- ETH shot up above $2,700 in the past 24 hours as chances of a reversal rose.

- Between Feb 1 and Feb 9, the number of addresses having more than 10K ETH rose 2.30%.

- ETH whales withdrew 121,512 ETH (~$323.4 million) from Bitcoin and Bitfinex crypto exchanges.

ETH is on the verge of a potential short-term reversal as the cryptocurrency currently trades at $2,700.01, up 2% in the past day.

According to noted crypto analyst Ali Martinez, deep-pocketed investors, known as whales, have been snapping up huge amounts of ETH, capitalizing on the recent crypto market downturn. This could mean a reversal is in the works.

Whale Wallets Swell During Price Dip

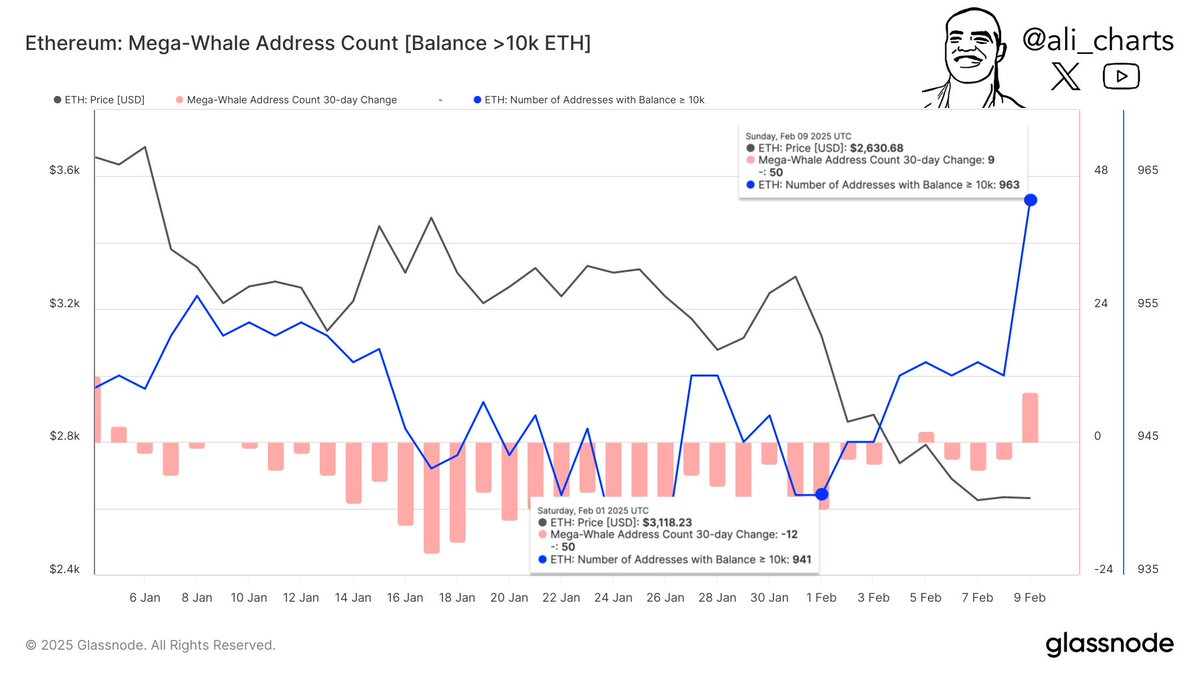

Martinez pointed out in a post on X (formerly Twitter) that there’s been a significant increase in Ethereum “mega-whales” (those holding 10,000 ETH or more).

Between February 1st and 9th, the number of these addresses jumped from 941 to 963 – a 2.30% rise. Historically, when this kind of buying happens during a price slump, it’s often a sign that whales are confident the price will bounce back

Exchange Data Backs Up Whale Buying Spree

Adding more credence, blockchain sleuths at Lookonchain revealed in a separate X post that over 121,512 ETH (worth around $323.4 million) flew out of major exchanges like Binance and Bitfinex, heading to just two whale wallets.

Related: BTC Could Easily Reach $150K As OTC Supply Nears Depletion – Analyst

One whale, identified as “0xb99a…BcF5,” pulled out 56,909 ETH ($151.6 million) from Binance earlier today. Meanwhile, another massive wallet, “0xEd0C…4312,” withdrew a hefty 64,603 ETH ($171.8 million) from both Binance and Bitfinex over the past couple of days.

This kind of exodus from exchanges usually suggests these whales aren’t planning to sell anytime soon; instead, they’re likely stockpiling for the long haul, which takes away selling pressure in the short term.

ETH Price Charts Hint at Potential Bullish Shift

The daily chart from TradingView confirms that ETH hasn’t been a star performer this cycle, but it just might be on the cusp of a bullish surge. The Relative Strength Index (RSI) is currently at 35.82, suggesting bearish territory. However, it’s worth noting the RSI dipped close to oversold levels recently, which often precedes a rebound.

Looking at the MACD indicator, it still paints a bearish picture, with the signal line (red) lingering above the MACD line (blue), indicating the downtrend is losing steam but hasn’t completely reversed.

Related: Bitcoin ‘Diamond Hands’? BTC Holds $97K as Whales Dump at 3AC Levels

The MACD histogram is also bearish, but the bars are getting shorter, hinting at a growing possibility of a bullish divergence – a potential early sign of a trend change.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/ethereum-price-set-for-a-shift-as-large-holders-buy-in/