- ETH remains in a strong bull trend according to its RSI, around 56.

- Its price declined by 0.73% in the last trading session.

Ethereum [ETH] has seen a slight decline over the last 24 hours, but technical indicators suggest there could be a short-term bullish shift.

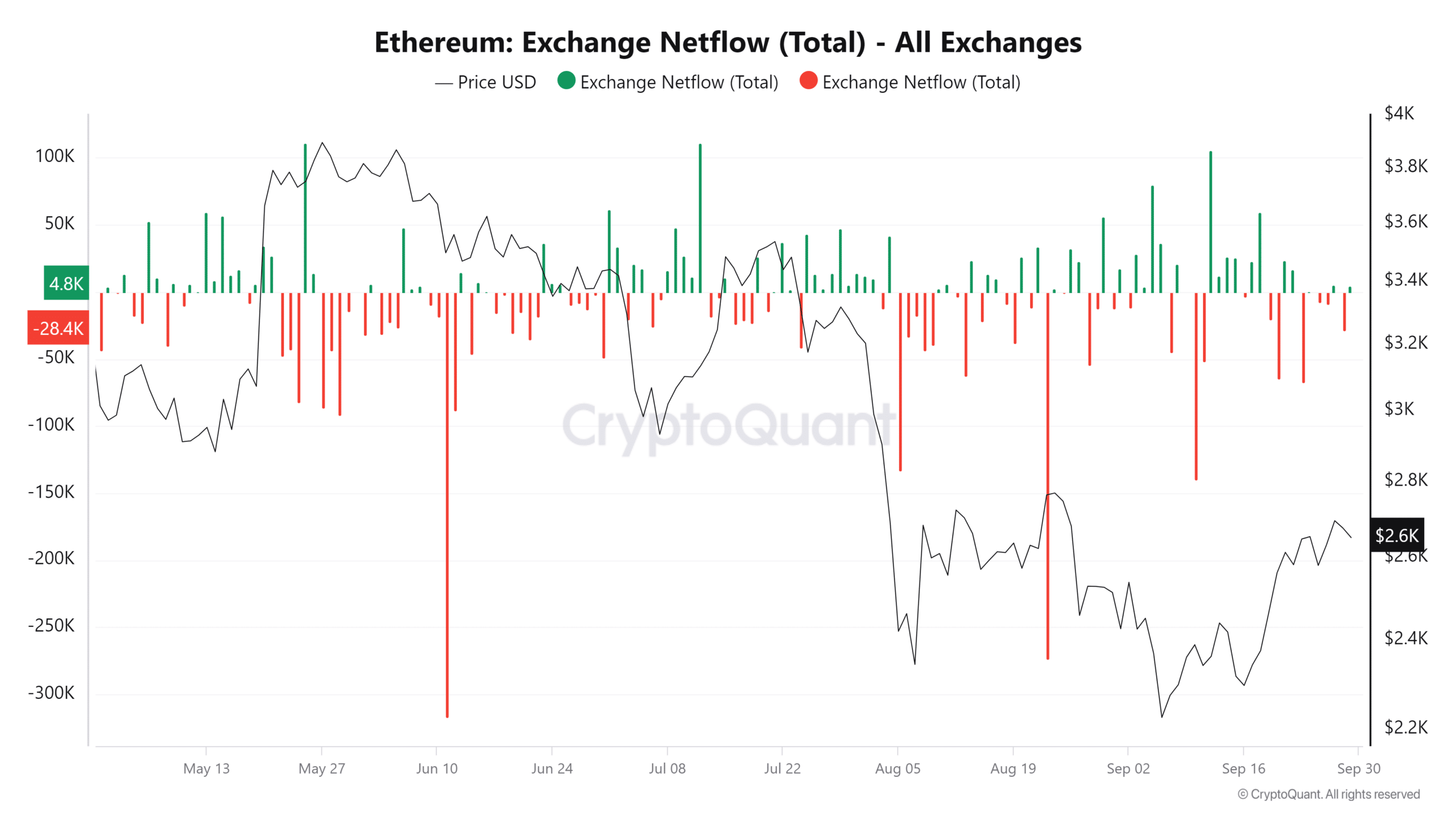

Despite recent sell-offs, its exchange netflow shows a dominance of outflows, indicating that more ETH has been withdrawn from exchanges than deposited, signaling potential buying interest and reduced selling pressure.

