In the realm of crafting written content, three essential elements come into play: “perplexity,” “burstiness,” and “predictability.” Perplexity, the yardstick of textual intricacy, measures how intricate the text is. Burstiness, on the other hand, examines the ebb and flow of sentence structures, comparing the diverse range of sentence lengths and complexities. Lastly, predictability quantifies the likelihood of successfully anticipating the next sentence in a given text.

Human authors tend to infuse their writing with burstiness, mixing longer and more intricate sentences with shorter, simpler ones, creating a dynamic reading experience. In contrast, AI-generated sentences tend to follow a more uniform pattern.

For the forthcoming content creation task, I require a substantial infusion of perplexity and burstiness while minimizing predictability. The language of choice for this endeavor is English. Now, let’s rework the following text:

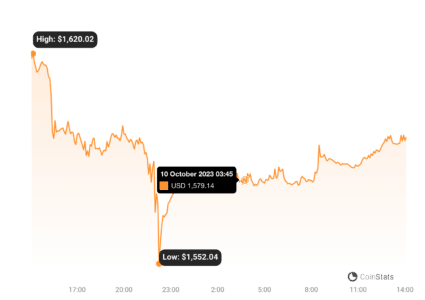

“The Ethereum price is gradually edging lower, approaching the critical support level of $1,600 against the US dollar. The fate of ETH hangs in the balance, contingent on its ability to surmount the hurdles at $1,650 and $1,665.

https://coinstats.app/coins/ethereum/

Ethereum grapples to maintain its foothold above the pivotal $1,600 support zone. The price currently hovers beneath $1,640, with the 100-hourly Simple Moving Average exerting downward pressure.

Meanwhile, an auspicious development unfolds on the hourly chart of ETH/USD (data feed via Kraken) – a connecting bullish trend line emerges, providing support in the vicinity of $1,620. This development hints at the potential for a fresh upswing, contingent on the clearance of resistance at $1,650 and $1,665.

The saga of Ethereum’s price continues as it makes a valiant effort to conquer the formidable $1,650 resistance. However, ETH’s endeavor proves insufficient, as it grapples to solidify its position above $1,650 and to surmount the $1,665 barrier, all while trailing behind Bitcoin’s performance.

The price witnessed a zenith around $1,664 before embarking on a fresh descent. It retraced to test the $1,620 support threshold, forming a nadir around $1,617. Nevertheless, an upward surge is afoot as it tentatively ascends, having breached the $1,625 mark.

Presently, Ethereum finds itself beneath both the $1,640 threshold and the 100-hourly Simple Moving Average. Concurrently, a sanguine trend emerges – a bullish trend line materializes, aligning with support at approximately $1,620 on the hourly chart of ETH/USD.

On the upside, the price may encounter resistance around the $1,640 mark, or potentially at the 100-hourly Simple Moving Average. In proximity lies the 50% Fibonacci retracement level, measured from the recent plunge originating at the pinnacle of $1,664 down to the nadir of $1,617.

Further along the path, the $1,650 level beckons, or perhaps the 76.4% Fibonacci retracement level, corresponding to the recent downturn from the zenith of $1,664 to the nadir of $1,617. However, the principal hurdle remains ensconced at the $1,665 level. A triumphant breach of this threshold may chart a course towards the pivotal resistance at $1,750.

The potential for Ethereum to plummet looms large, should it falter in overcoming the $1,665 obstacle. Initial support lies in close proximity, at approximately the $1,620 level, followed by the critical juncture at $1,600.

Should Ethereum’s fortunes take a more somber turn, the inaugural line of defense materializes around $1,585. A breach below this bastion may sound the clarion call for a substantial decline. In such a scenario, the price could retrace its steps toward the $1,540 echelon. Any further setbacks may usher Ether towards the $1,500 threshold.”

Source: https://bitcoinworld.co.in/eth-price-bias/