- The Ethereum Foundation transferred dormant 4,000 ETH after 9 years, impacting market dynamics.

- Funding ecosystem initiatives impacts ETH liquidity.

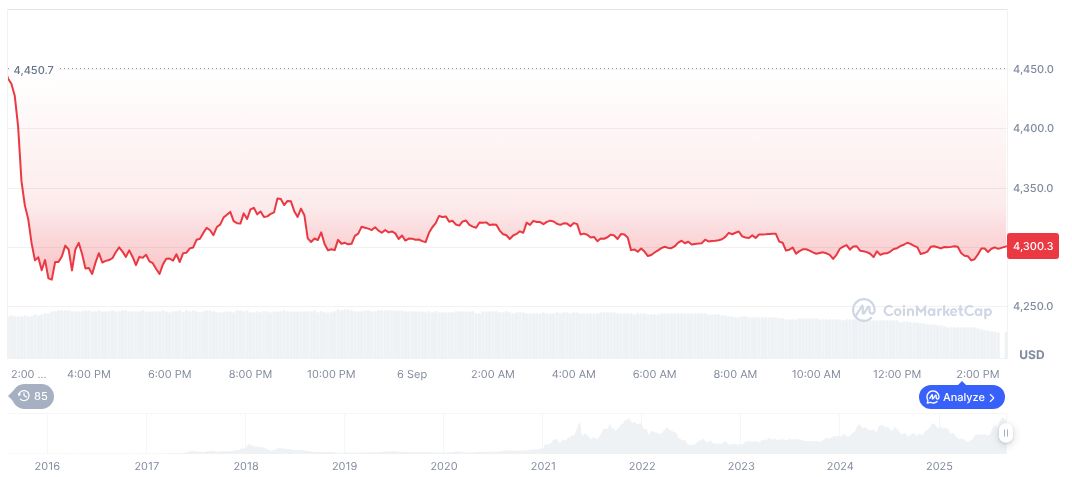

- Market response includes slight ETH price dip.

An Ethereum Foundation-associated address swiftly moved 4,000 ETH, approximating $17.19 million, after remaining inactive for nearly nine years, according to Onchainlens.

The transaction aligns with the foundation’s broader ETH sales, aiming to fund ecosystem operations, potentially affecting Ethereum market dynamics with slight selling pressure observed.

Ethereum Foundation Moves 4,000 ETH After 9 Years

The Ethereum Foundation’s recent activity witnessed the transfer of 4,000 ETH, approximately valued at $17.19 million, from a wallet inactive for nine years. This action aligns with the organization’s strategy to optimize asset management and finance ongoing ecosystem projects.

The shift in Ethereum’s reserve distribution could influence immediate liquidity in the market. Continued strategic resource allocation stands to fund research, development, and community grants over time, potentially stabilizing long-term ecosystem growth.

Market responses were measured, with a slight decline in ETH’s value, approximately 1% within 24 hours. Despite no direct commentary from Ethereum’s leadership, the transparency in operation enhances market understanding and promotes sustained trust in its financial maneuvers.

“No direct statement from me or other top EF officials regarding the dormant wallet transfer has been posted on our verified channels as of the query date.” – Vitalik Buterin, Co-founder, Ethereum

Historical Context and Market Insights on Ethereum

Did you know? Ethereum’s market moves have historically led to short-term volatility. Past Foundation transactions, such as the July 2025 sale, birthed notable price reactions showcasing the blockchain’s influential hold over altcoin market behaviors.

Ethereum, with a market cap of $518.52 billion and 13.61% dominance, is priced at $4,295.72. The cryptocurrency’s circulating supply is 120.71 million ETH. Over the past 90 days, it surged by 72%, according to CoinMarketCap data.

Insights from Coincu suggest a calculated approach from the Ethereum Foundation effectively buffers excessive volatility. The integration of staggered asset sales supports projected R&D operations, advancing Ethereum’s technological framework and prospective scope without adversely affecting its market position.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/ethereum-foundation-transfers-4000-eth/