- Ethereum showed strong support above $2,600, with a possible rally to $3,200 or $4,000.

- Growing institutional interest and active network usage signaled potential upward price movement.

Ethereum [ETH] has shown strong support above $2,600, signaling that it may continue on its upward trajectory. At press time, Ethereum is trading at $2,702.21, reflecting a 0.67% increase over the last 24 hours.

However, the real question is whether ETH can sustain its momentum long enough to break through these critical levels.

ETH technical analysis: Will the momentum last?

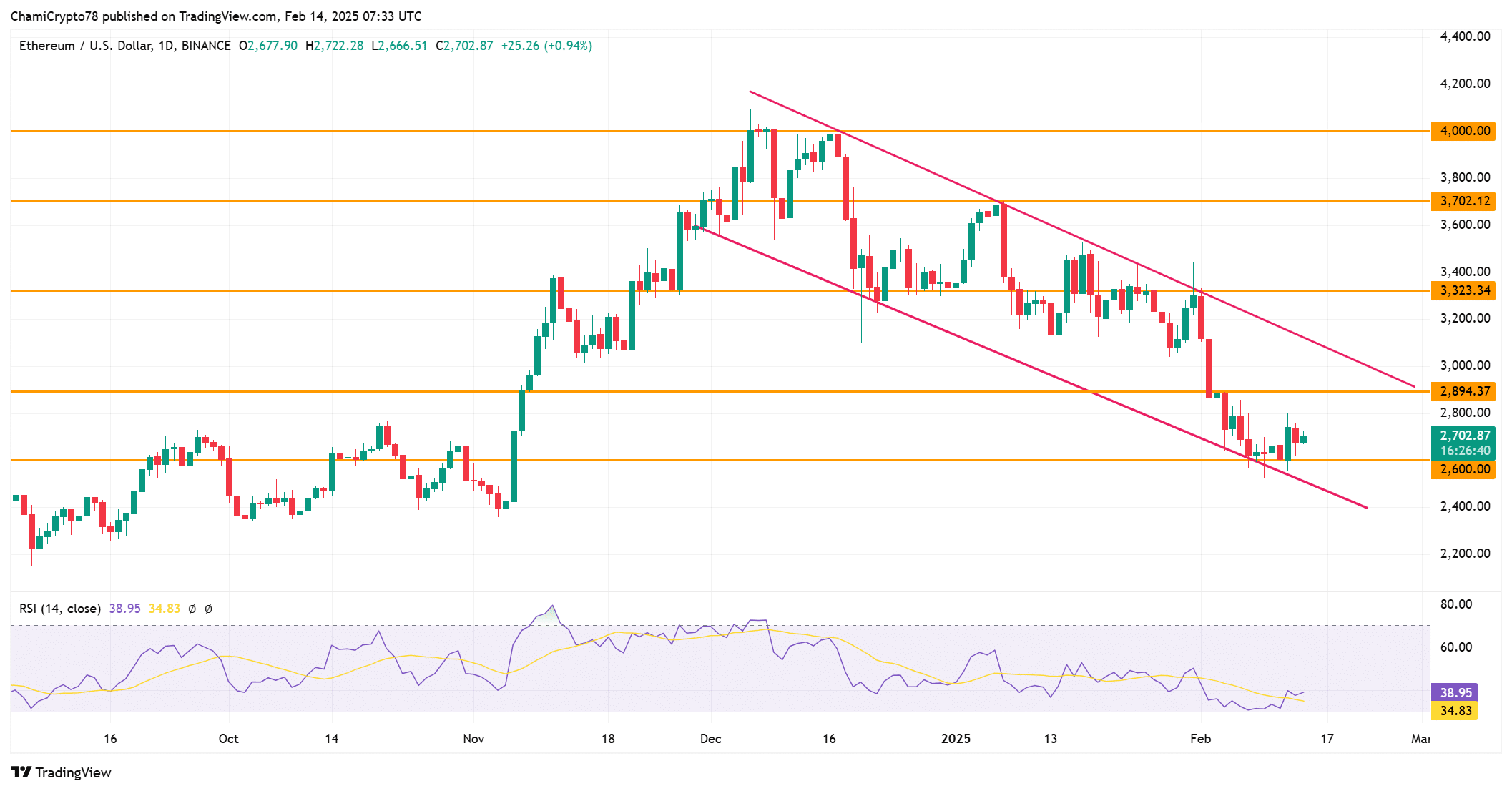

ETH’s recent price movement suggests that it could be entering a bullish phase. The chart shows Ethereum trading within a well-defined channel, with significant resistance at $2,800, $3,200, and $3,400.

If ETH can break above the $2,800 resistance, it could pave the way for a rally toward $3,200 or $4,000. At the time of writing, the RSI was at 38.95, indicating that there is still room for further upside potential.

However, Ethereum will need to overcome the challenges posed by the downward-sloping channel and stay above key support levels to maintain its bullish trend.

Source: TradingView

Institutional interest is booming: How will it affect the price?

Ethereum is seeing increasing institutional interest, particularly with 21Shares’ filing for an Ethereum staking ETF. This move represents a potential boost in demand for Ethereum, as institutional investors may flock to stake their ETH through the ETF.

A successful approval could further solidify Ethereum’s role in the institutional market and elevate its price.

Given that Ethereum’s supply could become more constrained due to staking, it might see further upward pressure as demand rises.

ETH daily active addresses: What do they tell us?

Ethereum’s network usage remains robust, with daily active addresses exceeding 524,000. This indicates a healthy level of engagement and growing adoption, both of which are crucial for long-term price appreciation.

