- Since FTX’s collapse, there has been an increase in ETH accumulation

- As most HODLers fail to see profit, short traders appear to be accumulating

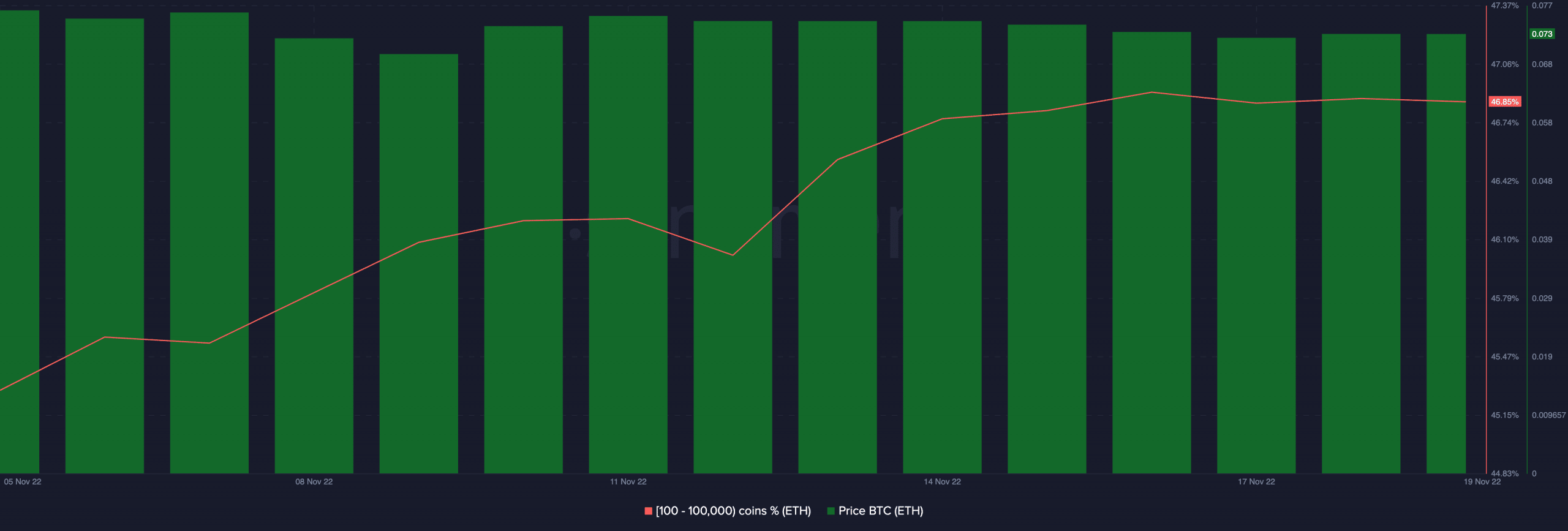

As the price of leading altcoin Ethereum [ETH] lingered above the $1,200 psychological support level, data from Santiment revealed that sharks and whales have ramped up their ETH holdings in the last 13 days.

🦈🐳 #Ethereum is limboing just above the $1,200 psychological support level, and is down a modest -3.3% in the past week. Sharks & whales, meanwhile, have rapidly added $ETH to their bags, increasing their holdings by 3.52% in just the past 12 days. https://t.co/dLz52ovfTs pic.twitter.com/fTrwdn8Ku0

— Santiment (@santimentfeed) November 18, 2022

Read Ethereum’s [ETH] price prediction 2023-2024

ETH witnessed a 4% price drop in the last seven days. However, according to the on-chain analytics platform, ETH addresses that hold 100 to 100,000 ETH grew their holdings by 3.4% in the last 13 days.

For context, 13 days ago, Binance co-founder and CEO Changpeng Zhao made the first tweet about FTX that cascaded into the exchange’s eventual collapse. Subsequently, ETH sharks and whales embarked on an accumulation rally as the general cryptocurrency market plummeted.

Per data from Santiment, this cohort of ETH holders currently held their largest percentage of ETH’s supply since July 2021 – 46.85% at press time.

