Large institutions continue removing Ethereum [ETH] from liquid circulation, and the pace shows no sign of slowing.

Bitmine recently staked 86,848 ETH worth $277.5 million, pushing its total staked holdings to 1.77 million ETH valued at around $5.66 billion.

Meanwhile, ETFs accumulated 158,545 ETH, absorbing roughly $520 million since late December. This steady absorption reduces available market supply day after day.

However, the price refuses to react immediately. Long-term participants clearly prioritize yield and custody over short-term volatility. At the same time, speculative traders hesitate.

As a result, a widening gap forms between structural accumulation and visible price response. Eventually, tightening supply should matter. For now, patience dominates.

Why $3,390 caps every upside attempt

Ethereum remains locked inside a clearly defined range, and sellers continue asserting control near $3,390. Each rally into this zone attracts fresh selling pressure.

Buyers manage to defend the lower region near $3,000, yet they struggle to build momentum beyond that point. Consequently, price oscillates rather than trends. This repeated rejection signals caution rather than weakness.

Sellers defend key levels but avoid aggressive follow-through. Meanwhile, buyers step in selectively instead of chasing strength. Therefore, price compresses further. Consolidation dominates daily structure.

A decisive break above resistance remains necessary to change sentiment. Until then, the range dictates behavior.

Momentum indicators reinforce the consolidation narrative. At the time of writing, the RSI rolled over from the low-50s and drifted toward the mid-40s. This shift reflects fading buyer strength after each rebound.

Importantly, RSI does not show bullish divergence. Therefore, momentum offers no confirmation for an upside breakout.

Source: TradingView

ETH keeps leaving exchanges

Spot flow analytics continues sending a constructive signal beneath the surface. Ethereum records consistent exchange outflows, with the latest daily netflow near -$72.6 million, as of writing.

Traders and long-term holders still prefer moving ETH into self-custody. This behavior steadily reduces the readily available supply.

However, price does not respond immediately. That disconnect frustrates short-term participants.

Still, persistent outflows often precede supply-driven moves. Meanwhile, sellers fail to force sustained breakdowns.

Therefore, price stabilizes despite weak momentum. Exchange behavior reflects conviction among holders rather than fear. Over time, this trend should tighten conditions further.

Source: CoinGlass

Funding stays positive but…

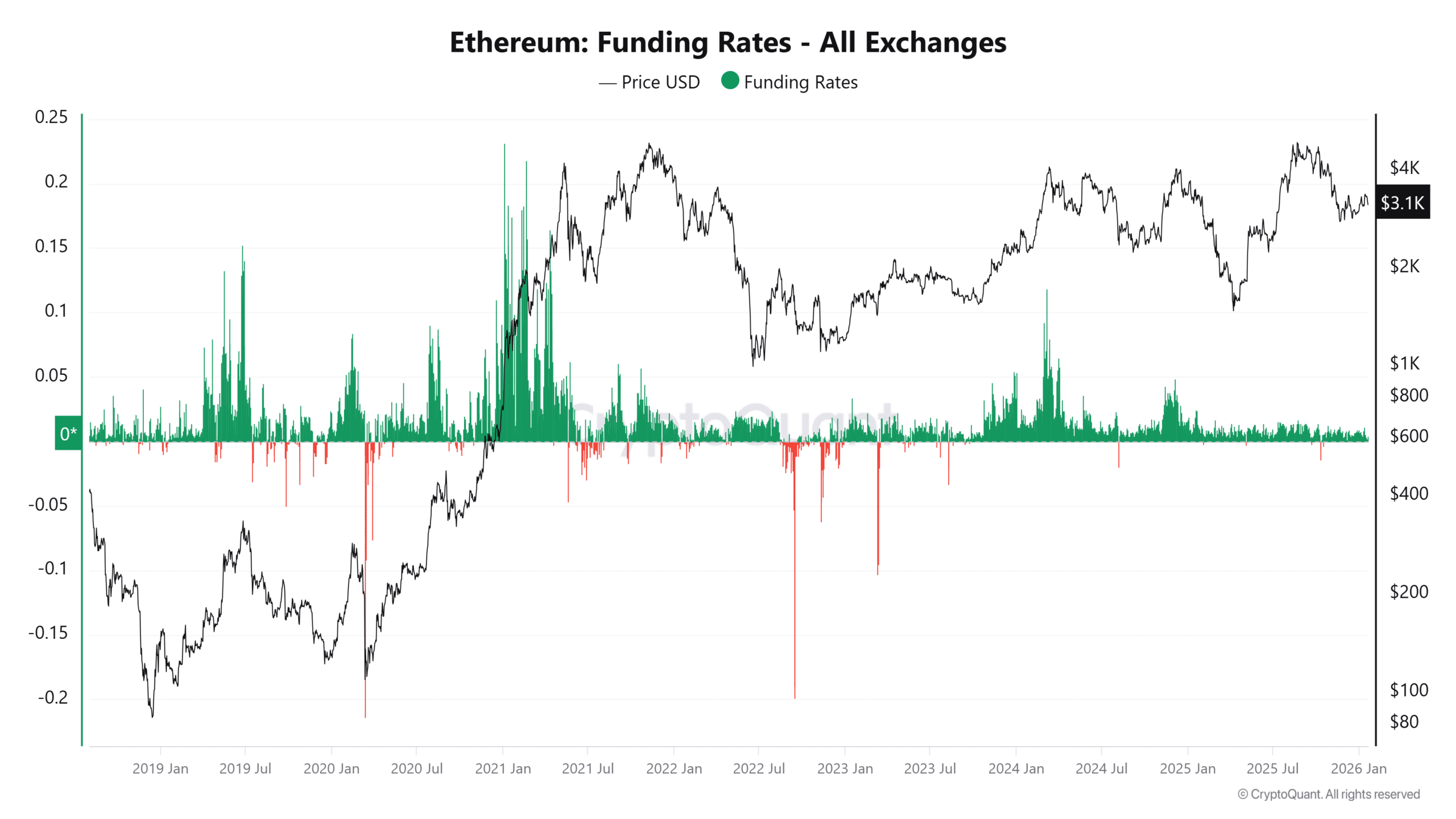

Derivatives markets continue signaling hesitation rather than confidence. Funding Rates remained positive near 0.0042, at press time, with the metric up roughly +1,900.87% from previously suppressed levels.

This rebound shows leverage has returned on a relative basis. However, the absolute funding level remains modest. Longs still pay shorts, yet they do so without urgency.

As a result, leverage participation stays restrained. Traders appear unwilling to chase upside aggressively.

At the same time, funding refuses to flip negative, indicating bears lack conviction as well.

Therefore, leverage fails to amplify price action. Without a sustained expansion in funding, Ethereum struggles to generate a durable breakout and remains trapped inside consolidation.

Source: CryptoQuant

Ethereum remains caught between strong structural accumulation and weak short‑term conviction.

Institutions continue to lock supply, but momentum and leverage have yet to confirm an upside move. With funding muted and RSI subdued, the price is likely to consolidate.

A decisive break above the $3,390 resistance, backed by stronger momentum, would indicate that tightening supply is finally pushing the price higher.

Final Thoughts

- Structural accumulation favors patience, but price needs conviction before rewarding long-term holders.

- Ethereum’s next move depends on participation returning, not just supply tightening alone.

Source: https://ambcrypto.com/ethereum-supply-shrinks-so-why-is-eth-still-stuck-below-3390/