- Ethereum whale that may have signaled July’s downside has started selling in bulk again

- Worth assessing the potential for a support bounce being cancelled

What happens when a whale starts to offload some of the ETH they received as far back as the Ethereum ICO stage? This kind of scenario recently played out, according to Lookonchain. And, it could have significant consequences.

New findings indicate that a whale that participated in the Ethereum ICO just offloaded 3,000 ETH. Lookonchain’s analysis revealed that the same whale address previously sold 7,000 ETH at the start of July this year. Why is this important? Well, it could underscore some correlation with the altcoin’s price action.

A 15% ETH price dip occurred after July’s sale, suggesting that news about such a large sale may be seen as a sell event. This also alludes to the possibility that the market could respond with a surge in sell pressure in the coming days.

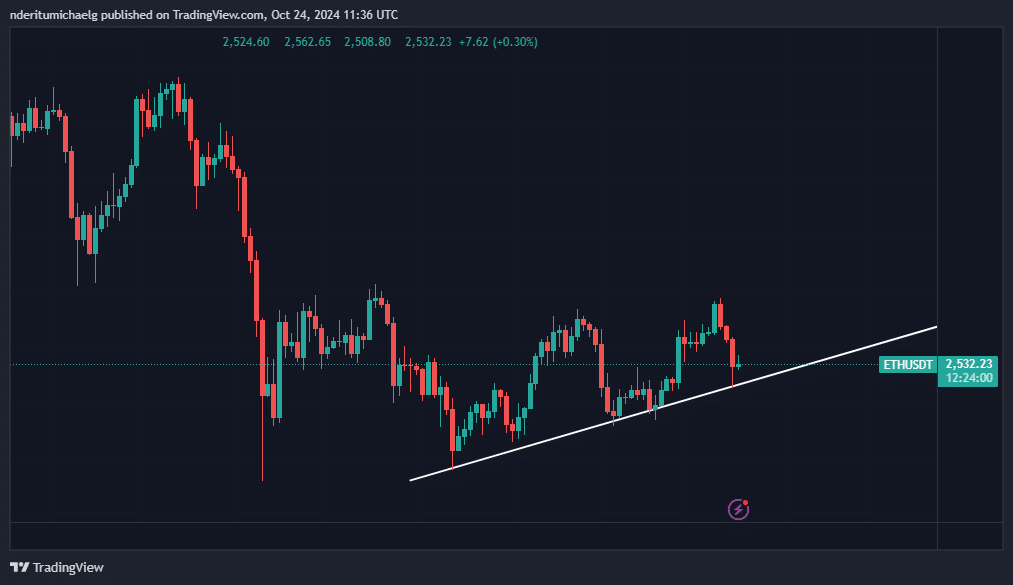

ETH, at press time, was already under a lot of sell pressure. It was down to a $2,526 at the time of writing, after pulling back by about 8% from its weekly high. More importantly, it retested a short term ascending support line in the last 24 hours, with a bit of a bounceback.

Source: TradingView

Simply put, Lookonchain’s assessment about the Ethereum ICO whale suggests that more sell pressure may come in the coming days. This would be a contrary outcome to the possibility that ETH might bounce from the aforementioned ascending support.

More ETH volatility incoming, but which direction?

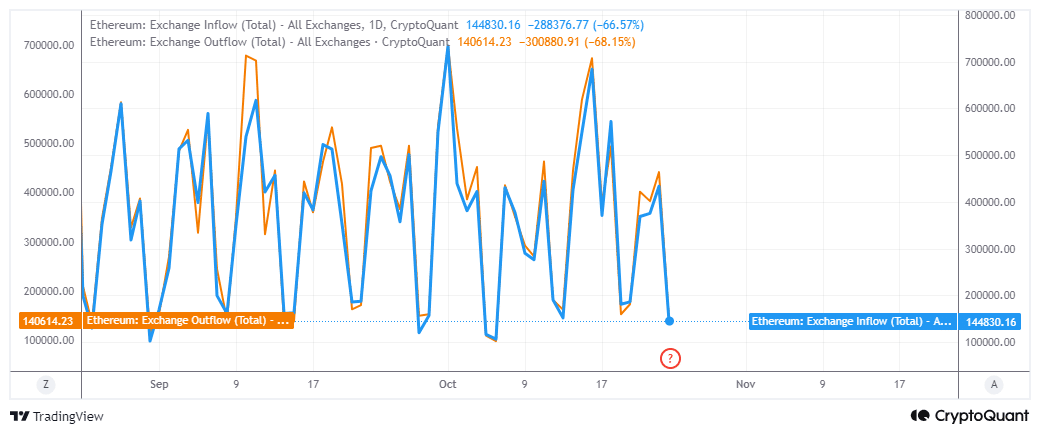

ETH’s exchange flow data revealed that both exchange inflows and outflows dropped to levels where they are likely to pivot in the next few days.

This means we may observe another surge in volatility. However, this could still go either way.

Source: CryptoQuant

Exchange inflow data was higher over the last 24 hours at 144,830 ETH. In comparison, exchange outflow data was lower at 140,614 ETH, at the time of writing. This meant that there was higher sell pressure than buy pressure. However, the price appeared to have bottomed out at the support level and the reason for this may have been whale activity.

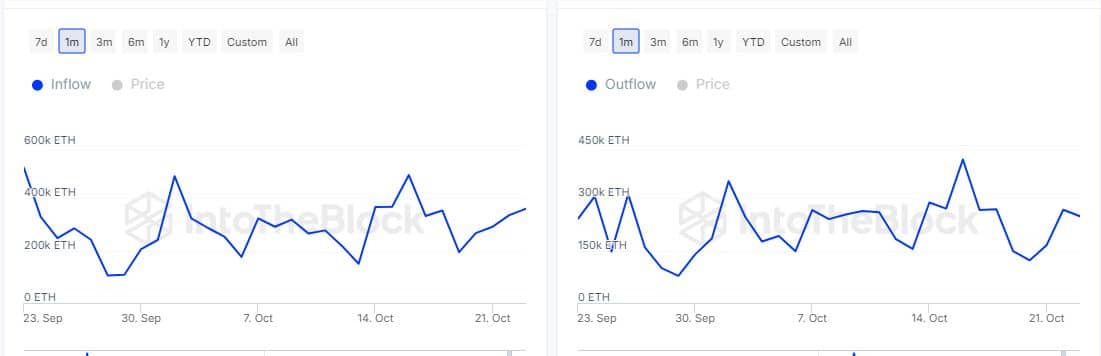

Data from IntoTheBlock also revealed that the amount of ETH flowing into large holder addresses was higher at 360,320 ETH. Meanwhile, outflows from large holder addresses were down to 248,590 coins.

Source: IntoTheBlock

Finally, the ownership data confirmed that whales have been accumulating at recent lows.

However, the lack of a significant price uptick during the last 24 hours confirmed a significant degree of uncertainty, one which could lead to weak demand.

Source: https://ambcrypto.com/ethereum-ico-address-shifts-3000-eth-is-a-repeat-of-july-24-on-the-way/