Ethereum accumulation continues to climb

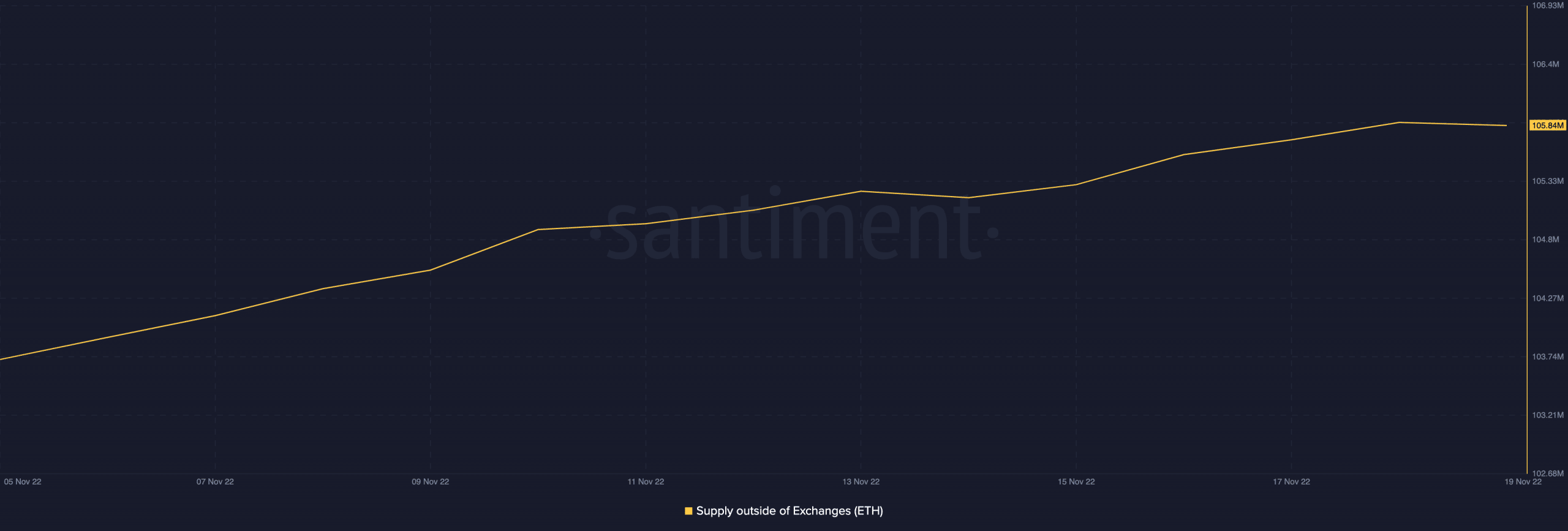

Although ETH traded at the price level last seen in June, on-chain data revealed that HODLers have increasingly accumulated the leading alt since 6 November.

