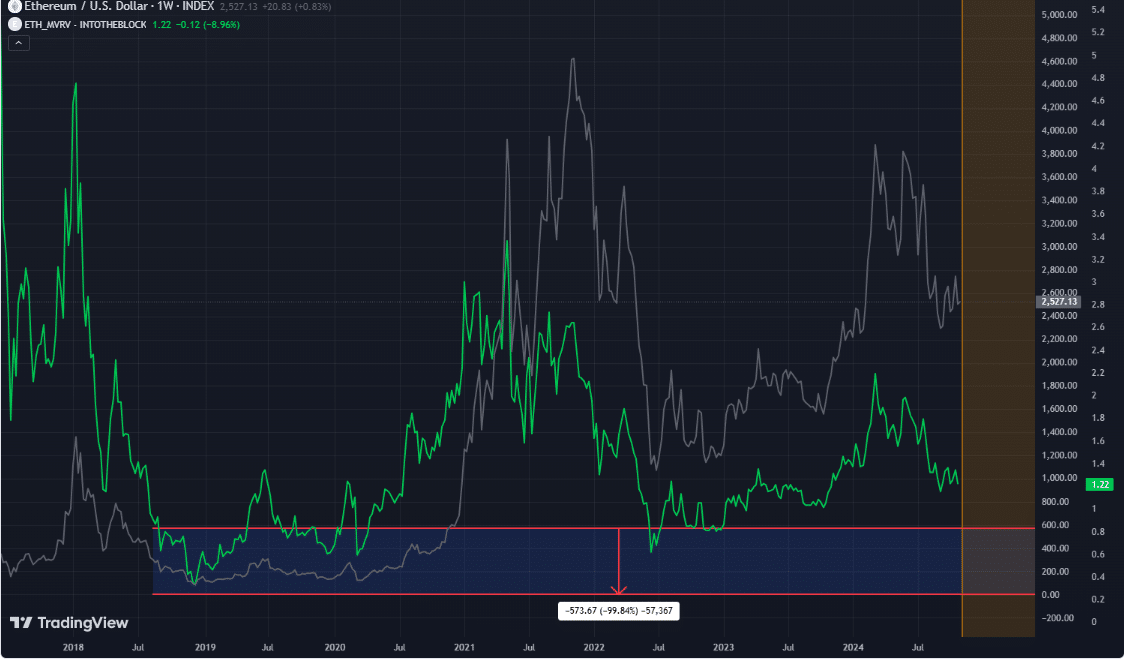

- Ethereum’s MVRV ratio at 1.2, hinting at a subtle overvaluation.

