After six consecutive days of inflows, the spot Ethereum ETF flows flipped negative again on Thursday, as the bullish sentiment driven by Trump-trade subsided. The ETH price also dropped 6% in the last 24 hours moving all the way to $3,000 losing over $22 billion in market cap.

Spot Ethereum ETF Flips Negative

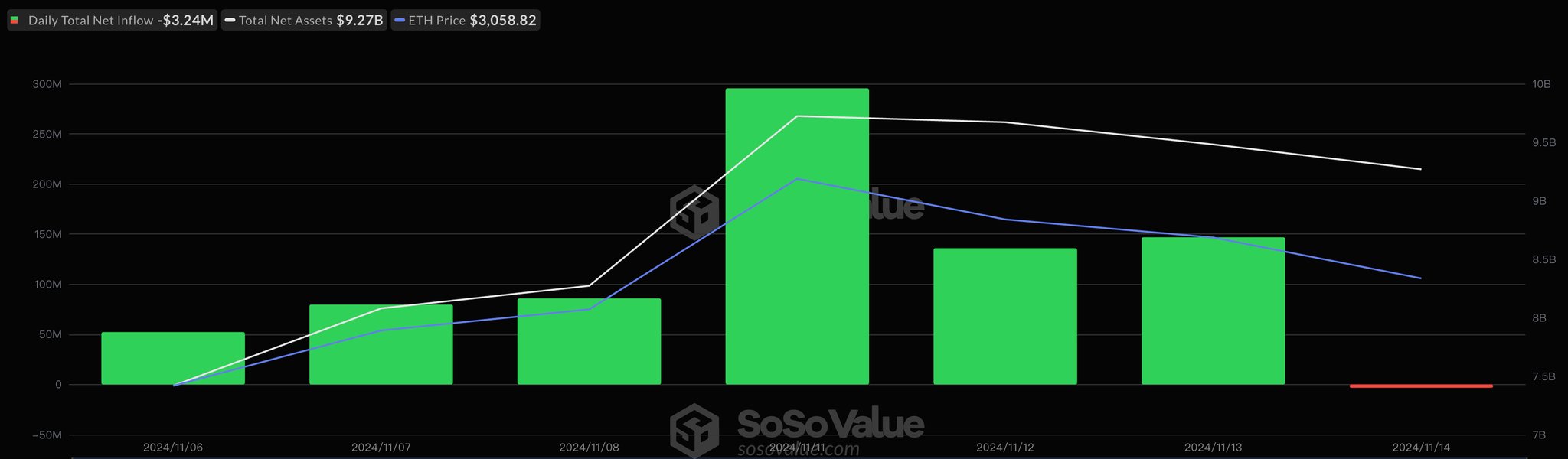

After six consecutive days of inflows, the US Spot Ethereum ETF is once again seeing outflows. On November 14, Ethereum ETFs experienced a minor outflow of $3.24 million, the first since the Donald Trump victory on November 5.

Despite this, BlackRock’s Ethereum ETF (ETHA) saw a net inflow of $18.87 million in a single day. However, Grayscale’s ETHE played the spoilsport with nearly $22 million in outflows yesterday. Besides, inflows in other Ether ETFs have dried up significantly, as per the data from SoSoValue.

Following the Donald Trump victory on November 5, the spot Ether ETFs saw strong inflows as the ETH price rallied 40% on the weekly timeframe all the way to $3,400. However, since the November top, the ETH price has corrected nearly 10% as bulls try to defend $3,000 levels.

ETH Price Action in Choppy Market

Amid the recent ETH price action, popular crypto trader Credibull Crypto has started to build a position in Ethereum (ETH) and add further if Ethereum drops to $2,800, amid the current low-time-frame (LTF) price action and crypto market drop. The decision to increase their exposure is based on Bitcoin’s recent stability, which may prevent a quick pullback to the low $80k range and allow ETH to continue upward.

The trader notes that a small range is forming, pushing into local demand, with untapped local highs above. They are eyeing potential gains toward the $3,500+ level before reassessing. However, the trader emphasizes that the invalidation point for their higher-time-frame (TF) ETH strategy is at $2,350.

Watching this LTF PA develop on $ETH and have started positioning here. If we make it down to the ideal entry zone (sub $2800) I’ll add to my position.

Reason for going in more aggressively here is that BTC is holding up decently atm and if we don’t get a pullback to low 80k’s… https://t.co/681HswOBoI pic.twitter.com/TmwCxBLgbu

— CrediBULL Crypto (@CredibleCrypto) November 14, 2024

Popular trading account IncomeSharks suggests that traders who missed the initial entry opportunity might find a second chance near Supertrend support just under $3,000. The trader also added that the swift shift in market sentiment, as “a few red candles” have led to widespread pessimism and negativity toward the asset. However, he believes that there’s a strong potential for a rebound moving ahead. This can again lead to resuming the inflows for spot Ethereum ETFs.

A recent Ethereum price analysis hints that analysts have been making bullish predictions for the crypto, potentially hitting $4,000, by November end. However, it will require the support of the broader market to continue this rally ahead.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/ethereum-etf-flows-flip-negative-again-as-eth-price-slips-6-whats-next/

✓ Share: