Ethereum price today is trading around $4,298, consolidating inside a tightening symmetrical triangle on the 4-hour chart. Support is close to $4,250, and resistance is at $4,370. This means that ETH is at a key point where it could either break out or go down even more.

Ethereum Price Compresses In Triangle Structure

Ethereum price action shows repeated defenses of the $4,250 zone, where the 200-EMA aligns with trendline support. Overhead, the 20-EMA near $4,312 and the 50-EMA around $4,351 continue to cap rallies, creating a narrow trading range.

Related: Dogecoin (DOGE) Price Prediction: Rising ETF Odds Spark Bullish Momentum

RSI is close to 46, which means that momentum is low and there isn’t a clear direction. If buyers push the price above $4,370, the next targets are $4,500 and $4,700. If the price doesn’t stay above $4,250, it could drop to $4,100, and maybe even $3,900 if selling pressure picks up.

Analysts Compare Cycle Patterns With Bitcoin

Market strategist Ted highlighted that Ethereum is mirroring Bitcoin’s past cycle structure. He noted that Bitcoin corrected nearly 20 percent after hitting its prior all-time high before resuming its uptrend. By that logic, Ethereum could retest the $3,800–$3,900 range before launching toward new highs.

This cycle-based analysis adds caution for traders betting on immediate upside. The weekly chart also shows ETH approaching the upper boundary of a multi-year wedge, making the $4,300–$4,400 zone a crucial pivot for long-term positioning.

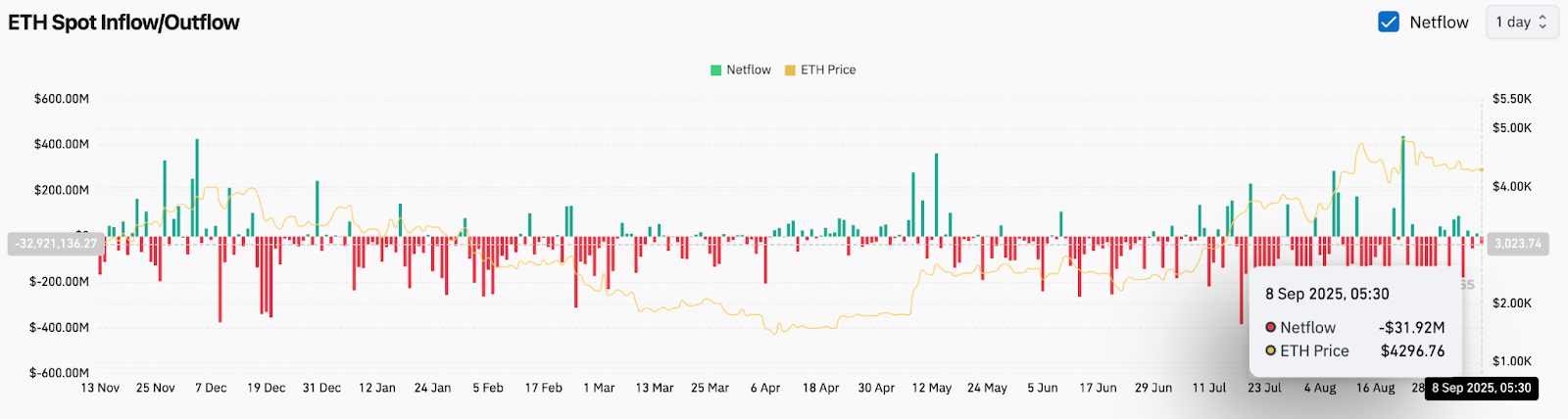

Outflows Signal Investor Caution

On-chain data shows that $31.9 million left the network on September 8, which means that holders moved ETH away from exchanges. Persistent outflows can mean accumulation, but they can also mean that there isn’t much liquidity for short-term rallies.

Spot flows have been volatile, with alternating bursts of inflows and outflows since late August. Without sustained inflows above $50–100 million, analysts caution that ETH may lack the fuel for a decisive breakout in the short run.

Related: XRP (XRP) Price Prediction for September 9

Technical Outlook For Ethereum Price

Key resistance stands at $4,370, followed by $4,500 and $4,700. Support levels sit at $4,250 and $4,100, with deeper risk toward $3,800 if sellers regain control. RSI and EMA clusters underline the compression phase, suggesting volatility expansion is imminent.

A confirmed breakout above $4,370 would strengthen bullish conviction, while losing $4,250 could extend consolidation or trigger a correction.

Outlook: Will Ethereum Go Up?

Ethereum’s short-term trajectory hinges on whether buyers can defend $4,250 while overcoming resistance near $4,370. Analysts remain divided, with cycle comparisons pointing to a possible correction, but broader adoption trends supporting the long-term bull case.

As long as ETH holds above $3,800, the structure favors eventual upside. Traders should watch closely for volume confirmation on any breakout attempt, as September could decide whether Ethereum rallies toward $5,000 or retraces before resuming its uptrend.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/ethereum-eth-price-prediction-for-september-9-2025/