Ethereum price continued its strong downward trend today, January 30, reaching its lowest level since November 17. It has now dropped for the second consecutive week, a trend that may continue as ETF outflows continue and after Vitalik Buterin moved 16,384 coins.

Ethereum Price Drops as Vitalik Buterin Makes a Big Withdrawal

The value of ETH has been in a strong downward trend in the past few months, mirroring the ongoing crypto market crash that has affected all tokens.

This crash continued today after Donald Trump nominated Kevin Warsh to become the next Federal Reserve Chair. Trump believes that Warsh will quickly lower interest rates, a move that would help the stock and crypto markets.

Ethereum and other coins dropped because the odds of Rick Rieder were rising before the Warsh decision. Rieder, who works for BlackRock, was widely seen as a better official for the financial market.

Meanwhile, Vitalik Buterin also moved 16,834 coins valued at $44 million. Data compiled by Arkham shows that he now holds 240,000 Ethereum valued at over $657 million.

In theory, Vitalik’s selling would be bearish for Ethereum because he is a top insider. However, he justified the sale noting that it was for the network’s good. He plans to use the tokens to deliver on an “aggressive roadmap that ensures Ethereum’s status as a performant and scalable world computer that does not compromise on robustness and decentralization’.

Buterin also wants to spend the money to ensure that Ethereum Foundation continues to implement its core mandate. He is also working on finding more funding for this goal using decentralized staking options.

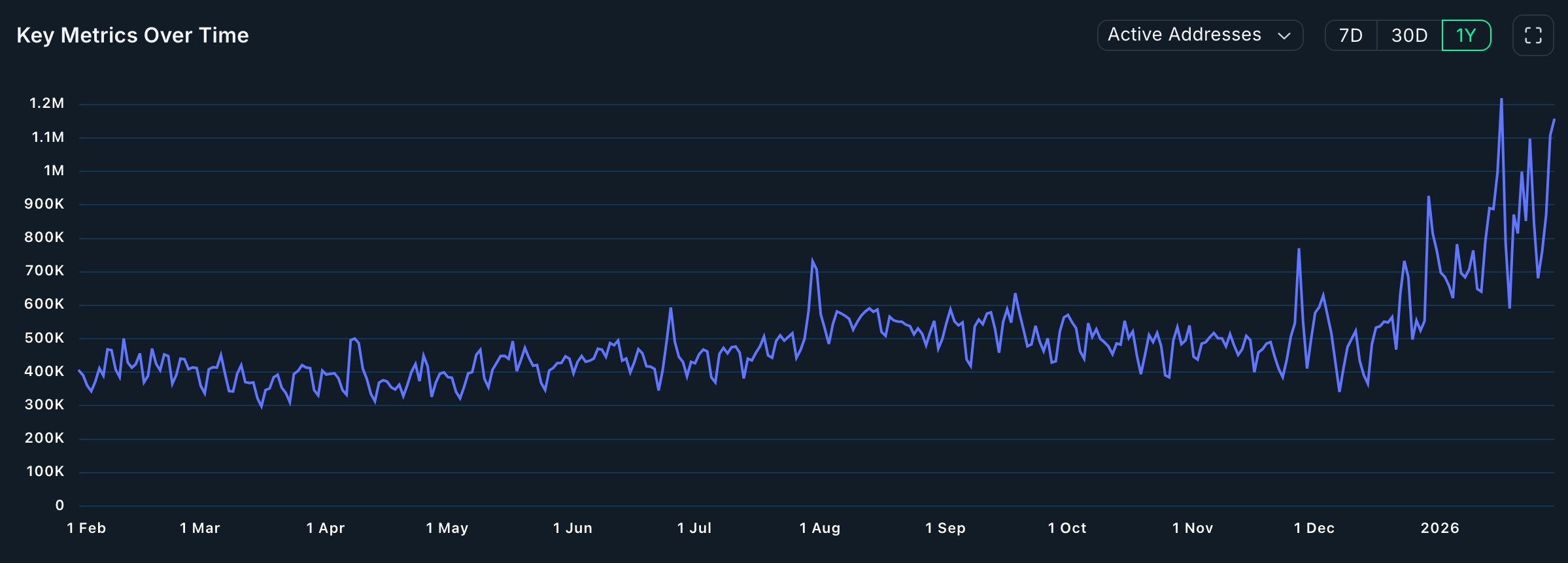

Buterin’s strategy comes at a time when Ethereum is doing well, with the number of active addresses and transactions surging. Active users rose by 47% in the last 30 days, while its active addresses soared to over 64 million.

This growth will likely accelerate in the coming months after the developers implement the closely-watched Glamsterdam upgrade that will have more privacy and performance features.

Still, Ethereum price is falling despite these issues because of the rising geopolitical tensions in Iran and the fact that investors are largely focusing on hard assets like gold and silver.

ETH Price Technical Analysis Points to More Downside

The weekly timeframe chart provides a clear picture on why ETH price is crashing. The coin has dropped from a high of $4,950 in August to the current $2,730.

A closer look shows that ETH formed a bearish flag pattern, which is made up of a vertical line and a consolidation. The ongoing weakness is happening as it completes the bearish flag pattern.

Ethereum has remained below the 50-week Exponential Moving Average (EMA) and the Supertrend indicator, pointing to more downside in the near term.

Most importantly, it has been forming an inverted head-and-shoulders pattern since 2024. It has completed the right shoulder, head, and the neckline, and is now moving towards the right shoulder.

This means that it may crash to the right shoulder at $2.114, which is ~23% below the current level. A move below that price will point to more downside to $2,000.