As Bitcoin aims to reclaim the $100,000 mark, Ethereum is making a bullish comeback. While the momentum is significantly lower than anticipated, it takes a crucial stand near a critical support trendline.

With multiple lower-priced exchanges seeing activity, Ethereum’s reversal run has now crossed the $2,700 mark. Will this reversal in ETH price bounce back to the $3,000 mark? Let’s find out.

Ethereum’s Bullish Comeback: Can ETH Reclaim $3,000?

In the daily chart, the ETH price trend showcases a strong support near the 23.60% Fibonacci level at $2,555. With multiple lower-priced exchanges at this level, Ethereum takes a bullish stand.

With a morning star pattern, ETH now marks two consecutive bullish candles and is trading at $2,711. Furthermore, with an intraday gain of 1.88%, the bulls are anticipating an ETH price to reach the 38.20% level.

This Fibonacci level is priced at $2,784. With the recovery run, the daily RSI line is forming a rounding bottom reversal from the oversold boundary level.

However, the 50 and 200-day EMA line maintain a bearish trend and warn of a death cross event.

Whales Accumulate ETH: Signs of Strength?

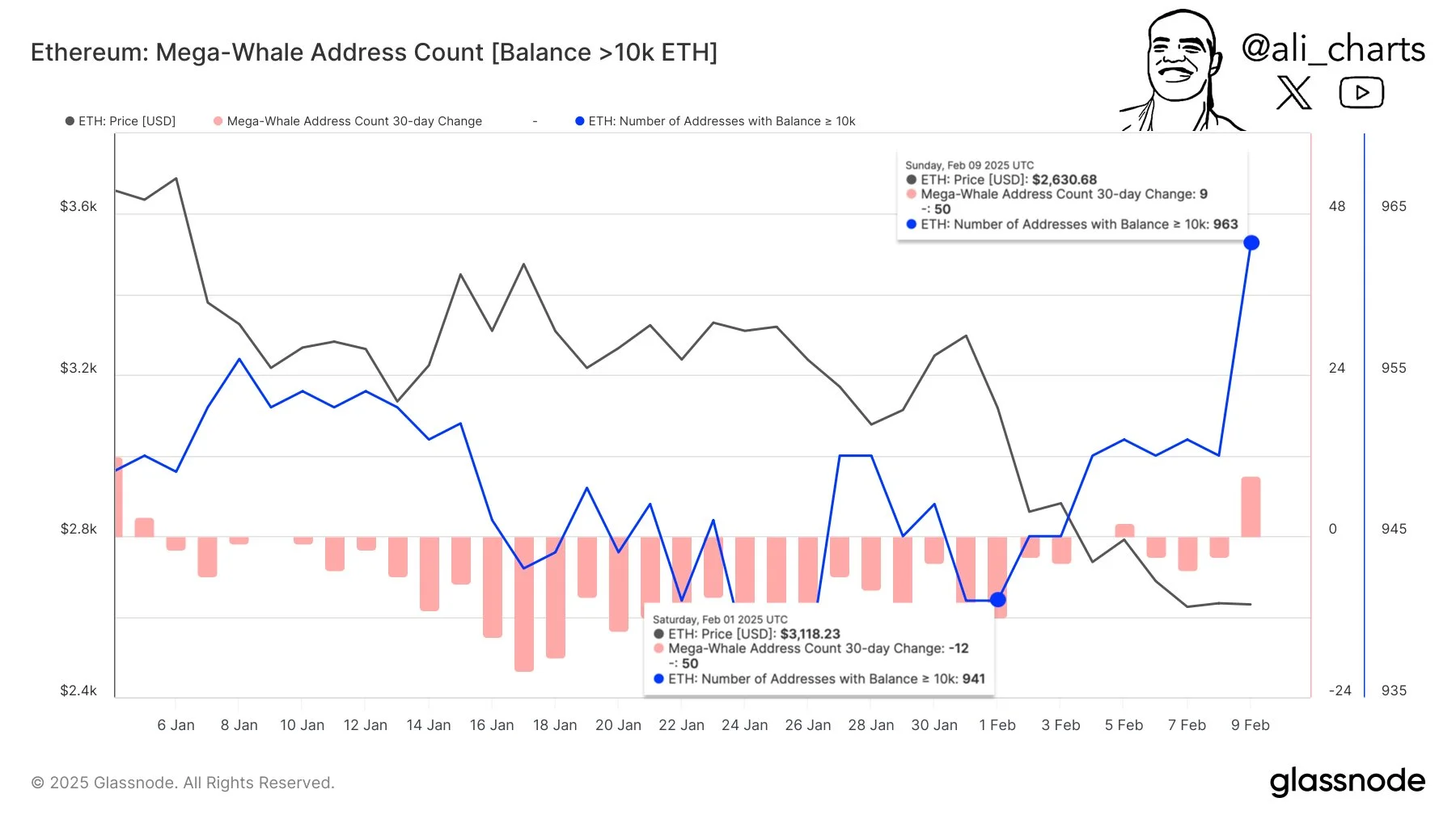

Amid the recovery run, the whales are maintaining a bullish stand on Ethereum. In a recent X post by Ali Martinez, a crypto analyst, the number of ETH whales holding over 10,000 ETH has risen by 2.3% since the start of February.

