- Ethereum spot ETFs receive $25M net inflow, led by BlackRock.

- Interest reinforces ETH’s role in portfolios.

- Net asset value hits $9.4B.

Ethereum spot ETFs witnessed a net inflow of $25.22 million on June 6, 2025, according to data from ChainCatcher. BlackRock’s iShares Ethereum Trust led the surge with a $15.86 million inflow, solidifying its dominance in the market.

This significant inflow reflects growing institutional confidence in Ethereum, boosting its visibility as a mainstream asset. The total net asset value for Ethereum spot ETFs now stands at $9.4 billion.

Surge in Ethereum Spot ETF Inflows with BlackRock Leading

Ethereum spot ETFs received net inflows totaling $25.22 million on June 6, with BlackRock’s ETHA leading with $15.86 million. Grayscale’s ETHE followed with $9.37 million. The overall ETF market shows increased institutional participation from advisors and hedge funds, contributing to inflow trends.

The event represents a further affirmation of Ethereum’s integration into institutional portfolios, potentially leading to tighter liquidity as funds absorb ETH. This bullish momentum could positively influence ETH pricing in subsequent trading periods.

Market response has been positive, with leading financial voices noting the inflow’s significance for Ethereum’s market cap and prevalence in institutional portfolios. Nate Geraci, CEO of ETF Store, shared that, “The sustained streak in ETF inflows is widely viewed as a vote of confidence from large institutional investors, paving the way for deeper liquidity and mainstream recognition of ETH as an investable asset.”

Ethereum’s Institutional Appeal: Growth Patterns and Market Speculations

Did you know? The Ethereum spot ETF inflow streak, now at 14 days, mirrors historical patterns seen during Bitcoin ETFs’ early adoption phases, highlighting growing institutional faith in Ethereum’s long-term value.

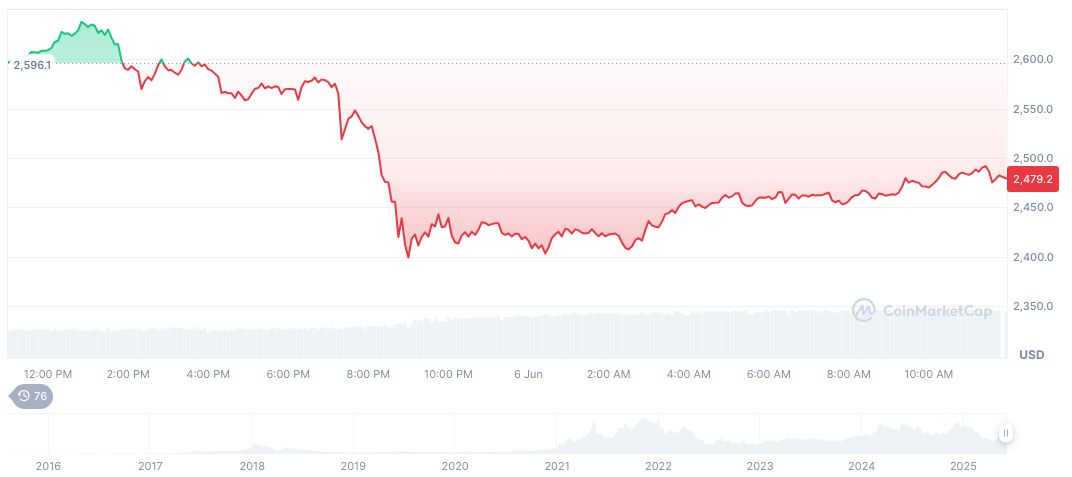

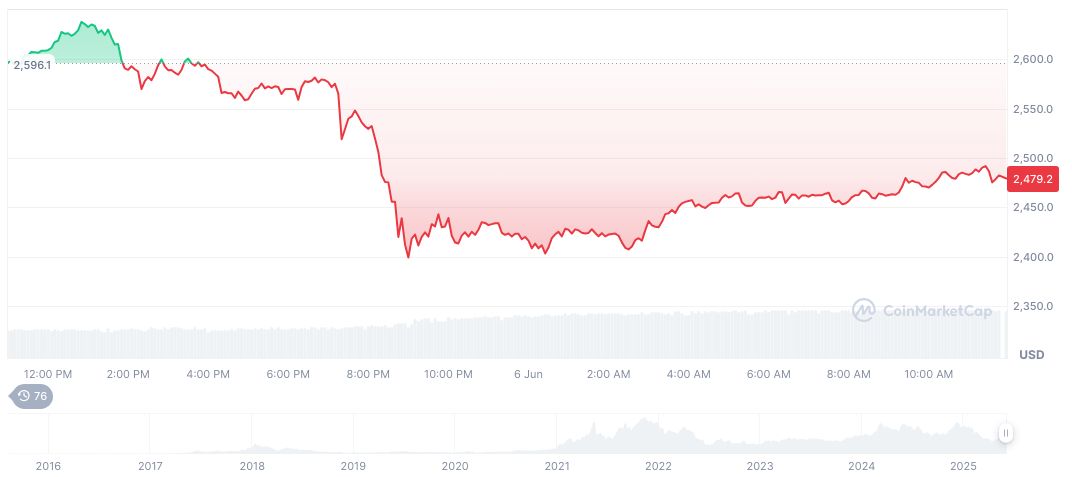

According to CoinMarketCap, Ethereum (ETH) trades at $2,488.16, with a market cap of $300.37 billion and 9.19% market dominance. The 24-hour trading volume stands at $17.03 billion, decreasing by 40.46%. Over the last 60 days, ETH has increased by 56.11%.

Coincu’s research team predicts that continued institutional engagement may increase ETH liquidity and mainstream usage, though regulatory changes could impact future ETF participation. Ethereum’s robust infrastructure and DeFi potential bolster this promising institutional trend. JSeyff discusses market implications for investors, adding depth to the strategic potential observed among industry leaders.

Source: https://coincu.com/341998-ethereum-spot-etfs-25m-inflow/