- A whale sold 30,000 ETH for profit, then bought back 16,500 of the same altcoin at a higher price of $2,818.

- If profit-taking cools, Ethereum could retest $3,000; otherwise, it may stay range-bound between $2,400–$2,700.

Over the past day, Ethereum [ETH] broke out of a consolidation range to hit a four-month high. Before this breakout, investors, especially whales, had started to become impatient with the prolonged price stagnation.

Whales sell, then buy back at a premium

One such case was observed by Onchain monitors where a whale sold 30,000 ETH worth $78.63 million to realize a profit of $6.72 million.

However, after ETH surged past $2,800, this whale bought back just one day after selling.

According to Spotonchain, this whale has decided to buy back 16.5k ETH worth $46.4 million from Wintermute at a higher price of $2,818.

The whale made this purchase at a higher price after selling at an average price of $2,621. When large entities decide to purchase an asset at a higher price, it reflects strong conviction and rising demand.

Source: IntoTheBlock

The return of whale activity wasn’t isolated.

Large Holders Netflow to Exchange Netflow Ratio hit -2.83, a two-week low. This sharp dip signals more ETH flowing into cold storage than into exchanges—a classic sign of accumulation.

Source: IntoTheBlock

Additionally, more than 140,000 ETH, worth approximately $393 million, have been withdrawn from exchanges, marking the largest one-day withdrawal in over thirty days.

This further reinforces our observation of the broad-based demand for Ethereum, with both whales and retailers entering to accumulate the altcoin.

ETH retraces, as profit-takers step in

Despite rising demand, Ethereum’s price dropped 1.76% over the last day to $2,756.

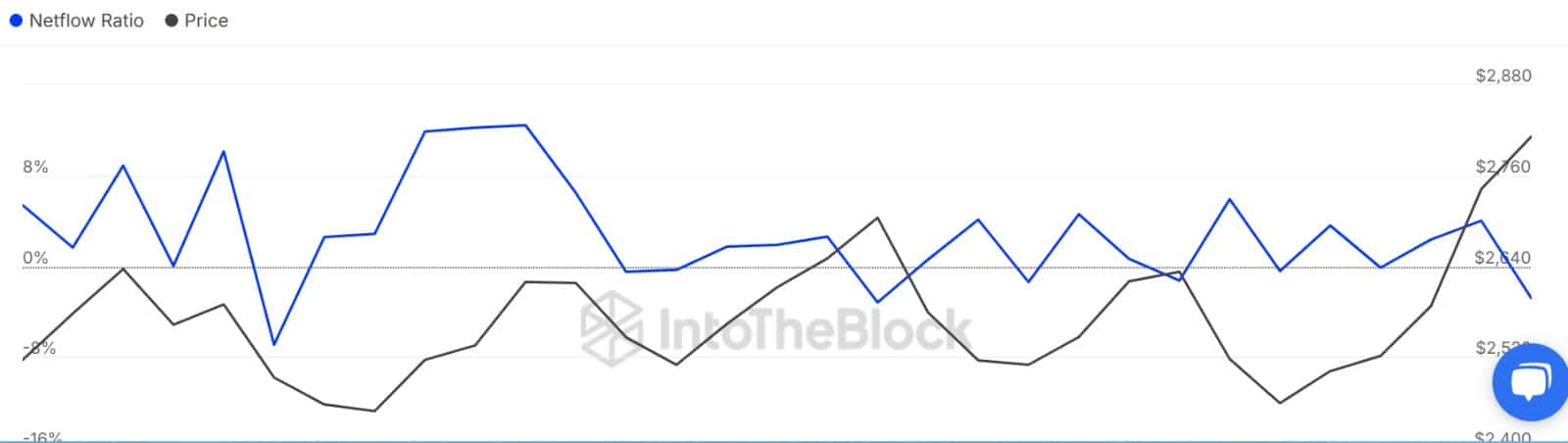

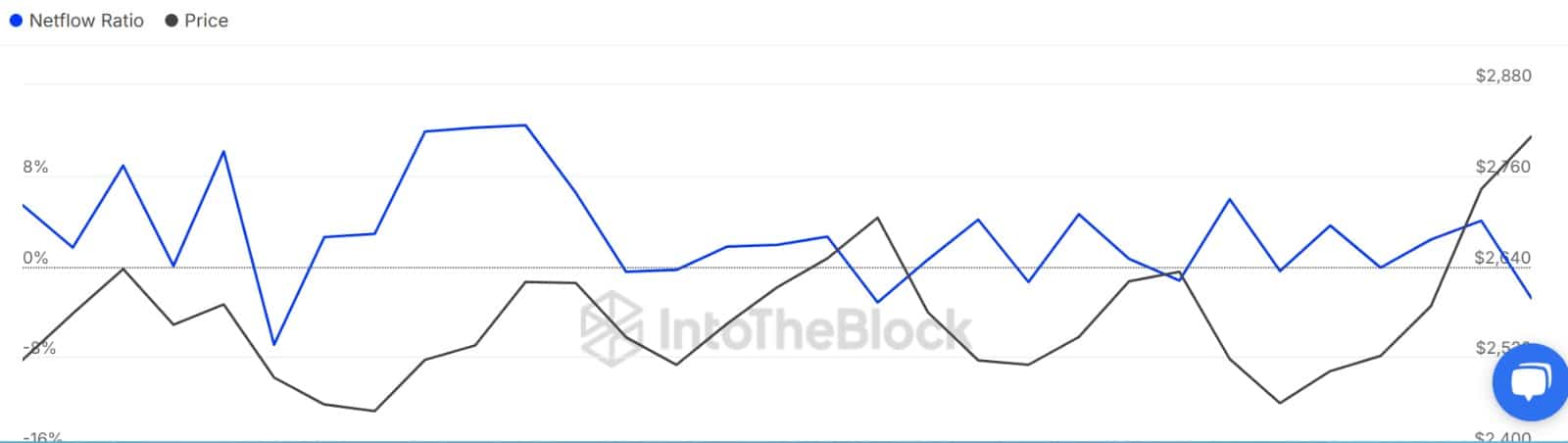

While whales stocked up, retail profit-taking began kicking in, evident in the shift in Exchange Netflow.

Source: CryptoQuant

The Netflow Ratio flipped positive again, meaning exchange inflows are outpacing outflows, hinting that many investors are cashing out while prices remain elevated.

This back-and-forth reflects an ongoing tug-of-war.

While ETH is leaving exchanges, it’s also entering, signaling uncertainty on whether the rally will stick.

If this stalemate persists, ETH may stay boxed within the $2,400–$2,700 range. For any sustained breakout toward $3,000, sellers must cool off.

Only once profit-taking slows can bulls seize momentum and push ETH to its short-term target.

Source: https://ambcrypto.com/ethereum-whales-buy-back-at-higher-prices-is-it-conviction-or-fomo/