Ethereum (ETH) network data shows the digital currency is primed for bullish moves.

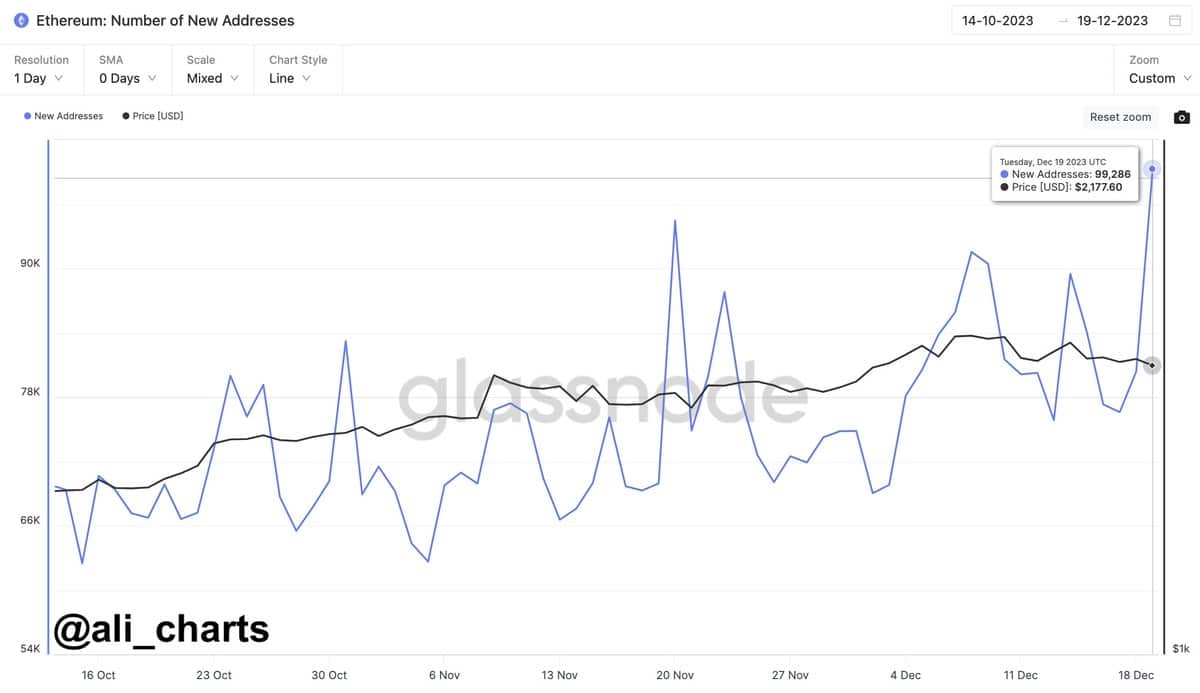

According to data presented by top market analyst Ali Martinez, Ethereum is seeing a steady increase in the number of new addresses. Specifically, the current data presented shows that new Ethereum addresses soared to a higher high as of December 19.

New addresses entering a network hint at a growing interest in accumulation, a trend that might ultimately boost the price of the asset in question.

Despite the inherent Ethereum FUD induced by Peter Brandt, after weeks of range-bound motion, Martinez is optimistic that this growing network activity could set the stage for ETH to resume its upward trajectory in the near term.

– Advertisement –

Ethereum Retesting Breakout Zone

Per the charts, new addresses entering the Ethereum network have soared to their highest level since October 16. The current level represents the second major spike recorded within the network since the uptick recorded on November 20.

This ongoing network activity coincides with the point ETH bulls are making an effort to revive the price of the coin.

At the time of writing, Ethereum changes hands at $2,234.32, up 1.32% in the past 24 hours. While market capitalization has soared by an almost equal growth rate to $264,962,859,280, its trading volume has jumped by 13.68% to $10,707,140,446.

In another post on X, Martinez highlighted that Ethereum is currently retesting its breakout zone from an ascending triangle. Per his experience, he posited that ETH is hinting at preparation for a further climb.

#Ethereum is currently retesting its breakout zone from an ascending triangle, hinting at preparation for a further climb.

The price range between $2,150 and $1,900 could be the ideal zone for accumulation before #ETH sets its sights on a higher target of $3,500. pic.twitter.com/6lGZT0ZKgv

— Ali (@ali_charts) December 20, 2023

The top analyst highlighted the price range between $2,150 and $1,900 as the critical accumulation zone to watch out for. If the accumulation scenario plays out, ETH might be on its way to the ultimate target of $3,500.

Ethereum and Market Influence

While the current Ethereum on-chain data shows the second-largest digital currency has all it takes to pull a dramatic bullish run, market sentiment might stall this current optimism.

Despite the Ethereum spot Exchange Traded Fund (ETF) sentiment in the market, the ripple effect of Bitcoin’s instability is impacting ETH’s performance in no small measure. While the broader crypto ecosystem is currently in a recovery mode, traders tracking ETH for the longer term may keep an eye on market dynamics.

Follow Us on Twitter and Facebook.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

Source: https://thecryptobasic.com/2023/12/20/ethereum-eth-showing-signs-of-robust-expansion-imminent-breakout-ahead/?utm_source=rss&utm_medium=rss&utm_campaign=ethereum-eth-showing-signs-of-robust-expansion-imminent-breakout-ahead