- Ethereum trades near $4,405, defending $4,300 support as buyers test resistance at $4,427–$4,536.

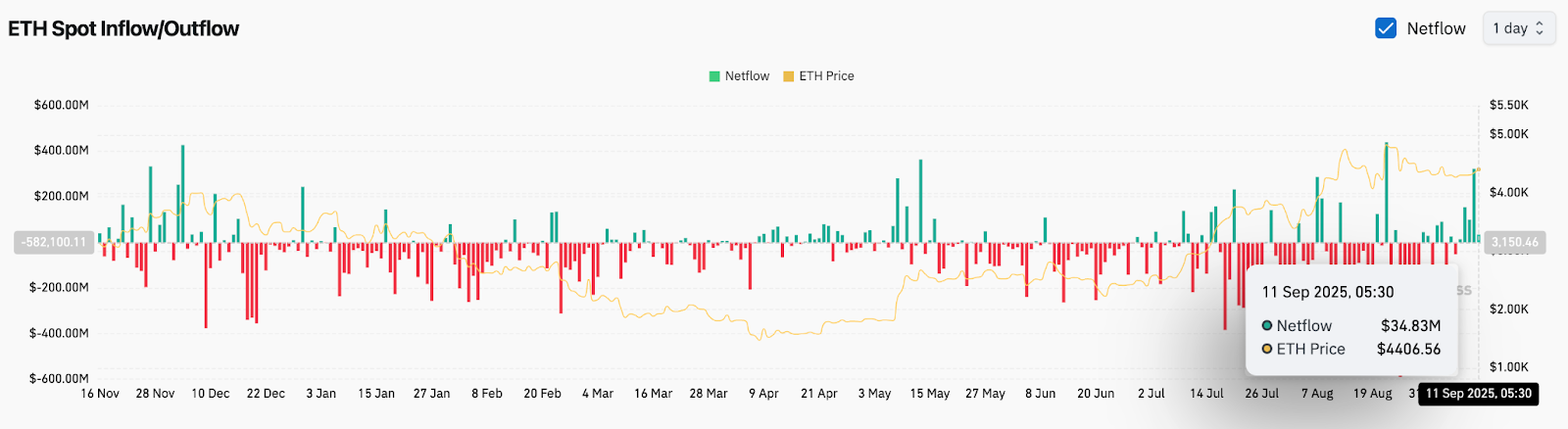

- Net inflows of $34.8M show renewed accumulation, hinting at institutional positioning for a breakout.

- Analysts compare ETH’s setup to Bitcoin’s 2020 cycle, projecting a path toward $8,000–$10,000.

Ethereum price today is trading around $4,405, consolidating after defending the $4,300 support zone. Buyers are attempting to push above $4,427 resistance, with broader attention fixed on the $4,496–$4,536 cluster. The battle between technical compression, on-chain flows, and macro cycle comparisons has left ETH at a pivotal juncture.

Ethereum Price Holds Range Support

On the 4-hour chart, ETH continues to trade within a defined $4,300–$4,500 range. Repeated defenses at $4,268–$4,300, supported by the 100 and 200 EMAs, have turned this zone into a firm accumulation base.

The RSI has ticked up to 58, showing improving momentum after weeks of sideways action. Price has also broken a descending trendline, hinting at the possibility of a stronger push toward the $4,500 resistance area. Clearing $4,536 would align with a breakout from the compression zone that has capped upside for nearly two weeks.

Fibonacci Levels Highlight Key Barriers

ETH is battling overhead supply near the 0.382 Fibonacci retracement at $4,496. A close above this level would pave the way toward $4,584 (0.5 retracement) and $4,672 (0.618 retracement). The Supertrend resistance also sits at $4,427, meaning ETH must establish dominance above this level to validate a bullish continuation.

Failure to hold $4,387 on the downside could re-expose $4,268, the broader range floor. A decisive break below would flip momentum bearish, leaving $4,211 as the next key support.

On-Chain Flows Turn Positive

Spot exchange flows show ETH recorded $34.8 million in net inflows on September 11, marking one of the stronger accumulation days this month. The pickup in inflows suggests buyers are positioning into the $4,300–$4,400 range, potentially anticipating a breakout.

While volumes remain below summer peaks, the return of positive net flows contrasts with the heavy outflows that dominated August. Sustained inflows above $50 million would strengthen conviction that institutions are re-accumulating ETH around current levels.

Analysts Draw Cycle Comparisons

Market strategist Ted Pillows highlighted Ethereum’s chart as mirroring Bitcoin’s 2020–21 cycle. His analysis suggests that ETH could follow a similar accumulation-to-breakout pattern, with mid-cycle corrections designed to clear excessive leverage before a larger rally.

He projected ETH could reach $8,000–$10,000 over the next 3–4 months, while cautioning that short-term corrections remain likely. The chart comparison, which aligns ETH’s current phase with Bitcoin’s pre-breakout consolidation, has fueled optimism that Ethereum may soon retest higher cycle highs.

Technical Outlook For Ethereum Price

Upside levels to watch include $4,427 as immediate resistance, followed by $4,496 and $4,536. A breakout here would expose $4,584 and $4,672, with the $4,957 zone as the ultimate bullish target from recent Fibonacci retracements.

On the downside, losing $4,387 could bring ETH back to $4,268, with deeper risks toward $4,211. A failure here would invalidate the bullish accumulation thesis and trigger a broader retracement.

Outlook: Will Ethereum Go Up?

Ethereum’s short-term path hinges on whether buyers can clear the $4,496–$4,536 resistance cluster. Rising inflows and supportive cycle narratives favor upside, but the market remains cautious given prior rejections.

As long as ETH holds above $4,300, the bias leans toward a breakout attempt. Clearing $4,536 would confirm strength, opening the door to $4,672 and potentially $4,957. However, failure to defend $4,387 could drag price back toward $4,211 and delay the bullish cycle thesis.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/ethereum-eth-price-prediction-for-september-12-2025/