Key Insights:

- Binance ETH NUPL falls to -0.16, lowest level in nine months.

- Ethereum remains below $2,000 as technical indicators show weak momentum.

- Bitmine holds 4.37 million ETH, nearing 5% supply ownership target.

Ethereum trades at $1,964.58 after recent declines. The asset has slipped 0.52% in 24 hours and 4.67% over seven days. Trading volume stands at $10.05 billion as price stays below the $2,000 mark.

On-chain data shows Binance Net Unrealized Profit and Loss at a nine-month low. The current reading sits near -0.16, which means many ETH coins held on Binance are in unrealized loss.

Binance NUPL Falls Into Negative Territory

NUPL tracks whether exchange-held coins sit in profit or loss. A negative value shows that holders would exit below their cost basis at current prices. The latest -0.16 level marks the weakest reading since early 2025.

Kamran Asghar wrote that “Ethereum NUPL on Binance just hit a 9-month low.” He added that with ETH near $1,973, a large share of coins on the exchange are underwater. Similar drops below zero have appeared during prior market downturns.

The chart shows ETH falling from above $3,000 toward the $2,000 range while NUPL declined in parallel. The latest price slide pushed the metric deeper below zero.

ETH Price Trades Below Key Resistance

The daily ETH/USDT chart shows a downtrend from the $3,300–$3,400 zone. Price has printed lower highs and lower lows over recent months. A sharp drop in early February sent ETH near $1,800 before price steadied.

The $2,000 level now acts as resistance. ETH has not reclaimed the $2,100–$2,200 area. Support sits near $1,900, followed by the $1,800 swing low.

RSI stands near 34, close to oversold levels. MACD remains below zero, though histogram bars have narrowed. Momentum has slowed, but the overall structure remains weak.

Source: TradingView

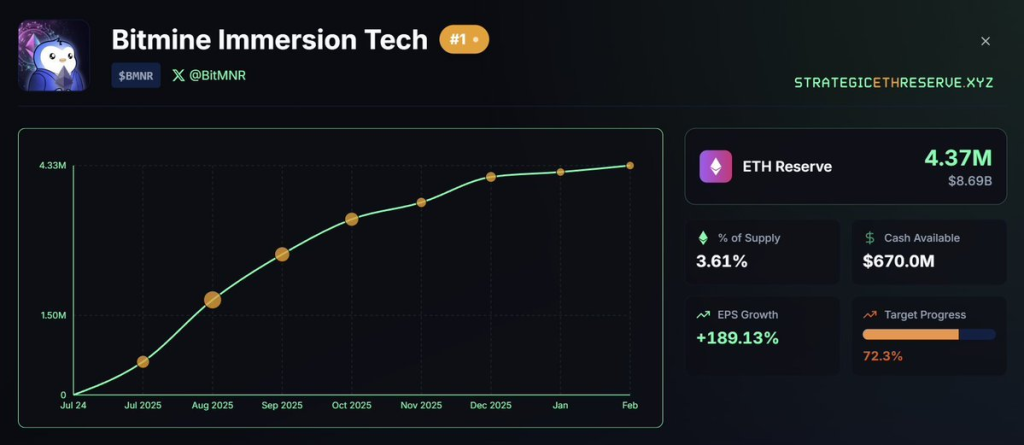

Bitmine Moves Toward 5% Supply Target

While exchange balances show unrealized losses, Bitmine Immersion Tech continues to build reserves. The company holds 4.37 million ETH, worth about $8.69 billion. This equals 3.61% of total supply.

Crypto Rover stated that Bitmine’s target to control 5% of ETH supply is “72.3% complete.” The firm has increased holdings steadily since mid-2025. The dashboard lists $670 million in available cash for potential purchases.

Source: Crypto Rover/X

Exchange metrics reflect pressure on holders, while corporate accumulation continues in the background.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Source: https://coincu.com/analysis/eth-struggles-below-2k-as-nupl-signals/