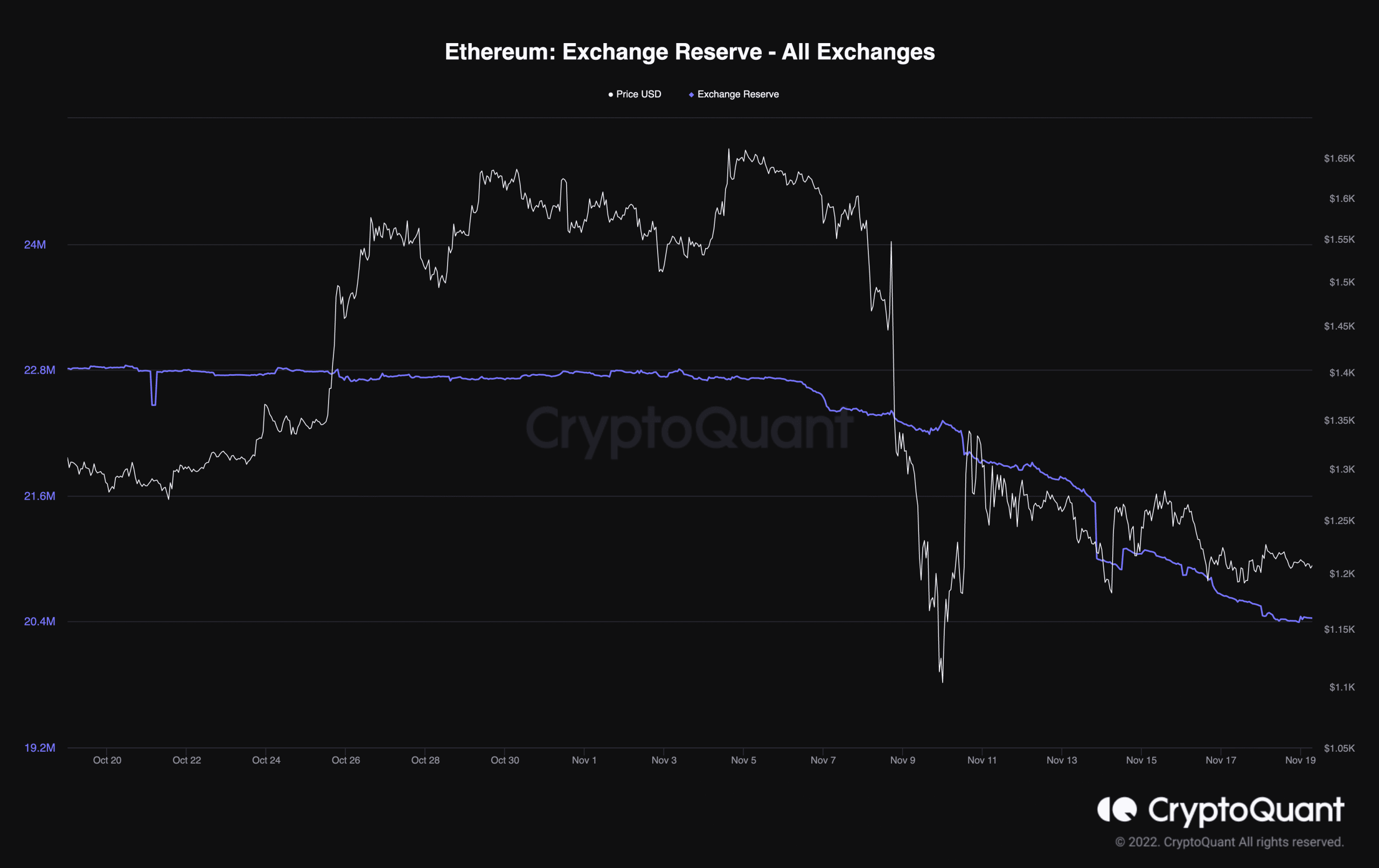

Furthermore, data from CryptoQuant showed a consistent decline in the coin’s exchange reserve. In the past two weeks, the amount of ETH on exchanges declined by 10% and sat at 20.33 million at press time.

This was an indication that fewer ETH sell-offs have taken place since FTX’s collapse, and more investors have bought than sold since then.

This position was further corroborated by the growth in ETH’s supply outside of exchanges within the same period. As per data from Santiment, the alt’s supply outside exchanges went up by 2% since 6 November.

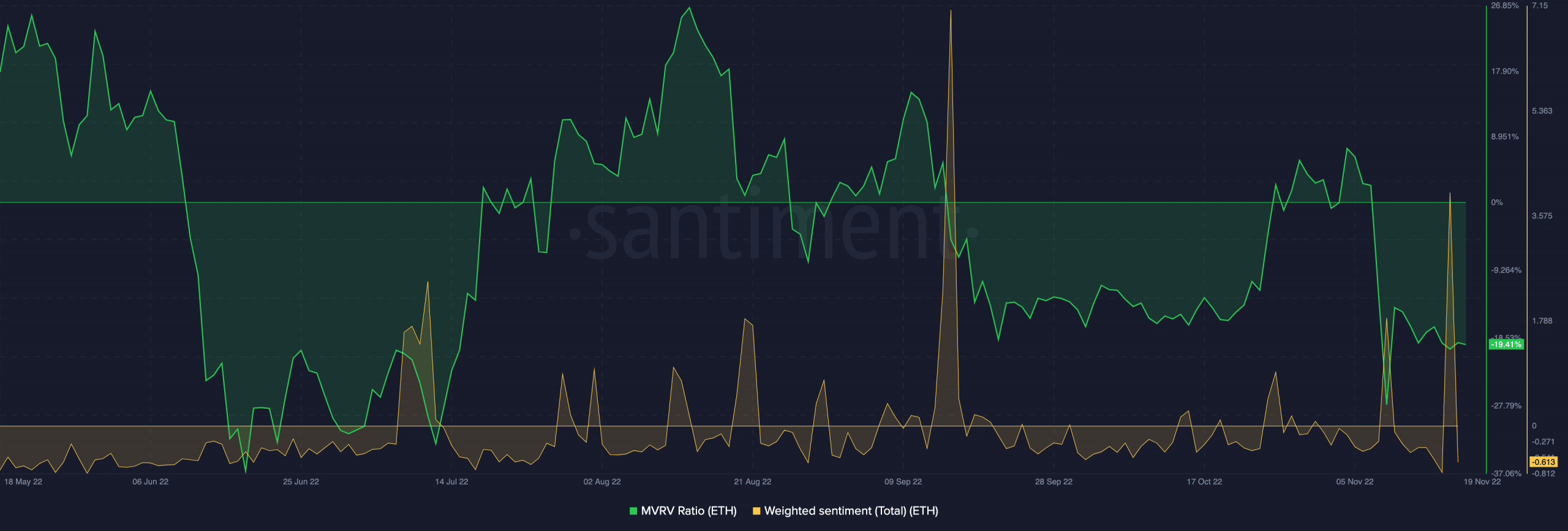

However, as uncertainty and FUD trailed the general cryptocurrency market following FTX’s collapse, investors’ sentiment toward ETH remained mostly negative and sat at -0.613 at press time.

In addition, most ETH holders held on to their tokens at a loss since 6 November, data from Santiment revealed. The Market Value to Realized Value (MVRV) ratio at press time was negative -19.41%.

If most holders have seen losses on their investments since 6 November, why the continued accumulation? A look at ETH’s funding rates can explain this.

Since 6 November, ETH’s funding rates have been primarily negative. This meant that the ETH market was flooded by short traders who accumulated in expectation of a further price decline.

Source: https://ambcrypto.com/ethereum-sharks-whales-their-interest-in-eth-and-the-events-of-the-last-13-days/