Disclaimer: This content is a sponsored article. Bitcoinsistemi.com is not responsible for any damages or negativities that may arise from the above information or any product or service mentioned in the article. Bitcoinsistemi.com advises readers to do individual research about the company mentioned in the article and reminds them that all responsibility belongs to the individual.

Altcoins are under selling pressure as traders reduce leverage to eliminate risk after last week’s volatility. Ethereum and XRP were among the worst hit, bringing the total crypto market cap down 6% in 24 hours to $3.76 trillion.

As momentum fades in larger-cap assets, analysts are shifting focus to smaller, audited projects with quantifiable fundamentals. Among these candidates, MAGACOIN FINANCE has stood out, drawing attention from investors looking for growth opportunities below the $0.01 mark.

Ethereum Faces Continued Pressure

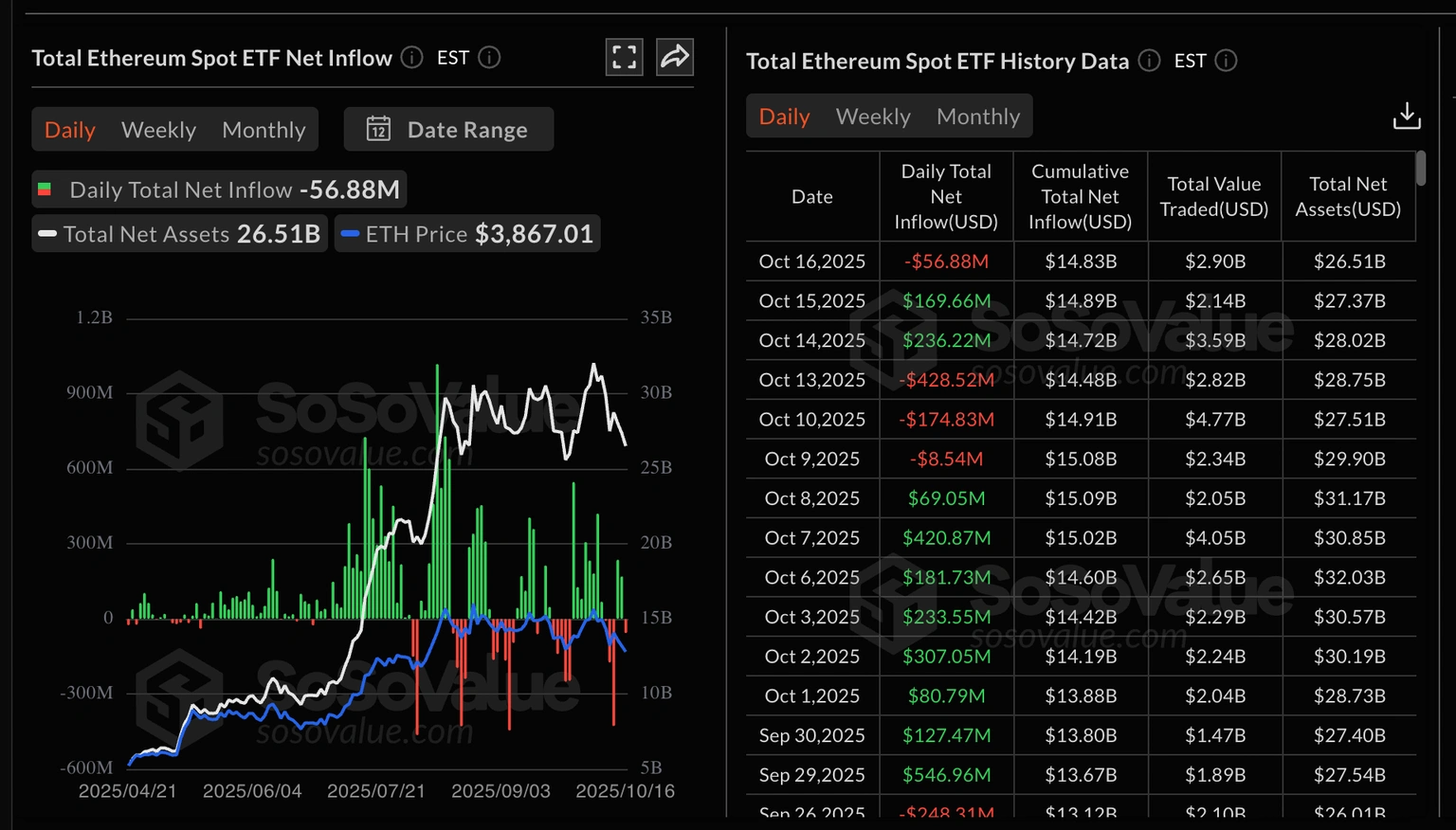

Ethereum dipped to $3,700 after four consecutive daily losses. The correction has followed heavy selling in derivatives and spot markets. ETF outflows averaged $57 million on Thursday; only BlackRock’s ETHA had inflows of $47 million. Graysale’s ETHE recorded $69 million withdrawals, a reflection of reduced confidence in institutional participation.

Source: SoSoValue

Technical indicators also favor a bearish trend. The daily indicator chart shows some sell signals, including a downward-sloping MACD and weakening momentum around short-term support areas. If the sell continues, Ethereum could touch its 200-day EMA close to $3,550 with its continuation near the October low of $3,430. Analysts noted that a fresh recovery will need new inflows and stronger on-chain activity to restore buyer confidence.

XRP Buyers Lose Confidence

Ripple’s XRP is trading below its major support level at $2.22, indicating higher selling pressure. Open Interest (OI) has dipped to an average of $3.81 billion, down from a high in July of $10.94 billion. This decline signifies a diminishing pool of speculative buyers and limited conviction among traders.

Source: CoinMarketCap

Technical momentum is still weak. The MACD is flashing sell signals again, RSI is in oversold territory, but no clear divergence. Bulls have been unable to recover lost ground, indicating that market participants await new catalysts. Analysts caution that whales are relatively inactive, which means that XRP will face further downside if overall sentiment doesn’t improve.