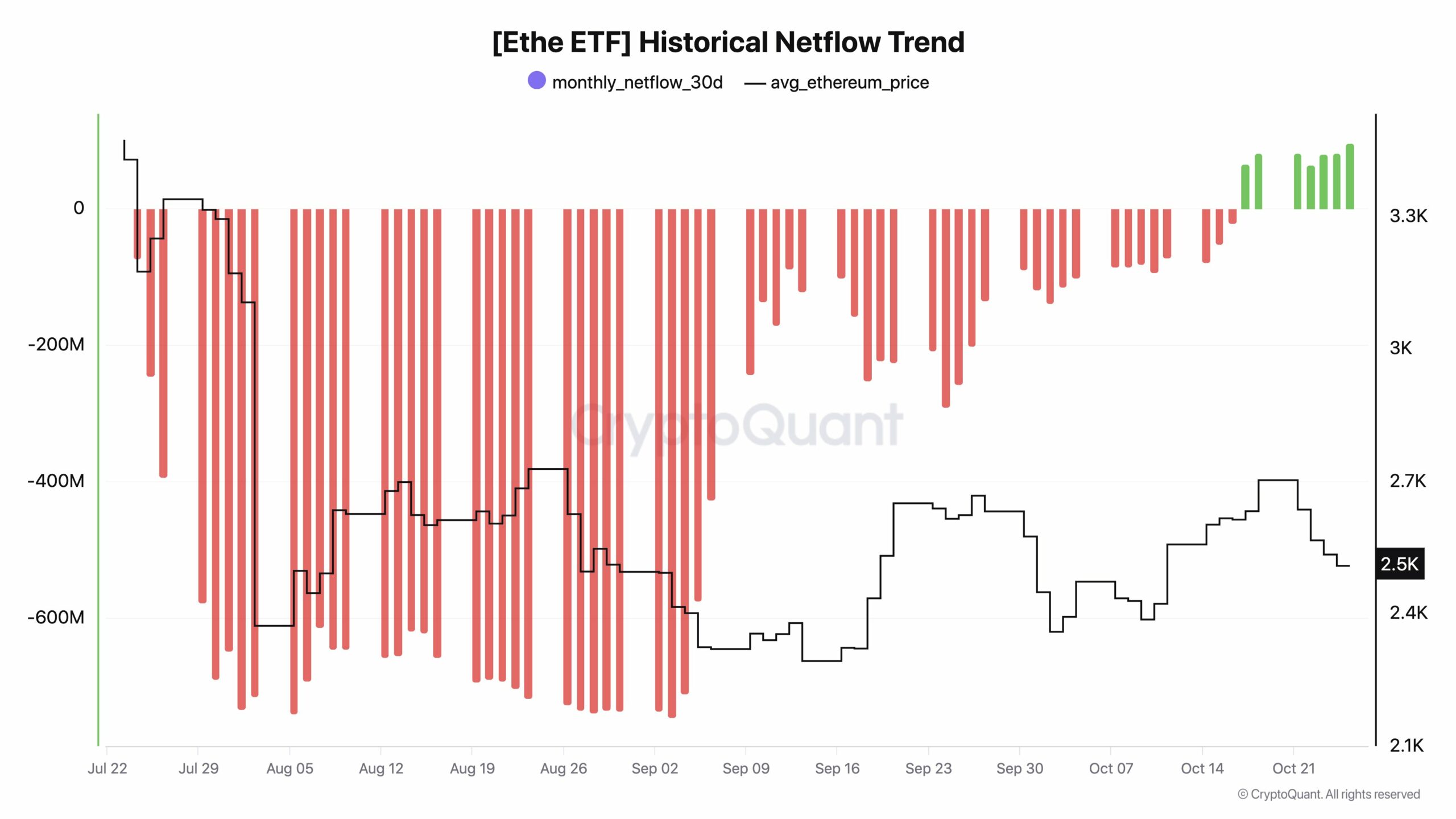

- Ethereum saw positive monthly net flows for the first time since July.

Ethereum’s [ETH] market value recently sat above its realized value, with its MVRV ratio at 1.2, hinting at a subtle overvaluation.

Historically, Ethereum has shown support near MVRV levels around 1, marking a significant accumulation phase for investors aiming to buy low.

Ethereum’s MVRV metric can often predict key buy zones, where dips below 1 indicate a phase of investor capitulation and heightened buying opportunities.

If ETH’s price drops further, it could create an ideal setup for value-focused traders looking to buy during periods of potential underpricing.

Source: Trading View

In October, Ethereum also saw positive monthly net flows for the first time since July. This change in liquidity trends diverged from previous cycles, with capital flow into Bitcoin at record highs and dominance around 60%.

Some Ethereum holders view this period as an opportunity, positioning themselves for potential gains once momentum builds.

However, others are urging caution, noting that a significant price jump could only occur once Bitcoin dominance starts to decline significantly.

Source: CryptoQuant

ETH Supertrend indicator is bullish

Despite the rising inflows into Bitcoin, Ethereum’s performance remained resilient, supported by its Supertrend indicator, which maintained a bullish stance.

Even after dipping to $2,640, Ethereum continued to show higher lows, bolstering confidence among long-term investors and indicating potential for a sustained upward trend.

Ethereum’s Supertrend support suggested that bulls could push the price higher, provided ETH breaks above the $2,570 level.

For many market watchers, Ethereum’s current level represents more than a chance to invest — it’s also a point of strategic anticipation.

Source: Trading View

The ongoing resilience amid fluctuating market conditions has driven comparisons to similar sentiment shifts seen in previous cycles with assets like Solana, which rebounded after extended lows.

