Ethereum has bounced above $2,570, forming a bullish flag pattern with a 33% upside potential. Derivatives data suggest a breakout toward $3,577.

As Bitcoin reclaims $109,000, Ethereum starts the weekend on a positive note, trading at $2,570. With a bounce off the 200-day EMA, Ethereum hints at a potential double-flat breakout that could result in a price surge of over 30%.

Ethereum Price Analysis

Ethereum continues to consolidate sideways on the daily chart between the 38.20% and 50% Fibonacci retracement levels, which are $2,395 and $2,699, respectively.

Following a 50% surge in early May, Ethereum has completed a bull flag pattern. The 200-day EMA aligns with the lower boundary of the flag, further supporting the bullish setup.

Additionally, growing underlying bullishness has increased the likelihood of a positive crossover between the 50-day and 100-day EMAs.

Based on the bull flag pattern and Fibonacci levels, a potential breakout could lead to a 33% rally toward $3,577. This would surpass the 78.6% Fibonacci level at $3,436, signaling strong upside potential.

Ethereum’s bounce from the 200-day EMA, marked by a long-tailed doji candle on Sunday, reflects strong investor confidence. However, short-term consolidation has reduced trend momentum, as a declining RSI trend line indicates.

As Ethereum maintains a sideways movement, the falling RSI line reveals a hidden bearish divergence. A close below the 38.20% Fibonacci level could result in a retest of the 50-day EMA at $2,213.

ETH Derivatives Anticipate Breakout Rally

Despite the consolidation, bullish sentiment in the derivatives market continues to build. According to CoinGlass data, Ethereum open interest has risen by 2.73%, reaching $32.93 billion.

A short-term pullback in the funding rate to 0.0034% suggests a minor dip in bullish momentum. However, recent 12-hour liquidations have wiped out $17.84 million in bearish positions, reinforcing a bullish environment.

Overall, CoinGlass data supports a bullish narrative, indicating an anticipated upside continuation.

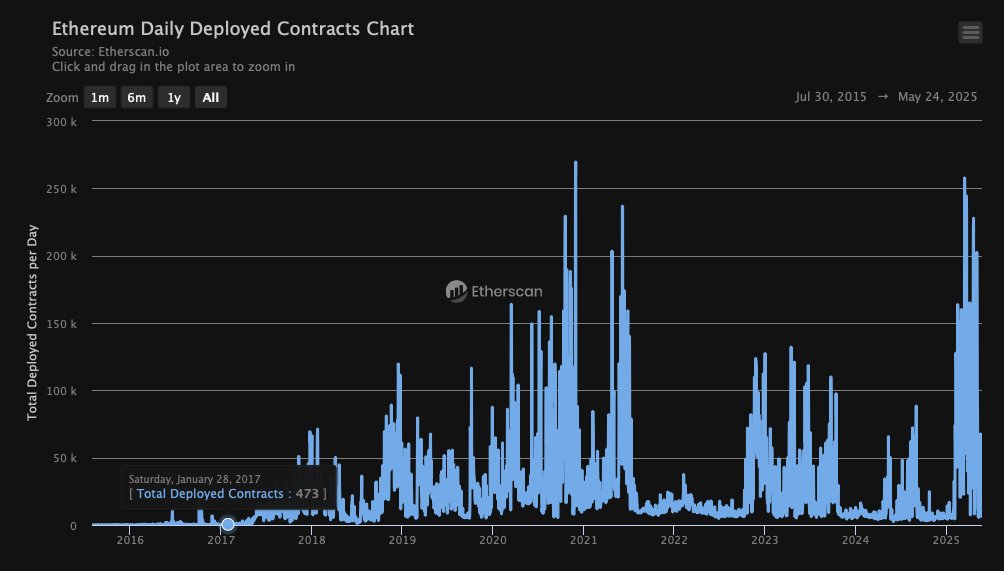

Analyst Spots Ethereum Blockchain Deployment Returning to 2021 Levels

In a recent tweet, crypto analyst Ted Pillows highlighted a notable increase in development activity on the Ethereum blockchain. According to his post, daily smart contract deployments have returned to levels last seen during the 2021 bull run.

This reflects a significant uptick in builder activity on the Ethereum network, signaling stronger on-chain momentum. As on-chain activity intensifies, the increased development is likely to support a rally in ETH’s spot price.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2025/05/26/ethereum-targets-3577-as-bull-flag-forms-above-200-day-ema/?utm_source=rss&utm_medium=rss&utm_campaign=ethereum-targets-3577-as-bull-flag-forms-above-200-day-ema