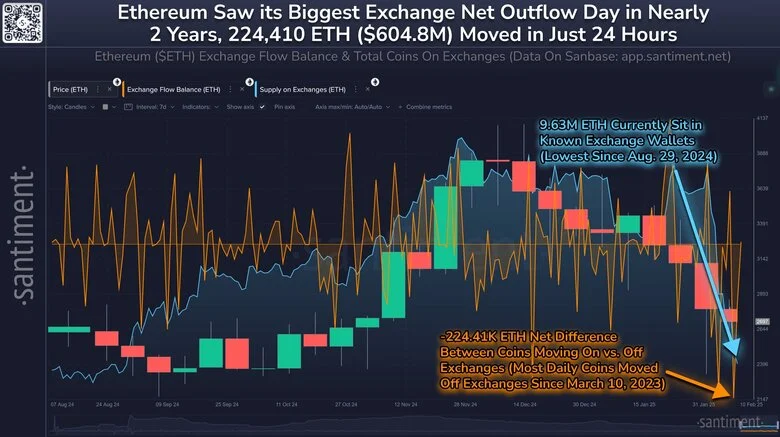

This marks a significant growth in the accumulation of Ethereum. Furthermore, a recent X post from Santiment reveals a historic milestone for Ethereum.

Between February 8 and 9, 224,410 ETH tokens were withdrawn from exchanges. As the massive amount of ETH moves from non-exchanges to wallets, this marks a significant rise in accumulation and signals a strong support from investors.

Currently, 9.6 million ETH is set in non-exchange wallets.

Ethereum Spot ETFs: Mixed Trends Despite Whale Accumulation

Despite the surge in whale activity, the ETF market marked a bearish net outflow day on February 10. 8 out of 9 U.S. Ethereum spot ETFs, marked a zero net outflow.

However, Grayscale’s Ethereum Trust recorded an outflow of $22.46 million. The Grayscale Ethereum Trust has a cumulative net outflow of $3.95 million, while the majority of U.S. Ethereum spot ETFs have a positive trend.

ETH Price Targets: Will ETH Reach $3,500?

With bullish momentum gradually increasing in Ethereum, the Fibonacci levels paint a bullish target. As ETH price bounces off from a support trendline, the 50% Fibonacci level at $2,984 will remain a key price target.

In case of an extended recovery, the bull run can reach the $3,500 mark near the 78.60% level.

Source: https://www.cryptonewsz.com/ethereum-whales-increase-holdings-can-eth-price-rally-to-3500/