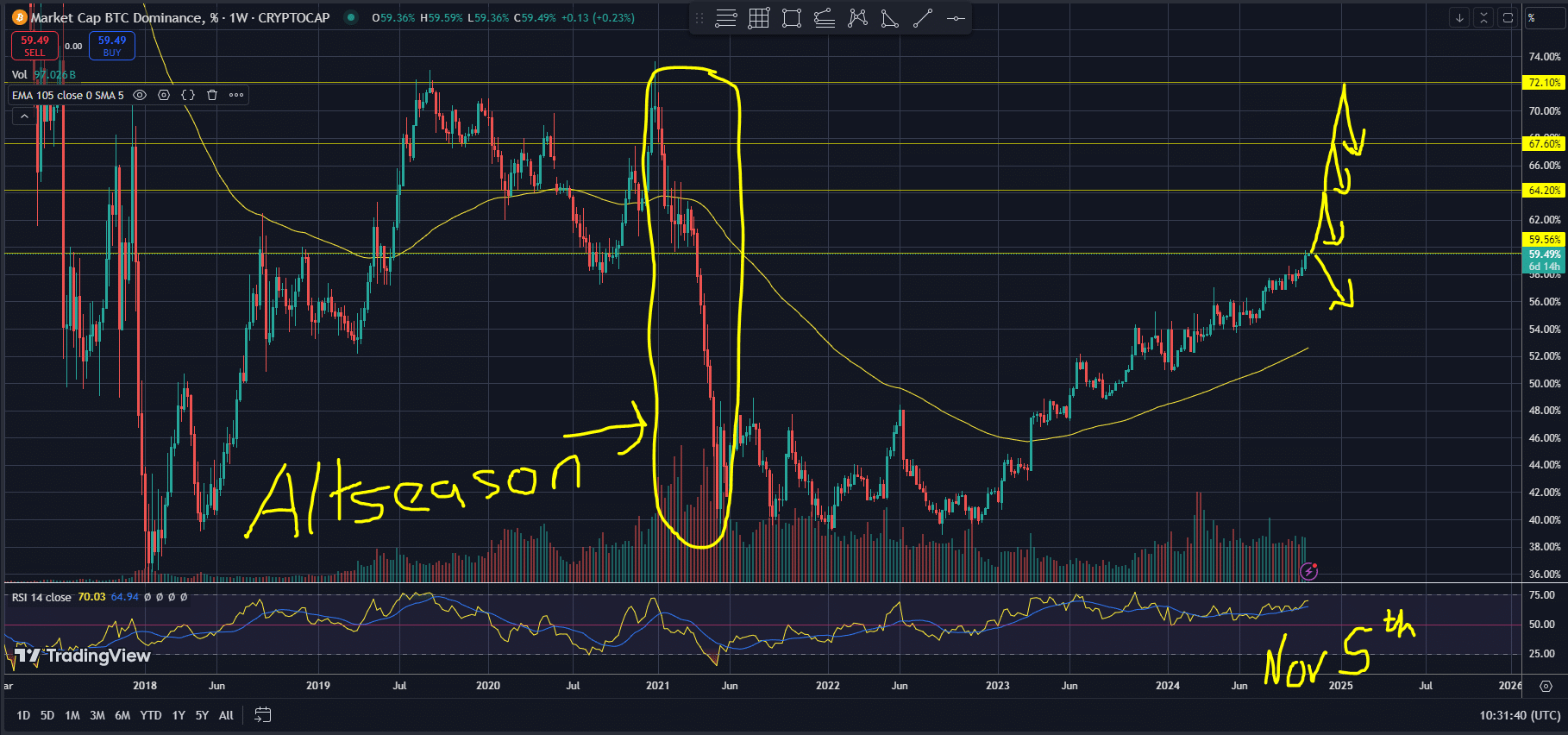

An “altseason” could also be on the horizon, a term many traders use to describe a period where Ethereum and other altcoins outperform Bitcoin.

For now, Bitcoin’s dominant presence at over 60% remains a significant indicator of the market’s current appetite for security.

As November approaches, factors like the U.S. elections could drive volatility, triggering a surge and eventual drop in Bitcoin’s dominance.

Source: Trading View

Read Ethereum’s [ETH] Price Prediction 2024–2025

Analysts anticipate that this shift may create conditions for a possible altseason if liquidity moves into Ethereum and other altcoins, sparking a broader rally.

Moving forward, ETH’s price activity will remain a focal point for traders. Many speculate that if Bitcoin dominance softens, Ethereum could witness its own surge, especially if momentum and capital start flowing out of Bitcoin.

Source: https://ambcrypto.com/ethereums-mvrv-at-1-2-a-sign-of-overvaluation-or-buying-opportunity/