While Ethereum (ETH) supply is on the rise for the first time since December 2022, this trend is attributed to low transaction fees and an increase in daily mints.

Despite this, Ethereum’s inflation remains significantly below Bitcoin’s, with a net supply increase of 0.44% annually. As of now, Ethereum’s supply stands at 120.26 million.

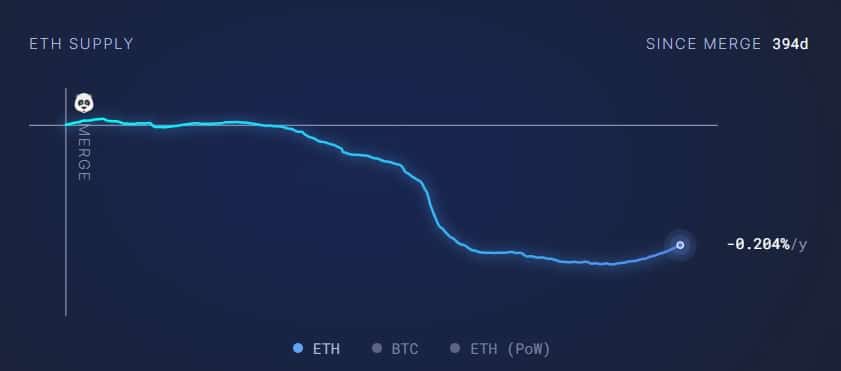

On September 15 last year, Ethereum underwent a major update known as Merge. With this update, ETH has transformed its blockchain from a proof-of-work (PoW) consensus mechanism to a proof-of-stake (PoS) system.

Since the merge, a total of 1,013,068 ETH has been burned and 747,774.27 ETH has been minted, resulting in a net supply change of -265,394 ETH.

If Ethereum had remained in PoW instead of switching to PoS, 1,013,069 ETH would have been burned and 5,156,788 ETH would have been issued in the same time period. This would lead to a supply change of +4,143,719 ETH. So, ETH’s transition to the Proof of Stake consensus mechanism has greatly reduced the coin’s inflation rate.

The PoS mechanism requires market participants to hold a minimum number of ETH to verify transactions in exchange for rewards. This differs from the previous PoW scheme, where miners solved transactional problems to process transactions for rewards.

*This is not investment advice.

Follow our Telegram and Twitter account now for exclusive news, analytics and on-chain data!

Source: https://en.bitcoinsistemi.com/ethereum-total-supply-surges-after-a-long-time-whats-the-latest-data/