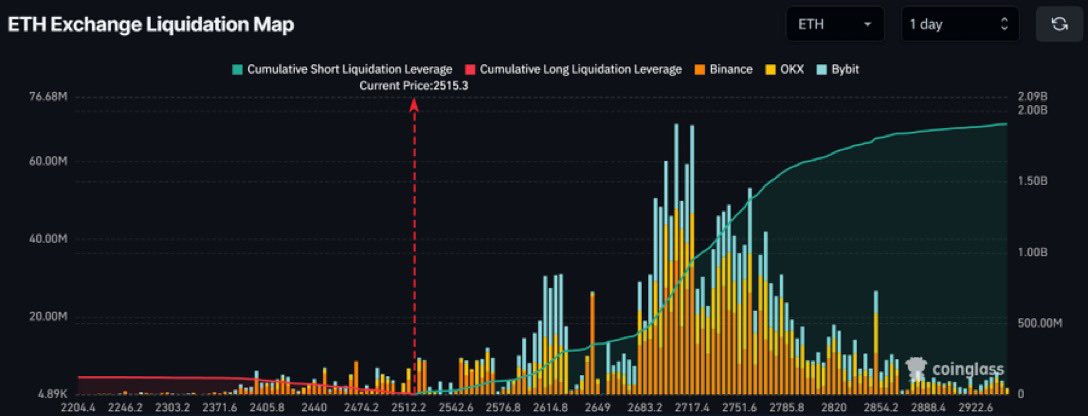

- More than $2 Billion ETH shorts will be liquidated if the Ethereum price pumps to $3,000.

- Ethereum is days away from printing a similar BTC monthly Hammer candle that preceded a parabolic rally.

Ethereum’s [ETH] Exchange Liquidation Map indicated massive accumulation of short positions, with potential liquidations approaching $2 billion if ETH’s price reaches $3,000.

As of press time, ETH was trading at $2,479.30. The increase in cumulative short liquidation leverage suggested high bearish speculation within this price range.

If ETH’s price surges to $3,000, liquidating these short positions could create a short squeeze. This could propel the price even higher as short sellers cover their positions.

This could attract more bullish sentiment and buying activity, pushing ETH’s price towards new resistance levels.

Source: Coinglass

Alternatively, if Ethereum fails to reach this trigger point, the bearish sentiment could continue. This could lead to price stabilization or further decline if bearish market conditions persist.

Long position liquidations could exacerbate this if prices fall, as indicated by the smaller peaks in long liquidation.

What potential monthly Hammer candle means?

A comparative analysis between Bitcoin’s 2021 price action and Ethereum’s current movements shows ETH is on the brink of forming a monthly hammer candlestick. This pattern mirrors Bitcoin’s pattern before its 2021 rally.

If Ethereum completes this pattern, it suggests potential bullish momentum similar to Bitcoin’s climb from around $10,000 to nearly $66,000.

Currently, Ethereum’s price at $2,479.76 could follow a similar trajectory, potentially targeting the $4,800 level, marked by previous resistance points in 2021 before advancing towards $16,000.

Source: TradingView

Conversely, if the pattern does not fulfill and the candle turns negative, Ethereum could see support testing lower bounds near $2,150, aligning with past support levels.

This pattern suggests an imminent decision point for ETH. The formation of a hammer candle could catalyze a rally, reflective of historical patterns seen in BTC.

The next few trading sessions will be crucial. They will confirm whether ETH will emulate BTC’s explosive past performance or diverge onto a bearish path.

Ethereum ICO whale cashing out

Despite the potential rally, another Ethereum ICO whale from the 2015 ICO era has cashed out big. The whale deposited 3,046 ETH worth $8.16M to Kraken. This follows a 6,046 ETH worth $16.34M sell-off in the past day, according to EyeOnChain.

With a jaw-dropping cost basis of $0.31 per ETH, this profit-taking spree leaves him with only 1,024 ETH. As crypto markets grapple with widespread declines and capitulation, this move could amplify bearish sentiment.

Large-scale liquidations from early adopters often spook investors, potentially driving ETH prices lower amid fragile market confidence. This means that Ethereum’s next moves hang in the balance.

Source: https://ambcrypto.com/ethereums-2b-liquidation-risk-will-a-short-squeeze-send-eth-soaring/