Ethereum [ETH] has faced intense pressure since it breached $3k support one week ago. With a sustained downward spiral, Ethereum touched a low of $2.1k, then stabilized around $2.2k.

At the time of writing, ETH traded at $ 2,266, down 1.51% on the daily chart, extending its month-long bearish trend.

With the market under intense stress, the ETH’s weakened structure has pushed holders, especially Ethereum whales, to capitulate.

Ethereum whales deleverage to pay loans

Amid prolonged market decline, Trend Research and Garrett Jin continued to offload ETH to repay loans and avoid liquidation.

According to Lookonchain, these two entities have deposited a total of 316,185 ETH, worth $738 million, on Binance for sale. Jin sold $82.37 million in ETH over the past day, while Trend Research sold $76.4 million in ETH.

Such selling constitutes a risk-driven market exit aimed at reducing the debt burden and improving market health, thereby decreasing risks of liquidation.

At the same time, the Bitcoin OG (10/11) has also continued to sell ETH. Onchain Lens reported that the whale deposited 15,000 ETH, valued at $33.35 million, into Binance to sell and repay the loan.

Usually, forced deleveraging creates extra selling pressure, further accelerating the downside risk.

Selling pressure hits a weekly high

With whales deleveraging, sell pressure on ETH has surged significantly. As such, Ethereum’s supply on exchanges rose considerably, as evidenced by the Exchange Supply Ratio (ESR).

According to CryptoQuant data, ESR reached a weekly high of 0.138, at press time, a substantial reversal from the prior trend.

Source: CryptoQuant

When ESR rises, it suggests that most market participants have increased supply-side activity. Such market behavior reduces scarcity, thus further weakening the market.

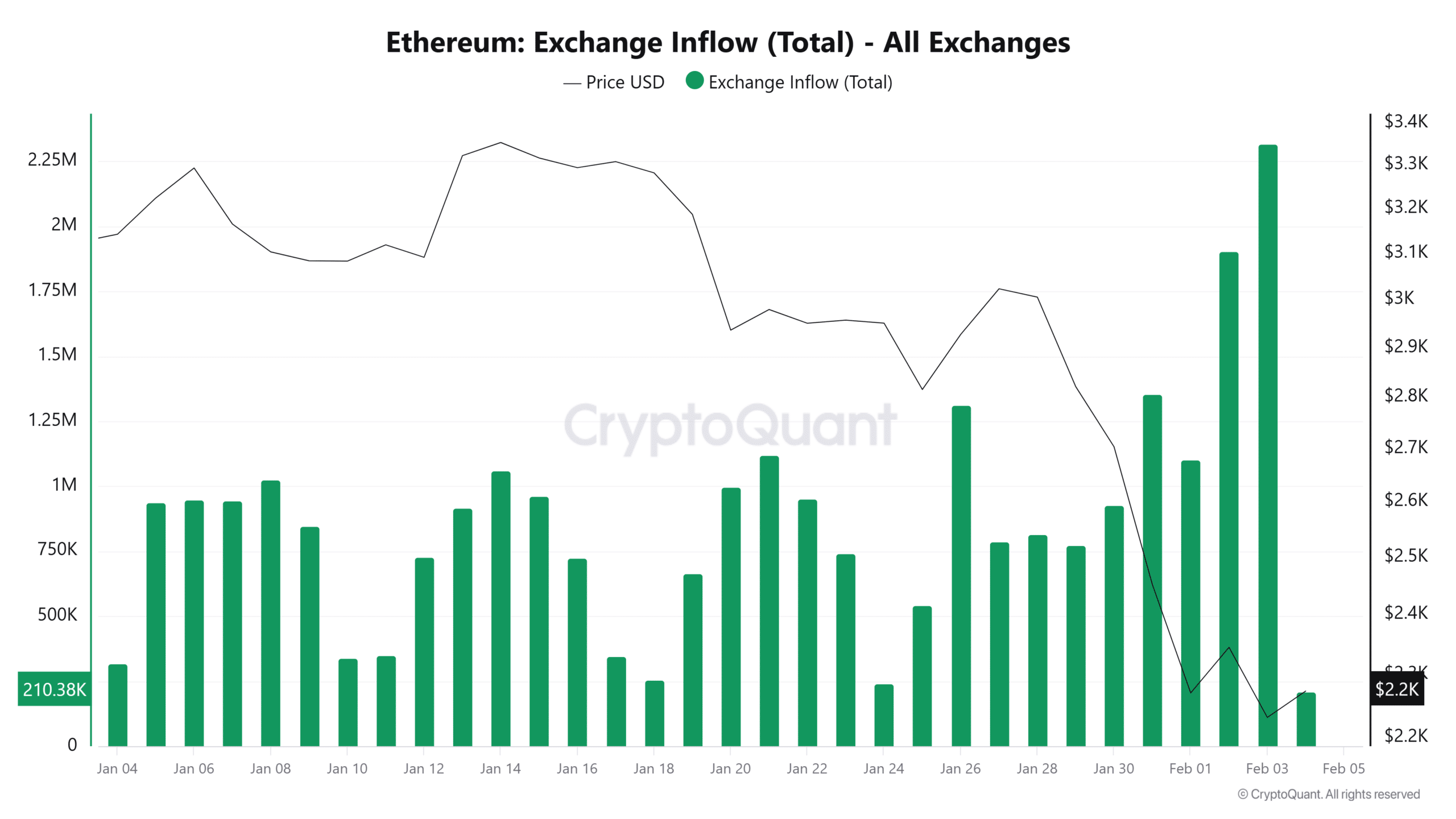

Furthermore, Exchange Inflow rose to a two-month high of 2.3 million on the 3rd of February before falling to 210k.

Source: CryptoQuant

Such massive inflows validated the early observation of increased sell-side pressure, often a prelude to lower prices as recently observed.

Is ETH at risk of slipping below $2k?

Ethereum has faced intense selling pressure across all market participants, mainly from whales forced exit. These prevailing conditions have pushed ETH to a significantly weakened position.

As a result, the altcoin fell below its Parabolic SAR and both medium- and long-term Fibonacci Bollinger Bands (FBB), as of writing, indicating strong downward momentum.

Source: TradingView

Typically, when ETH holdings are below these two levels, it signals the continuation of the dominant trend. Thus, if selling pressure persists, ETH could drop below $2k, with the lower boundary of the FBB at $ 1,796 acting as support.

However, despite the price drop, Ethereum Treasury Bitmine has held its ground and continued to accumulate at lower prices.

According to Lookonchain, Bitmine purchased 20,000 ETH, valued at approximately $46 million. With these purchases, Bitmine has positioned itself as the central pressure absorber.

Source: Lookonchain

Therefore, if Bitimine continues to hold and add positions despite rising losses, it will provide support, preventing further declines.

To avoid this downward spiral, ETH bulls must reclaim the Parabolic SAR at $2656, which will set the ground for a move towards $3k.

Final Thoughts

- Ethereum extended its bearish streak and hovered around $2.2k.

- ETH faced intense selling pressure as whale borrowers deleveraged, selling $771 million in ETH to repay loans and reduce liquidation risk.

Source: https://ambcrypto.com/ethereum-can-2k-support-hold-amid-771m-eth-dump/