Large off-market buyers stepped in during Ethereum’s [ETH] decline, absorbing supply aggressively while the price traded below resistance levels.

An OTC whale accumulated 33,000 ETH in a single day, while DBS-linked wallets added nearly 25,000 ETH within a week at an average entry near $2,463.

These purchases occurred as ETH dipped below $2,300, not after a breakout. Buyers showed willingness to absorb downside risk rather than wait for confirmation.

Moreover, these flows stayed largely off-exchange. Spot inflows did not spike during the decline, suggesting sellers lacked urgency. Instead, larger participants accumulated gradually. This behavior aligns with medium-term positioning rather than short-term trading.

As a result, ETH built a demand base quietly. That base now supports the early recovery visible on the chart, even before sentiment improves broadly.

Price stabilizes within the descending channel

Ethereum continues to trade within a well‑defined descending channel on the daily chart. After sweeping the $2,261 support level, price rebounded toward the $2,320–$2,330 zone and has since stabilized in the channel’s lower half.

Buyers quickly absorbed selling pressure, preventing a deeper breakdown of the structure. Even so, the broader corrective trend remains intact. Lower highs continue to limit upside attempts, keeping momentum capped.

Immediate resistance lies near $2,797, a former consolidation area that has since flipped into resistance.

Above that, $3,404 marks the upper boundary of the channel. Holding above $2,261 allows the price to rotate higher within the structure. A loss of that level would reopen lower liquidity zones.

Source: TradingView

RSI dropped to 27, placing Ethereum firmly in oversold territory during the sell-off. Since then, the indicator has begun recovering, indicating that selling pressure has started to fade.

Buyers responded as momentum reached exhaustion, limiting further downside acceleration.

Despite the rebound, RSI remained well below the neutral 50 level at press time. Momentum has stabilized, but it has not turned constructive yet.

Similar setups in past cycles often led to consolidation or measured recoveries rather than immediate reversals. Ethereum now has room to stabilize within its range.

Top traders stay net-long despite downside volatility

Binance top traders continue to favor the long side even after Ethereum’s sharp pullback. Long accounts currently account for 77.46%, while short accounts stand near 22.54%, pushing the long-to-short ratio to roughly 3.44.

Traders did not abandon exposure as the price tested structural support. This positioning reflects confidence but also concentration. A heavily skewed long bias can amplify volatility if the price stalls.

However, traders appear comfortable holding exposure near current levels. Their positioning aligns with the off-market accumulation observed during the dip.

Together, these signals suggest participants expect stabilization rather than immediate continuation lower, provided structure holds.