Analysts Turn to MAGACOIN FINANCE

As Ethereum and XRP dip, traders are moving to MAGACOIN FINANCE for 75x returns from sub-$0.01 levels. The shift is driven by the growing demand for low-cap projects that offer transparency, certified audits, and sustainable token design. Analysts believe MAGACOIN FINANCE has the fundamentals investors are looking for when major altcoins lose momentum.

The Hashex audit reinforced confidence in the project’s smart contract with zero critical or medium-risk findings. Token minting, liquidity, and distribution functions work as they have been designed to. No hidden administrative control is present, so the token supply cannot be manipulated, providing reassurance to long-term holders.

Additionally, MAGACOIN FINANCE’s scarcity model adds to the optimism. As the total number of tokens in circulation slowly erodes, organic demand pressure builds. With an infrastructure of verified audits, transparent liquidity tracking, and a growing investor base, these fundamentals offer a realistic path for the 75x compounding gains once broader market sentiment improves.

Broader Market View

Market analysts observe that capital rotation often follows phases of weakness in leading assets. When Ethereum and XRP lose steam, investors tend to explore smaller, verified ecosystems capable of delivering asymmetric returns. Projects that emphasize accountability and clear token structures are now attracting the majority of early interest.

This rotation marks a shift in investor priorities from hype to proof-based participation. Transparency, liquidity control, and community engagement are becoming essential filters for new capital inflows. MAGACOIN FINANCE aligns with these evolving standards, making it a key name in current analyst discussions about potential recovery plays.

Conclusion

Ethereum and XRP’s latest correction is reshaping investor focus across the market. While large-caps consolidate, interest is gravitating toward smaller, well-audited tokens that demonstrate clear fundamentals and transparent tokenomics. MAGACOIN FINANCE has positioned itself in that space, bridging investor caution with credible long-term potential.

Analysts agree that the next bull cycle will reward projects built on transparency and verified data. If MAGACOIN FINANCE maintains its structured ecosystem and community momentum, it could become one of the defining early-stage success stories of the upcoming market rebound.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance