The Ethereum validator exit queue has reached closer to 1 million ETH, or $4.0 billion worth of ETH, with staking withdrawals on the rise amid the recent price rally. Over the past few weeks, the validator exits have been on the rise, largely driven by top three liquid staking platforms – Lido, EthFi, and Coinbase. As a result, the ETH price has seen over 10% pullback after facing rejection at $4,800 last week.

Ethereum Validator Exits On the Rise

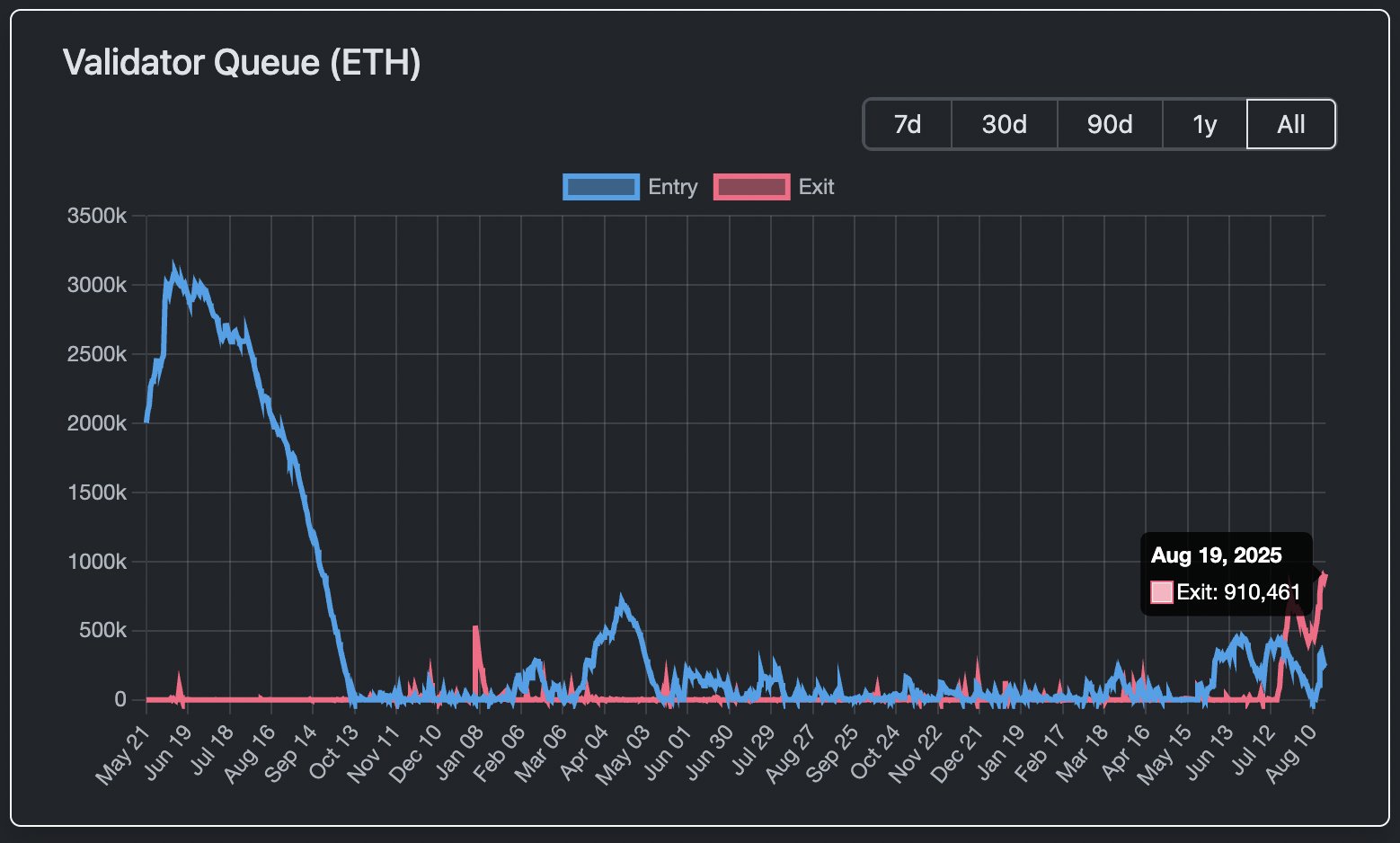

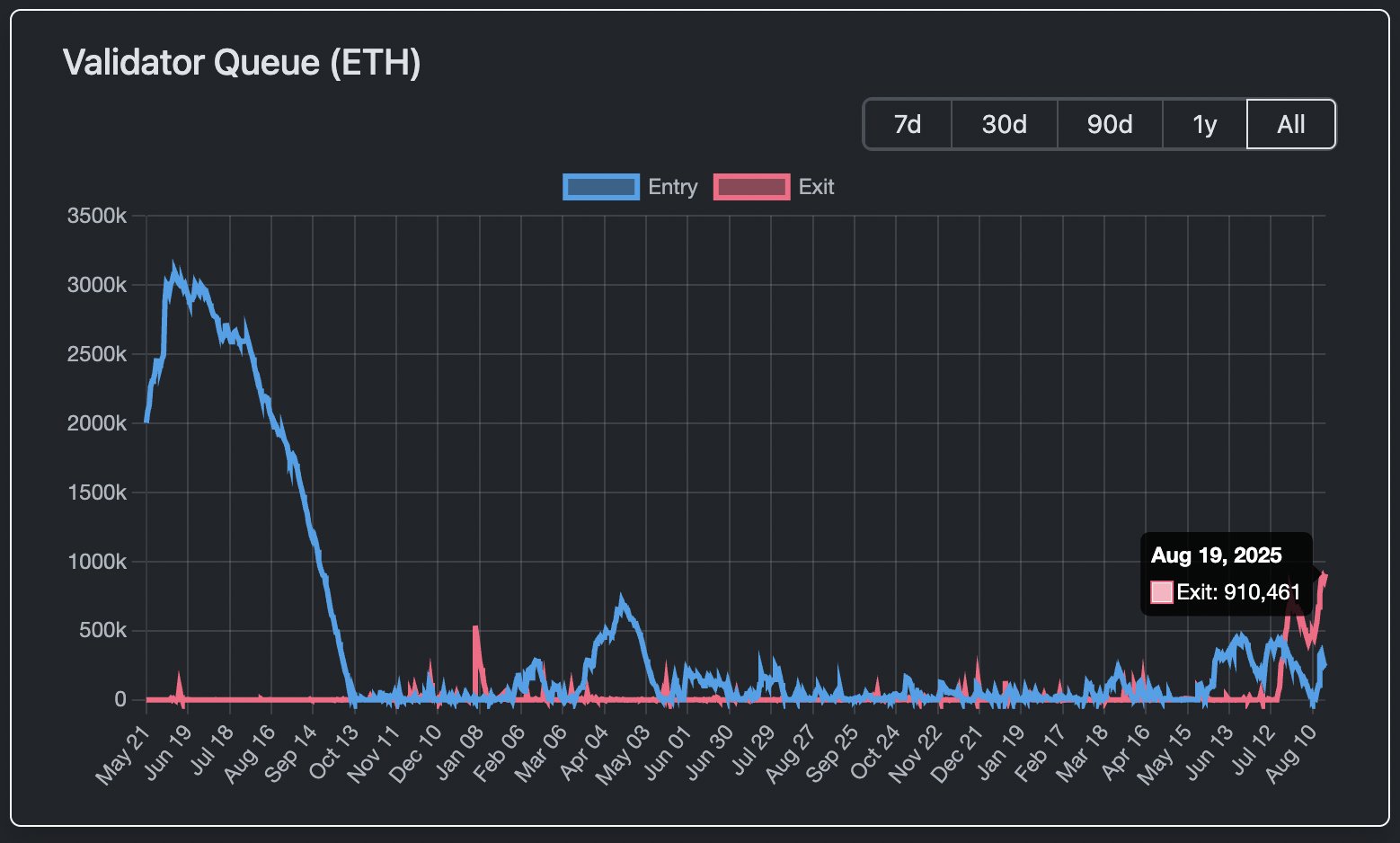

Amid the rising Ethereum staking withdrawals and validator exits, investors have raised caution on the development. Over the past two weeks, the validator exit queue has grown from 640,000 ETH to more than 910,461, worth a massive $3.9 billion.

As per the data from Validator Queue, there’s a 15-day waiting period for the ETH exit, with a total number of active validators at 1.08 million. As of now, nearly 29.45% of the total ETH supply i.e. 35.3 million ETH is currently staked. On the other hand, the demand for new ETH staking is far below the exit demand. As of now, the ETH staking demand stands at 258,951 ETH, worth $1.09 billion.

The growing queue of unstaked ETH suggests significant profit-taking in progress. So far, strong inflows into spot Ethereum ETFs, and massive accumulation by the ETH treasury firms, have absorbed most of the selling pressure coming from validator exit.

All eyes on Staking for Ether ETFs

Crypto market analysts also believe that some investors might be unlocking liquidity now with the intention of re-entering via stake Ether ETFs. This could lead to effectively reallocating their positions without fully exiting the ETH market. Last month, asset manager BlackRock filed for a proposal to bring staking to iShares Ethereum Trust (ETHA).

Although the SEC’s final approval deadline is April 2026, Bloomberg ETF analyst Seyffart suggests the decision could arrive by October this year.

The net flows into Ethereum ETFs have also flipped negative over the past two trading sessions. On Monday, August 18, the net outflows stood at $196.6 million, with BlackRock’s ETHA contributing $87 million, and Fidelity FETH contributing $78 million, as per data from Farside investors.

ETH price has also come under selling pressure, correcting 15% from its weekly top. As of now, Ethereum is finding support at $4,200, with daily trading volume dropping to $45 billion.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

Source: https://coingape.com/ethereum-exit-queue-tops-4b-as-staking-withdrawals-spike-is-a-staking-etf-approval-ahead/