Source: CryptoQuant

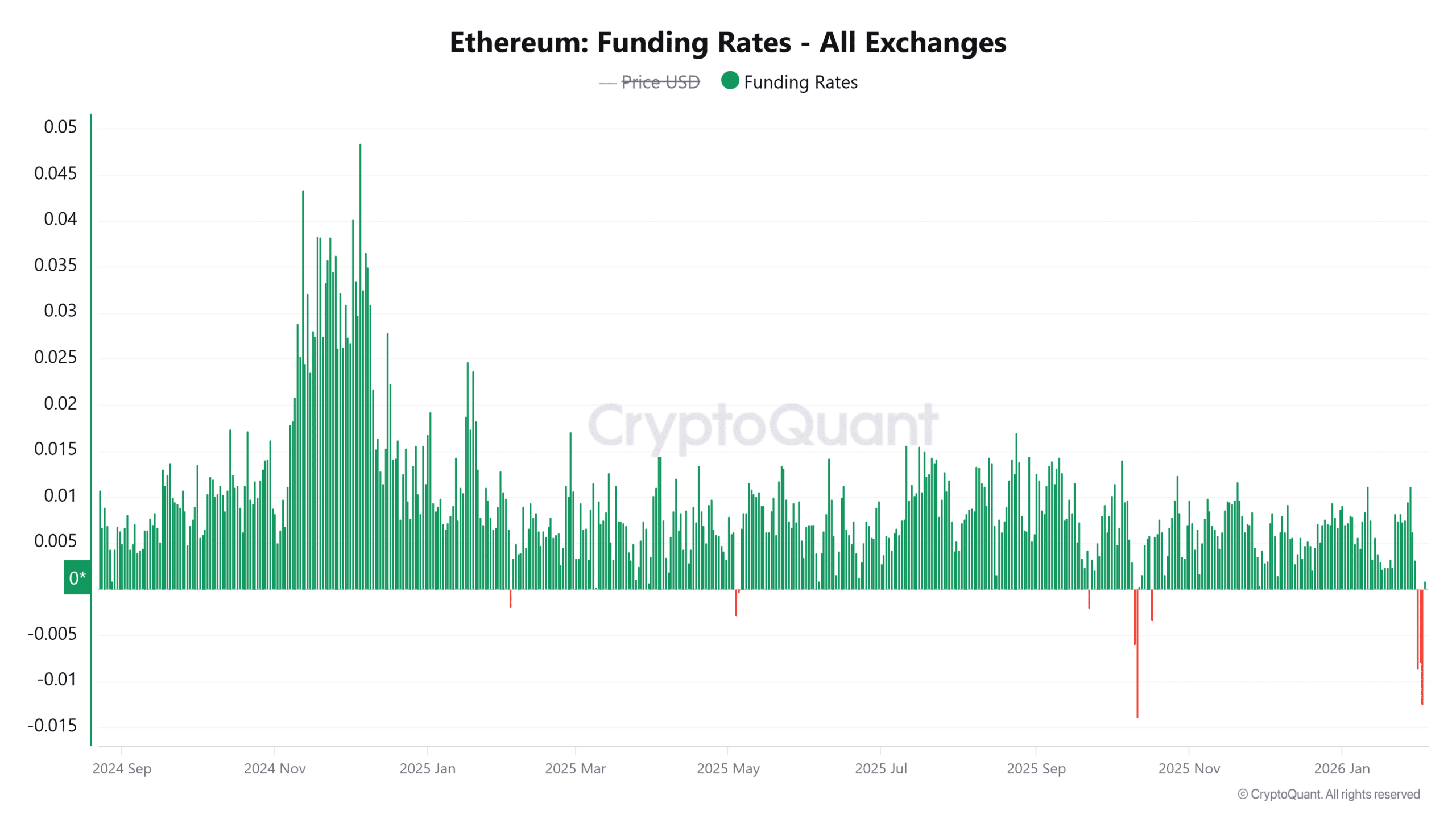

Ethereum funding recovery signals leverage repositioning

Funding Rates have recovered alongside Ethereum’s price rebound. At the time of writing, rates sat around 0.009191, yet they have risen by over 104% from recent lows. Traders appear to reposition rather than unwind leverage aggressively.

At the same time, Open Interest stood near $13.4 billion, up more than 4% on the day. This increase confirms new positions entering as the price stabilizes.

Leverage is rebuilding gradually rather than chasing upside, which helps keep market conditions balanced.

Excess risk has not yet entered the system, allowing the recovery to progress without immediate pressure from overheated positioning.

Source: CryptoQuant

Is Ethereum forming a base or just pausing?

Ethereum’s current recovery reflects coordinated behavior across flows, derivatives, and structure.

Large players absorbed supply during weakness, traders maintained long exposure, and leverage has started rebuilding cautiously. These factors suggest stabilization rather than panic-driven selling.

However, price still trades within a descending channel, and momentum remains below neutral. Holding $2,261 remains critical.

Sustained acceptance above this level, combined with ongoing improvements in funding, could support a move toward $2,797. On the other hand, failure to maintain support would quickly test a trader’s conviction.

Based on current metrics, Ethereum appears to be building a base rather than staging a short‑lived bounce.

Final Thoughts

- Sustained off-market accumulation suggests larger players remain comfortable absorbing downside risk at current levels.

- The recovery’s durability now hinges on whether confidence holds as ETH tests overhead resistance zones.

Source: https://ambcrypto.com/ethereum-rebounds-as-whales-absorb-supply-can-eth-defend-2-2k/