Strong network activity signals increased trust in Ethereum’s decentralized applications, which can lead to higher demand for ETH.

Therefore, the consistent rise in active users could be an important factor in Ethereum’s price potential.

Source: Santiment

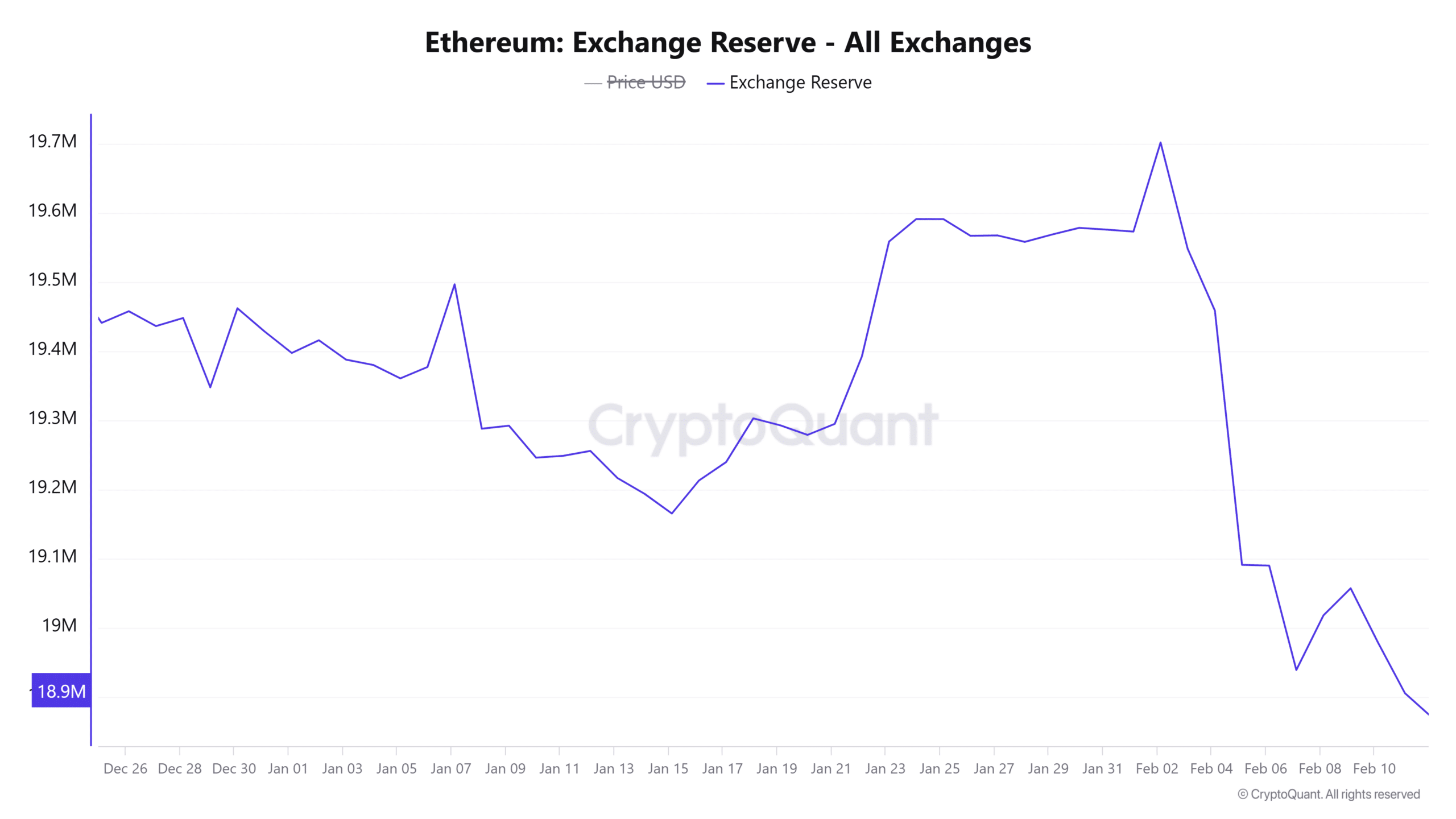

ETH exchange reserves: What does it signal about the market?

Ethereum’s Exchange Reserves, currently at 18.8841 million ETH, have increased slightly by 0.02%. Rising Exchange Reserves usually indicate higher selling pressure as traders deposit more ETH to exchanges for potential selling.

In general, an increase in reserves can signal market volatility and a higher likelihood of price swings.

While a growing reserve could suggest more liquidity, it also highlights the potential for increased market volatility that could impact short-term price movements.

Source: CryptoQuant

Bulls and bears: Which side has the advantage?

Currently, the market sentiment for Ethereum is largely bullish, with 114 bulls compared to 105 bears. This indicates that investors are generally optimistic about ETH’s near-term prospects.

However, if the price falters and experiences a sharp pullback, bearish sentiment could rise.

Therefore, Ethereum needs to maintain its upward momentum to keep the bulls in control and push toward higher levels.

Source: IntoTheBlock

Given Ethereum’s strong support at $2,600, growing institutional interest, active network usage, and increasing exchange reserves, it is likely to maintain its bullish momentum.

If Ethereum continues to hold above key support levels, it has a strong chance of reaching $3,200 or even $4,000.

Therefore, Ethereum’s price has a high likelihood of breaking these key resistance points soon.

Source: https://ambcrypto.com/ethereum-assessing-odd-of-eth-reaching-3200-soon/