- Ethereum experienced heightened volatility recently, with selling pressure intensifying above $2,600.

- About $15.5 million worth of ETH futures positions were liquidated in the past day due to increased volatility.

- Ethereum’s 7-day average gas fee hit $11, the highest since mid-December.

Ethereum has witnessed heightened volatility the past day, facing intensified selling momentum above $2,600 after Bitcoin peaked around $50,000 resistance. The pause in ETH’s climb follows data pointing to a nascent downtrend as gas fees and exchange whale inflows spike, reversing positive traction.

Per Coinglass, roughly $15.5 million worth of ETH futures positions have faced liquidation over the past day amid elevated volatility. The majority of those forced sells unfolded on the long side, hinting that overleveraged bulls felt strain during the latest pullback.

Meanwhile, surging network activity this month has driven Ethereum’s 7-day average gas fee to $11, its highest since mid-December. Alongside accelerating on-chain activity, this sharp cost increase risks dampening user growth and dApp adoption.

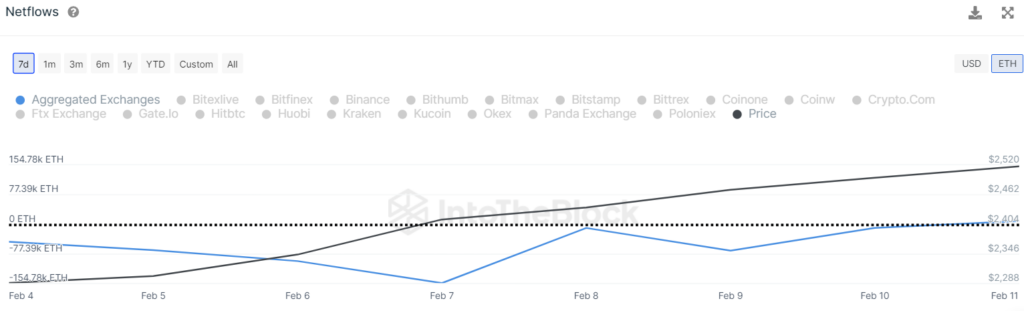

Additionally, the 7-day average of net inflows just crossed into positive territory after remaining negative throughout January. This means exchange whale wallets now accumulate ETH faster than they distribute, typically signaling an impending intent to sell reserves into market strength.

Both rising fees and accumulating exchange deposits point to trouble ahead despite Ethereum’s price bouncing 25% off 2023 lows in recent weeks. Still, bulls eyed a measured $2,700 target after ETH broke out from an ascending triangle pattern.

Bears Look to Wreck Ethereum Bullish Structure

Presently, the Ethereum price trades around $2600. The Bulls must now maintain levels above $2,600 to maintain control and allow the technical target to remain intact.

However, if sell orders overwhelm ETH and unravel its recent bullish structure, the pullback could extend toward the $2,400–$2,200 demand area that reversed 2023’s capitulation below $1,800. With fees climbing and whale deposits rising, bears have notable ammunition to wrest back control if momentum falters.

Source: https://thenewscrypto.com/ethereum-eth-faces-volatility-as-selling-pressure-intensifies-above-2600/