- Ethereum price holds above $4,490 while $4,665 remains the resistance to beat for a push toward $4,850.

- On-chain flows show $25.7M inflows but broader accumulation trend continues as exchange balances stay low.

- Cycle patterns and endorsements fuel optimism, with analysts eyeing $5,000 if ETH breaks the $4,665 barrier.

Ethereum price today is trading near $4,513, stabilizing after a sharp pullback from last week’s $4,850 peak. Buyers are defending support at $4,490 while sellers continue to cap gains near the $4,665 resistance cluster. The key tension now is whether inflows and bullish cycle patterns can power ETH toward new highs.

Ethereum Price Defends Key Support Levels

The 4-hour chart shows ETH holding above a rising trendline that has guided the rally since early August. The 20- and 50-EMAs, clustered between $4,500 and $4,510, are currently acting as immediate resistance. A strong closing above these levels would allow for a return to $4,665 and $4,850.

Related: Dogecoin Price Prediction: Can DOGE Break $0.28 After ETF Approval?

Failure to defend $4,490 could expose ETH to deeper retracement zones at $4,465 and $4,358, where the 200-EMA provides the next cushion. RSI sits at 46, signaling neutral momentum after cooling from overbought conditions earlier this month.

On-Chain Data Points To Renewed Accumulation

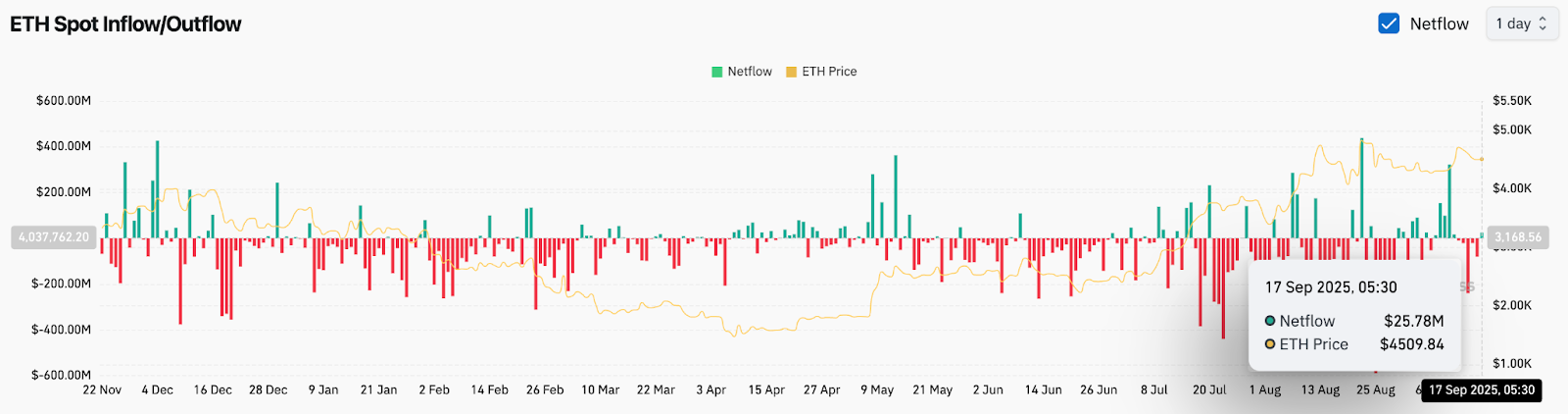

Exchange data recorded $25.7 million in net inflows on September 17, one of the larger single-day moves this month. While money coming in might suggest short-term selling pressure, analysts point out that a lot of this activity shows a shift into derivatives markets and structured products before important resistance tests.

Overall exchange balances remain historically low, signaling that investors continue to withdraw ETH into self-custody. This supply drain has been a consistent bullish driver since midyear, suggesting the broader accumulation trend is intact.

Cycle Patterns Suggest Breakout Potential

Market commentators have drawn parallels between the current ETH setup and the 2021 breakout. Analyst Crypto Rover highlighted that Ethereum’s structure in 2025 closely mirrors the wedge-to-rally pattern seen four years ago, which preceded a surge to record highs.

Related: Cardano (ADA) Price Prediction For September 18

The comparison has fueled optimism that ETH may be preparing for another major breakout, with the $4,600–$4,700 zone acting as the launchpad for a move toward $5,000. Technical traders warn, however, that confirmation is needed through a clean break of $4,665 before momentum re-ignites.

Macro And Celebrity Endorsements Fuel Sentiment

Adding to the bullish narrative, Eric Trump commented that he sees Ethereum potentially reaching $8,000, citing institutional adoption and cycle strength. While such endorsements are not traditional market drivers, they contribute to heightened retail and media attention that can amplify short-term volatility.

This aligns with broader macro sentiment, where Bitcoin remains steady above $108,000, offering a supportive backdrop for altcoin performance.

Technical Outlook For Ethereum Price

Ethereum’s short-term forecast hinges on reclaiming the mid-$4,600 zone.

- Upside levels: $4,665, $4,850, and $5,000.

- Downside levels: $4,490, $4,465, and $4,358.

- Trend support: $4,100 remains the deeper line of defense if selling pressure escalates.

Outlook: Will Ethereum Go Up?

Whether buyers can regain momentum above $4,665 will shape Ethereum’s near-term direction. On-chain data shows continued accumulation, while cycle analysis and high-profile endorsements add to the bullish case.

Related: Solana (SOL) Price Prediction For September 18

If ETH clears $4,665, traders expect a swift push toward $4,850 and possibly $5,000. Failure to hold $4,490, however, would weaken the structure and raise the risk of a slide toward $4,358. For now, Ethereum remains in a consolidation phase, with the next breakout attempt likely to decide its September trajectory.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/ethereum-eth-price-prediction-for-september-18-2025/