Ethereum’s price action and technical indicators

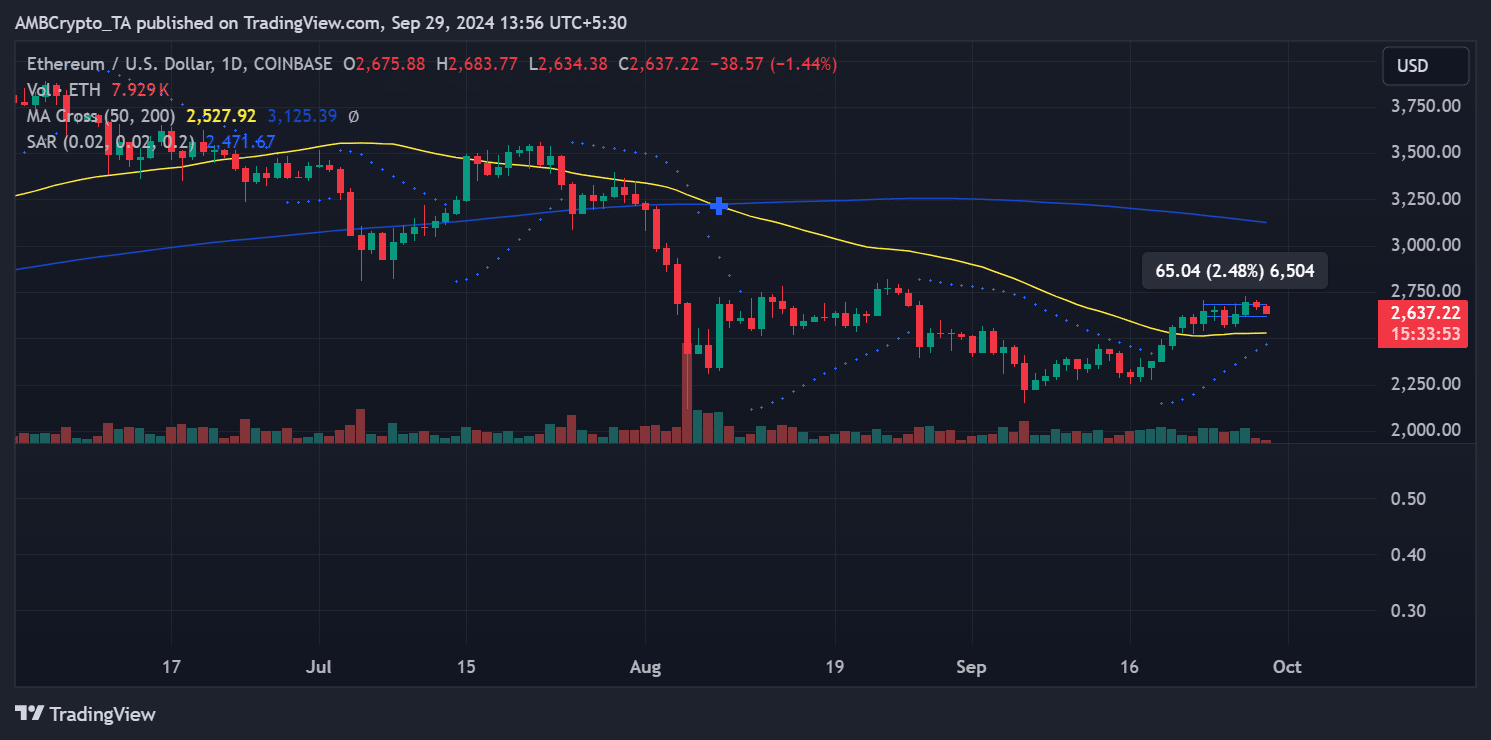

Ethereum was trading at $2,637.22 at press time, reflecting a 1.44% decline in the short term. On the daily chart, the 50-day moving average (yellow) sits at $2,527.92, while the 200-day moving average (blue) remains higher at $3,125.39.

ETH trading above the 50-day moving average points to short-term bullish momentum. However, it remains well below the 200-day moving average, which suggests that the broader long-term trend is still bearish.

Source: TradingView

The Parabolic SAR indicator also supports this short-term bullish outlook, with dots positioned below the price. This indicates that the current uptrend remains intact, and buyers are still in control of the market for now.

While Ethereum is showing signs of strength in the short term, it faces strong resistance from the 200-day moving average, which could prevent a longer-term breakout.

Increasing number of Ethereum holders in profit

Despite the recent decline, Ethereum’s earlier rally this week had a significant impact on the profitability of its holders. According to data from the Global In/Out of the Money chart, the percentage of ETH holders in profit increased from 59% to 68%.

This translates to over 83 million addresses now holding ETH at a profit.

On the other hand, 29.47% of the addresses, equivalent to 36.17 million, are currently “Out of the Money,” meaning they are holding at a loss. Approximately 2.38%, or 2.93 million addresses, are breaking even.

Exchange netflow: Outflows dominate

Ethereum’s exchange netflow has been fluctuating between inflows and outflows throughout the past week. However, the overall trend shows a higher volume of ETH leaving exchanges, signaling more outflow than inflow.

This net negative flow is significant, especially considering retail investors and institutions’ sell-off events earlier in the week.

Source: CryptoQuant

At the close of the last trading session, ETH’s netflow was negative by over 28,000 ETH, highlighting the outflow dominance. This trend of ETH being moved off exchanges suggests that investors might be holding onto their coins, reducing the potential for immediate sell-offs.

Read Ethereum (ETH) Price Prediction 2024-25

Conclusion

Ethereum is currently navigating a mixed market with short-term bullish momentum as it trades above the 50-day moving average and experiences increased outflows from exchanges.

However, the significant resistance posed by the 200-day moving average remains a hurdle for long-term bullish trends.

Additionally, the increase in profitable holders signals renewed confidence among investors despite the recent dip in price.

Source: https://ambcrypto.com/ethereum-analysis-profitable-holders-increase-despite-price-dip/